Capital Notes Media Digest #1

A Compilation of Thought-Provoking Charts and Media Insights

Welcome to the first ever Capital Notes Media Digest! — this is a work in progress. However, I want the Capital Notes Media Digest to be a recurring addition to this newsletter.

The Media Digest is designed to be a time saver and a visual guide, allowing someone to quickly catch up on what’s important in the world of finance, investing, and economics. Everything showcased here was selected by Capital Notes from around the financial web or created by us.

Again, this is the first issue. I expect the structure and presentation will improve with time.

TL;DR:

Sentiment is nearing bullish extremes

Positive economic growth continues

Inflation continues to be a problem

Unemployment might be starting to crack

U.S. stock market valuations remain rich

Housing is extremely unaffordable

Sentiment

The Euphoriameter [Figure 1], created and published by Topdown Charts, hit a new all-time high in June. This indicates bullish sentiment is near an extreme level.

💡Capital Notes: While this extreme reading could point to a potential top, high levels of bullish sentiment can last for months, if not years, before finally culminating in a significant market top.

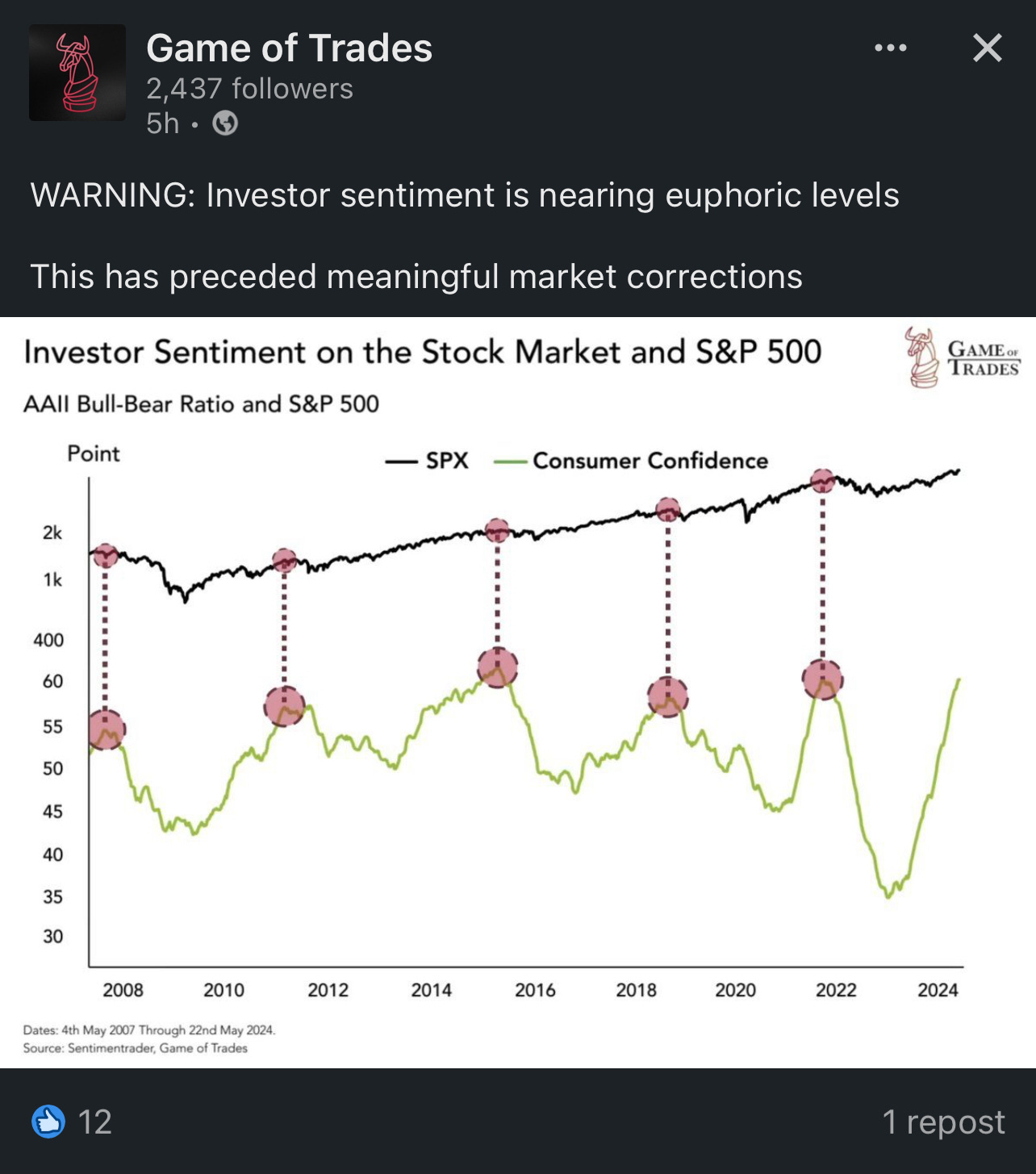

In Figure 2, Game of Trades presents a smoothed version of the AAII Bull-Bear Ratio, a commonly used sentiment measure. It has reached levels that have previously led to significant increases in market volatility and/or a market correction.

Investors are all in on stocks when measured by sentiment surveys, equity allocations, and the use of margin debt.

💡Capital Notes: Investors are not just claiming they are bullish, they’re putting their money where their mouth is. Everyone is invested. This is a prerequisite for a major top to form. However, this should not be used as a precise timing tool.

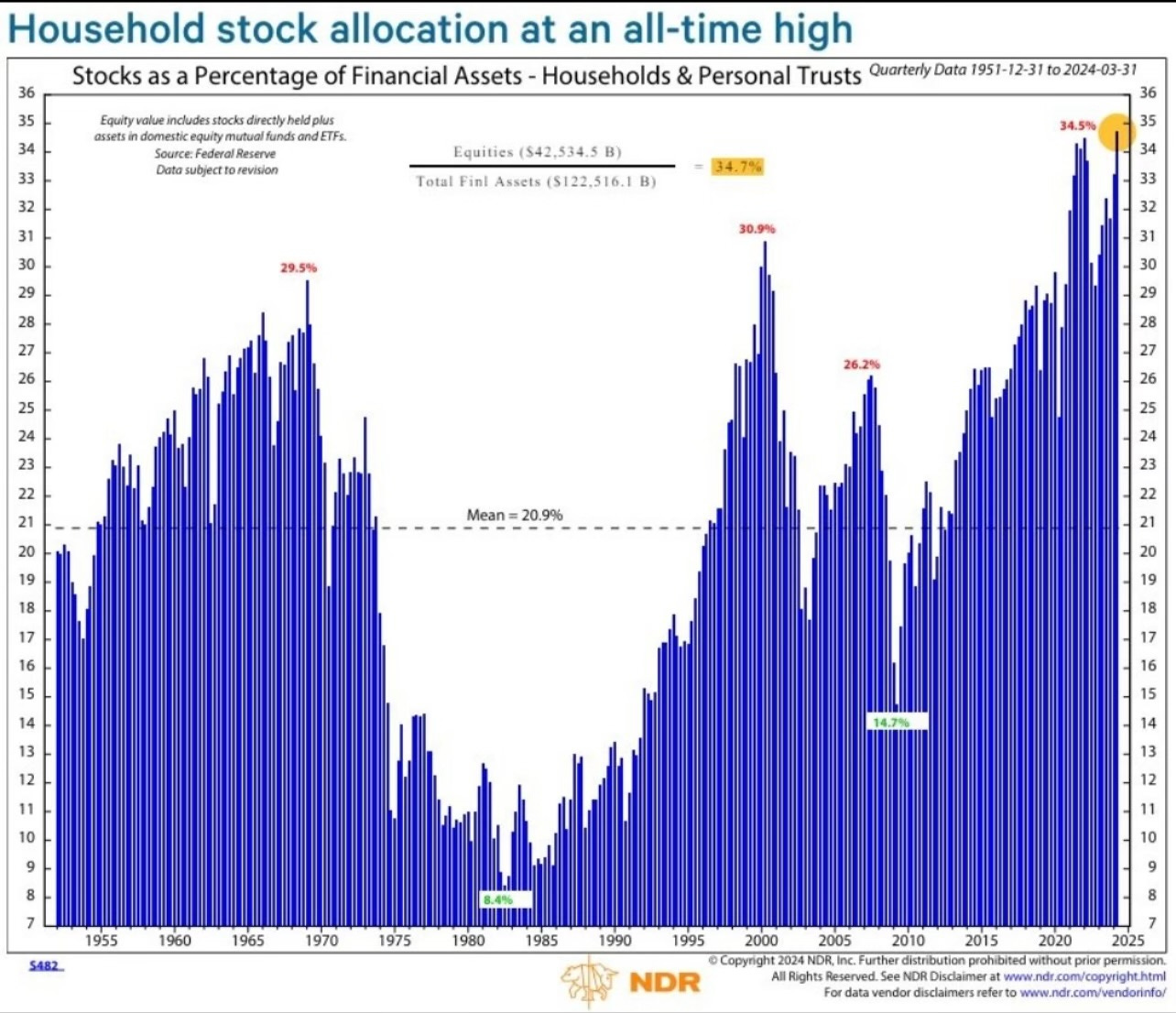

As mentioned in Figure 3, Figure 4 shows allocations to stocks are near an all-time high.

Fund managers are also quite bullish. BofA’s Fund Manager Survey, Figure 5, shows the professionals are also the most bullish they’ve been in 3 years. However, this measure has not quite reached an extreme.

Fund flows suggest risk appetite is nearing extreme levels. There is still some room to move higher before reaching the most extreme historical levels.

The Conference Board is reporting the public overwhelmingly believes stock prices will be higher 1 year from today.

💡Capital Notes: Buying when the general public is pessimistic historically provides the best forward returns.

Economic Growth:

The Atlanta Fed GDPNow indicator is currently signaling that real economic growth is likely to continue through the remainder of this quarter. The current estimate is for Q2 2024 to provide a real GDP growth rate of 2.7% annualized.

💡Capital Notes: No recession on the immediate horizon. As long as growth is solid and unemployment is low it will be hard for the Fed to justify rate cuts.

It’s official. More people are traveling by air than before COVID.

💡Capital Notes: Record passengers on airplanes is not what one expects to see from an economy on the precipice of collapse.

Interest Rates:

Short term interest rates are holding steady. These typically fall rapidly in anticipation of a Federal Reserve rate cut.

Consensus estimates are for rates around the world to move in only one direction, minus slight rate hikes in Japan.

2-year yields typically lead the Fed’s policy rate. The 2-year has been moving higher over the last few months.

The Yield Curve, from a technical perspective, appears ready to steepen significantly. This assumes a breakout above chart resistance from the curve’s multi-year downtrend.

💡Capital Notes: When the yield curve inverts, it is a warning sign that the conditions for a recession are likely in place. However, it is not until the curve steepens and un-inverts, that the odds turn in favor of a imminent economic downturn.

Inflation:

McDonald’s has increased its prices far more than the CPI would suggest.

💡Capital Notes: The prices for everyday items that most Americans purchase have risen far more than what is reported by the consumer price index. This is why survey’s show most Americans are not happy with the current state of the economy.

The Fed trying to subtlety gaslight American’s into believing high rates of inflation is a net positive for them.

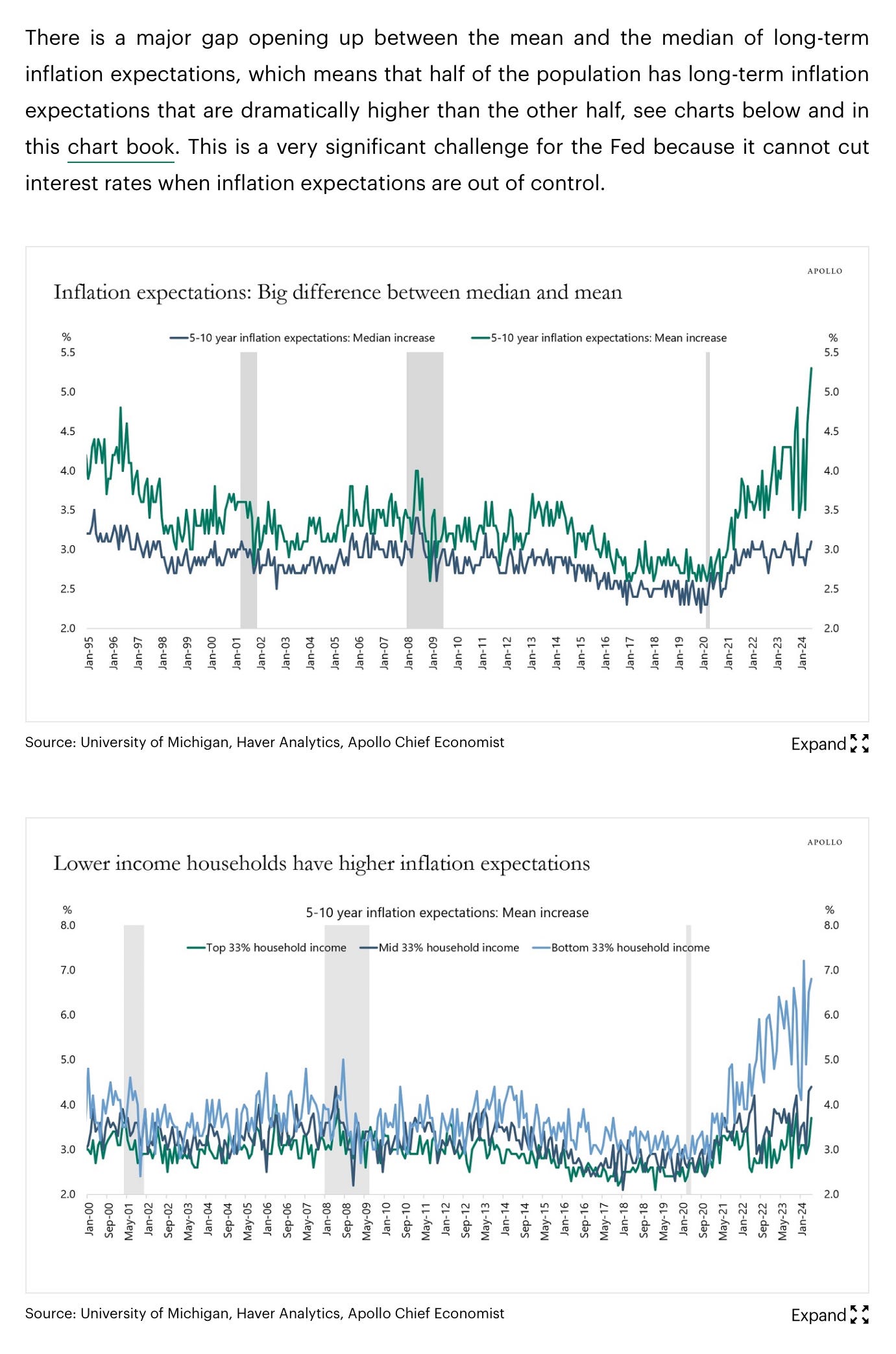

Inflation expectations have become unanchored.

💡Capital Notes: Inflation expectations are the primary concern of the Federal Reserve in their fight against inflation. It will be difficult to justify sustained rate cuts as long as expectations are for higher future rates of inflation.

The Minneapolis Fed President recently stated it could take a couple of years to return to the Fed’s 2% inflation target. He was also one of the many Fed President’s that was certain inflation would be transitory.

💡Capital Notes: I don’t put much weight in the predictions of economist who are consistently wrong, especially when they were not able to see the obvious signs of the inflation wave on the way in 2020-2021.

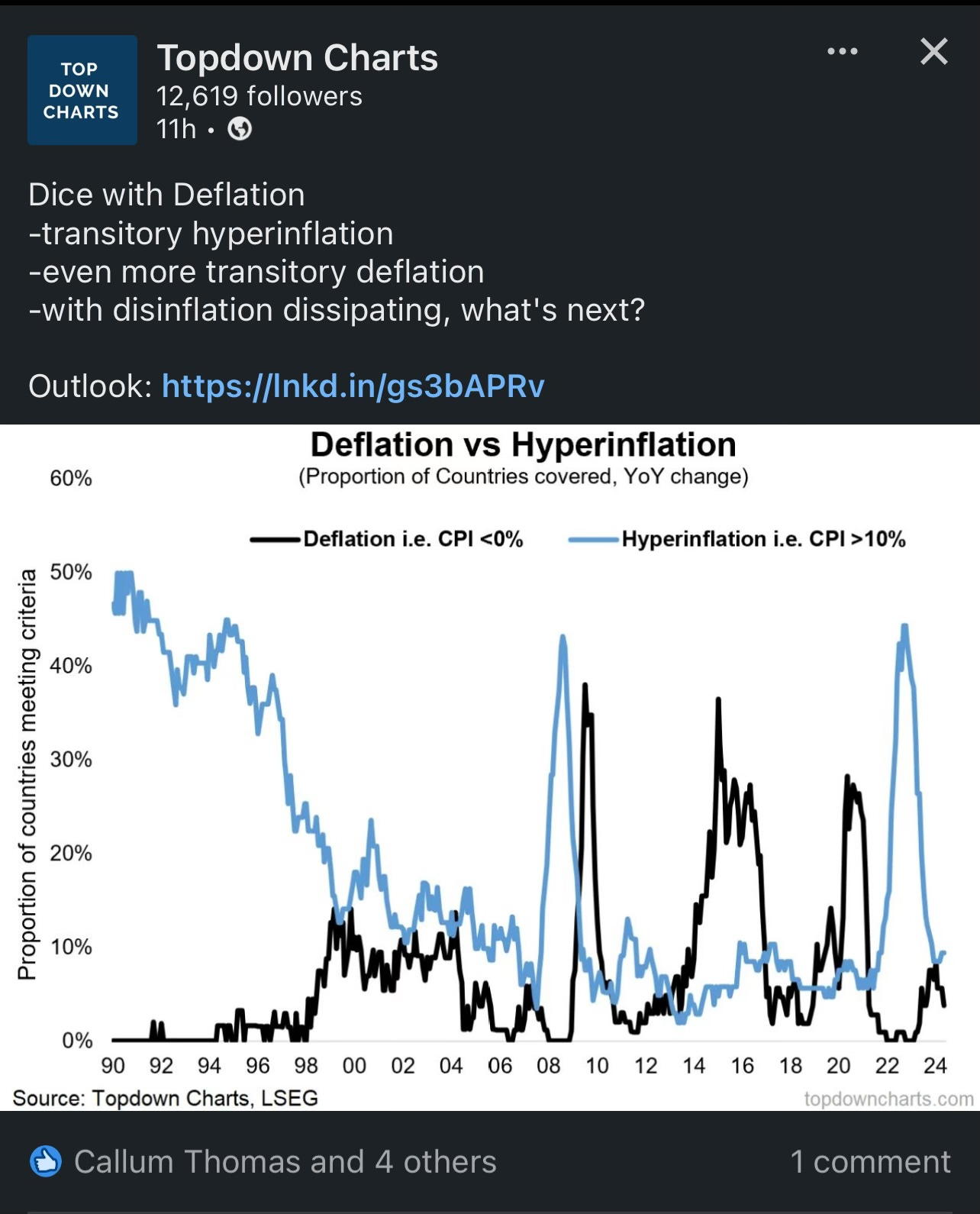

The deflation wave is over and inflation has returned to an uptrend.

Disinflation is over. Inflation is heating back up across the world.

Container rates for freight shipped globally are rising rapidly. This was one of the main drivers of the post-COVID inflation wave.

💡Capital Notes: This is not going to help the Fed’s cause.

Employment:

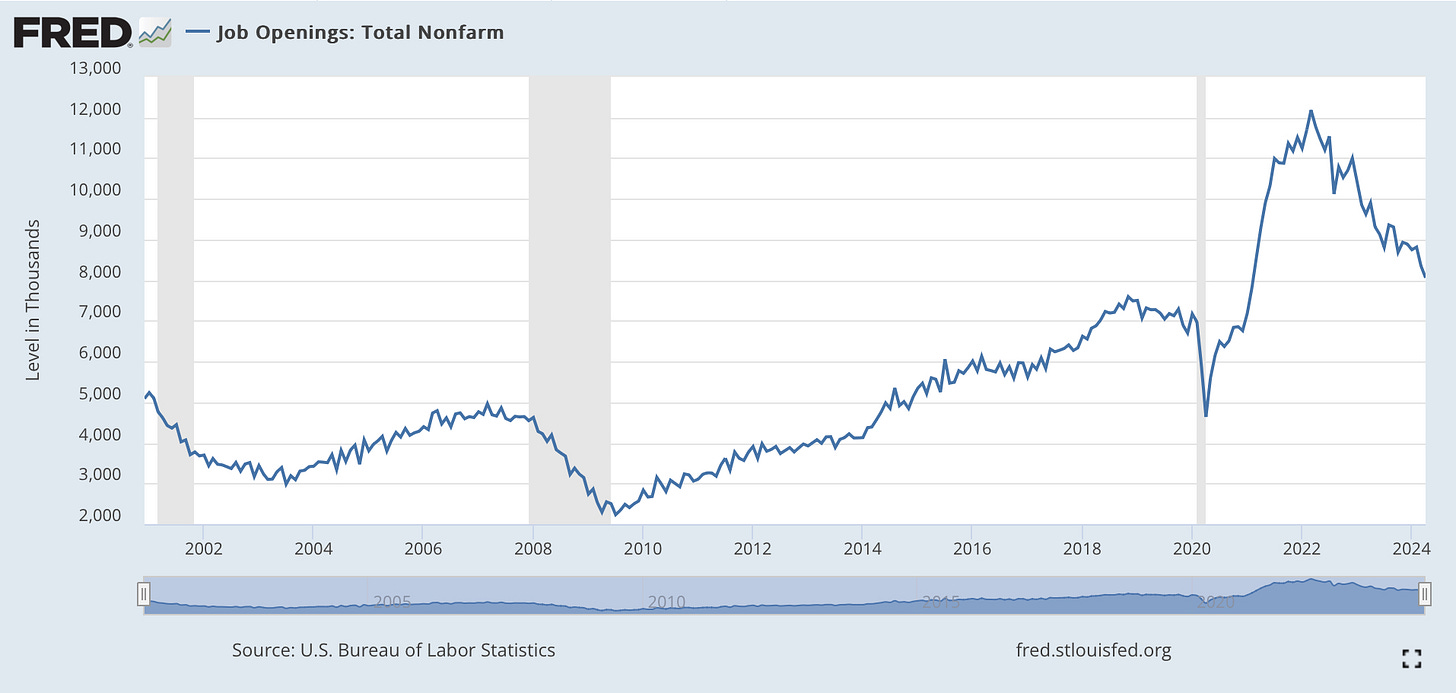

The number of job openings continued to plummet.

💡Capital Notes: This is typically a sign of a sick job market and a leading indicator of labor market weakness. However, we have yet to see a significant increase in the unemployment rate.

The number of full-time employed workers appears to have peaked for this cycle.

💡Capital Notes: This number rises during economic expansions and declines during recessions.

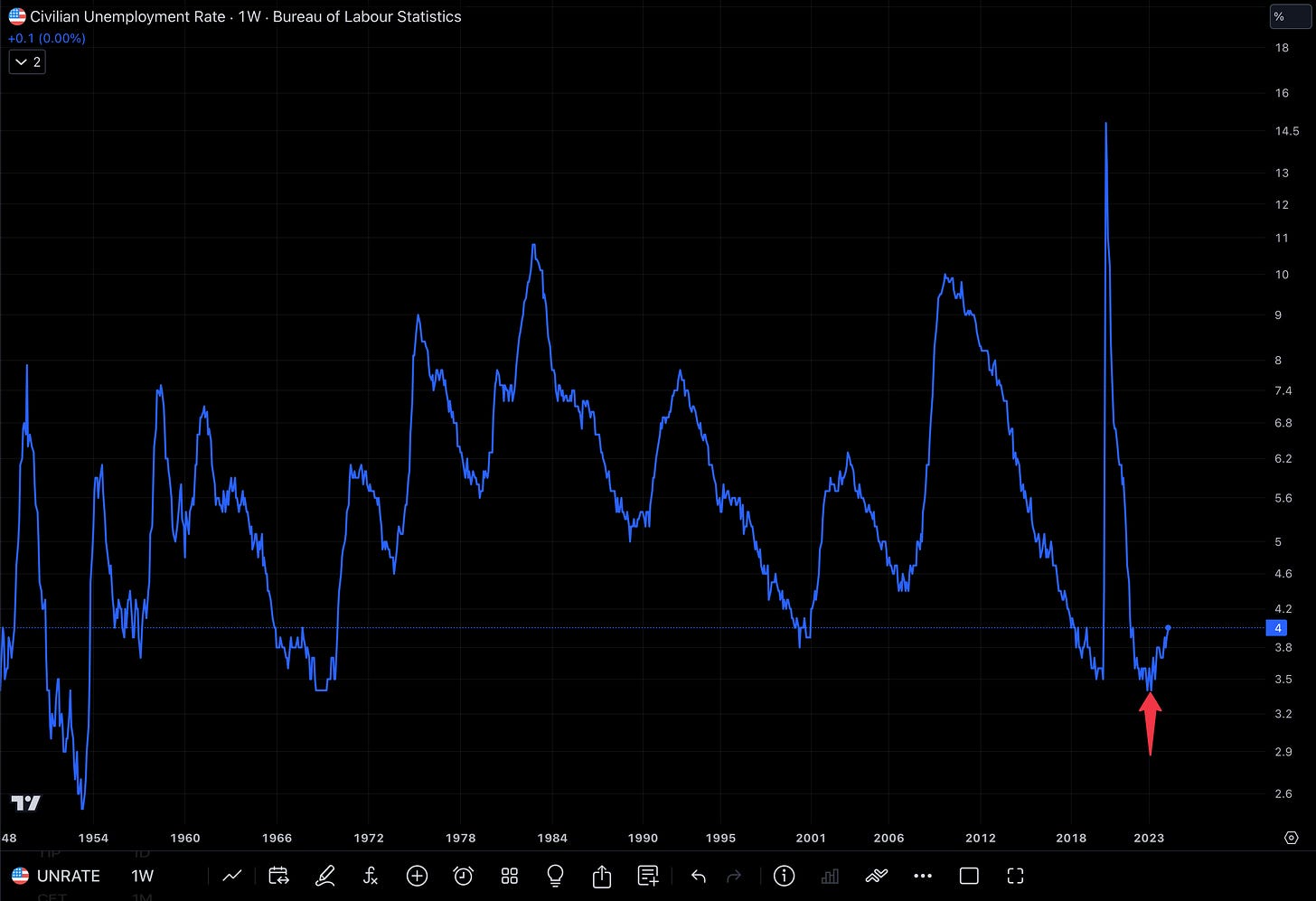

The unemployment rate is still near historic lows but has started an uptrend.

💡Capital Notes: Unemployment is like a snowball in reverse, once it gets moving uphill it develops momentum and becomes difficult to stop.

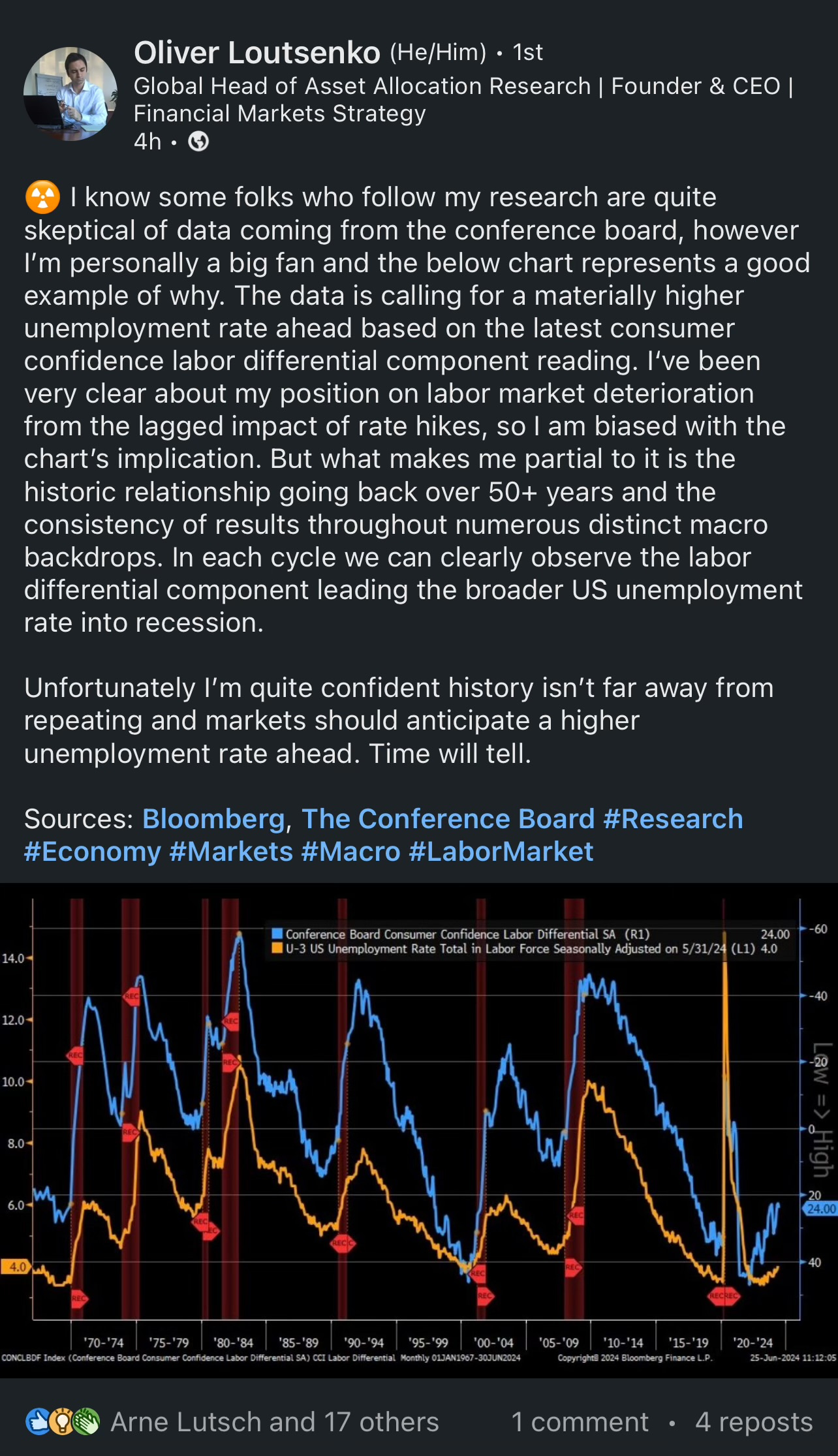

Using one of the metrics published by the Conference Board to forecast the unemployment rate currently suggest the unemployment rate is likely to continue rising.

💡Capital Notes: A rapid increase in the unemployment rate is the one thing that could convince the Fed it is time to start cutting rates.

Valuation:

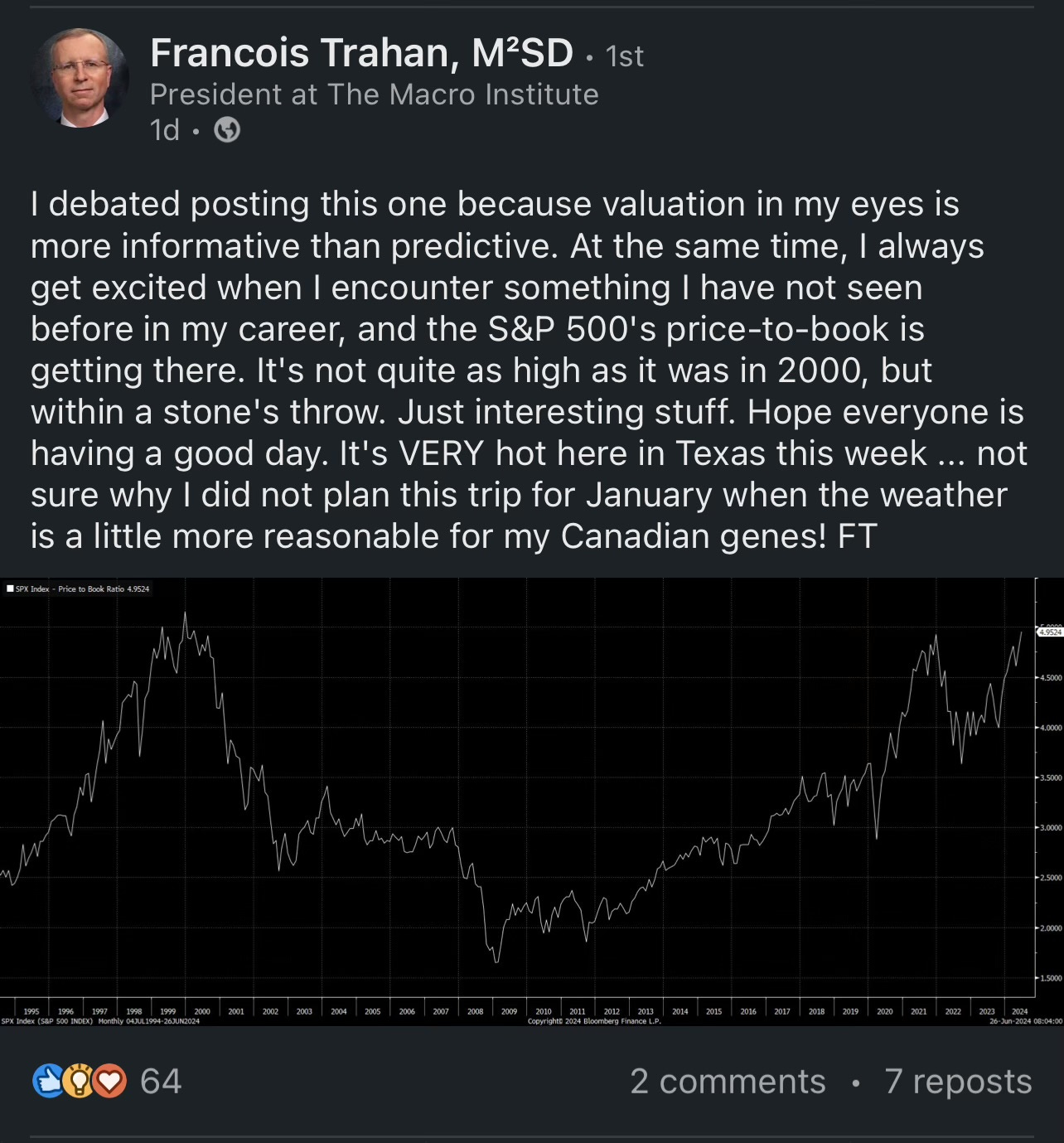

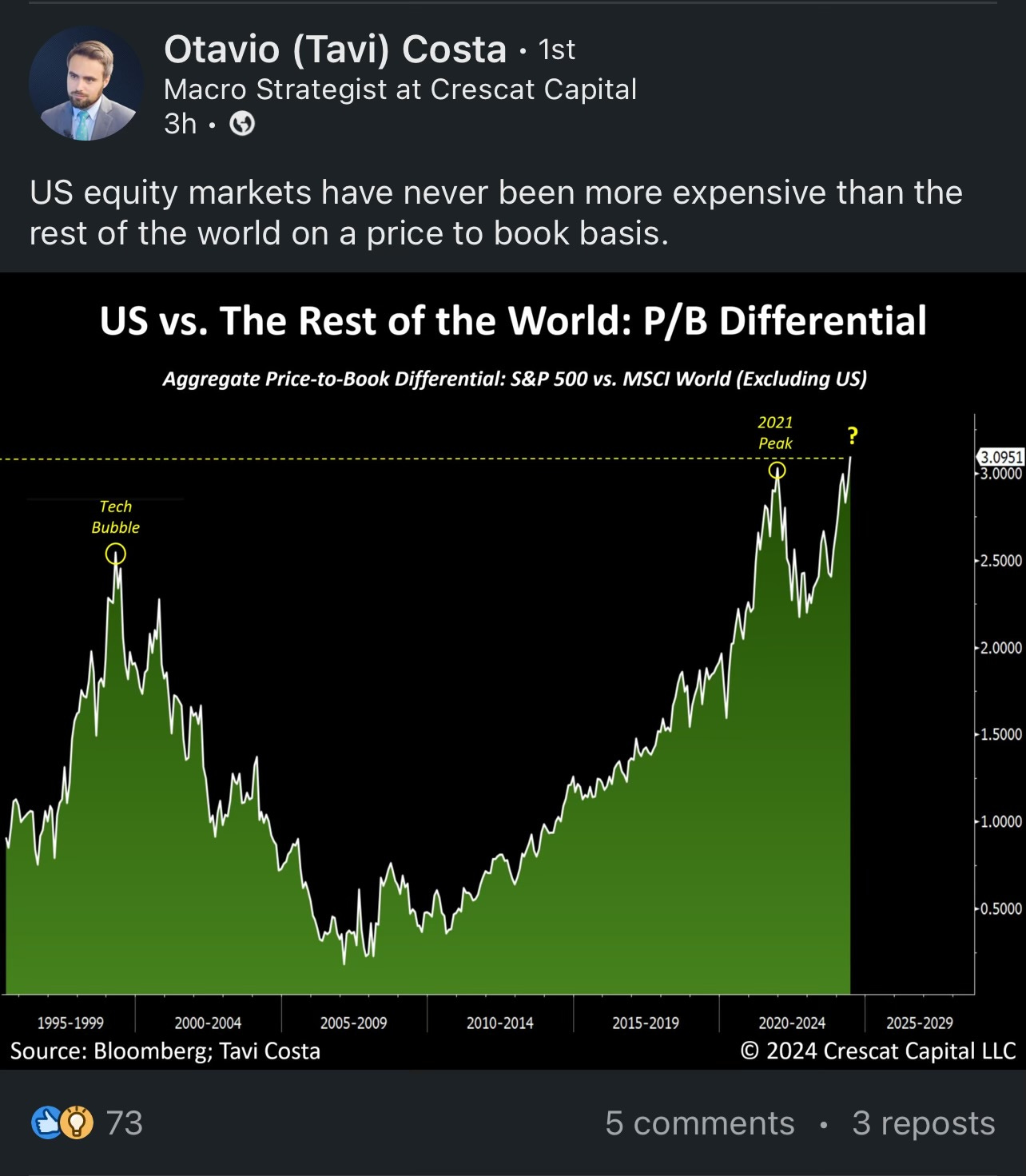

The S&P 500’s price to book ratio is near all-time highs.

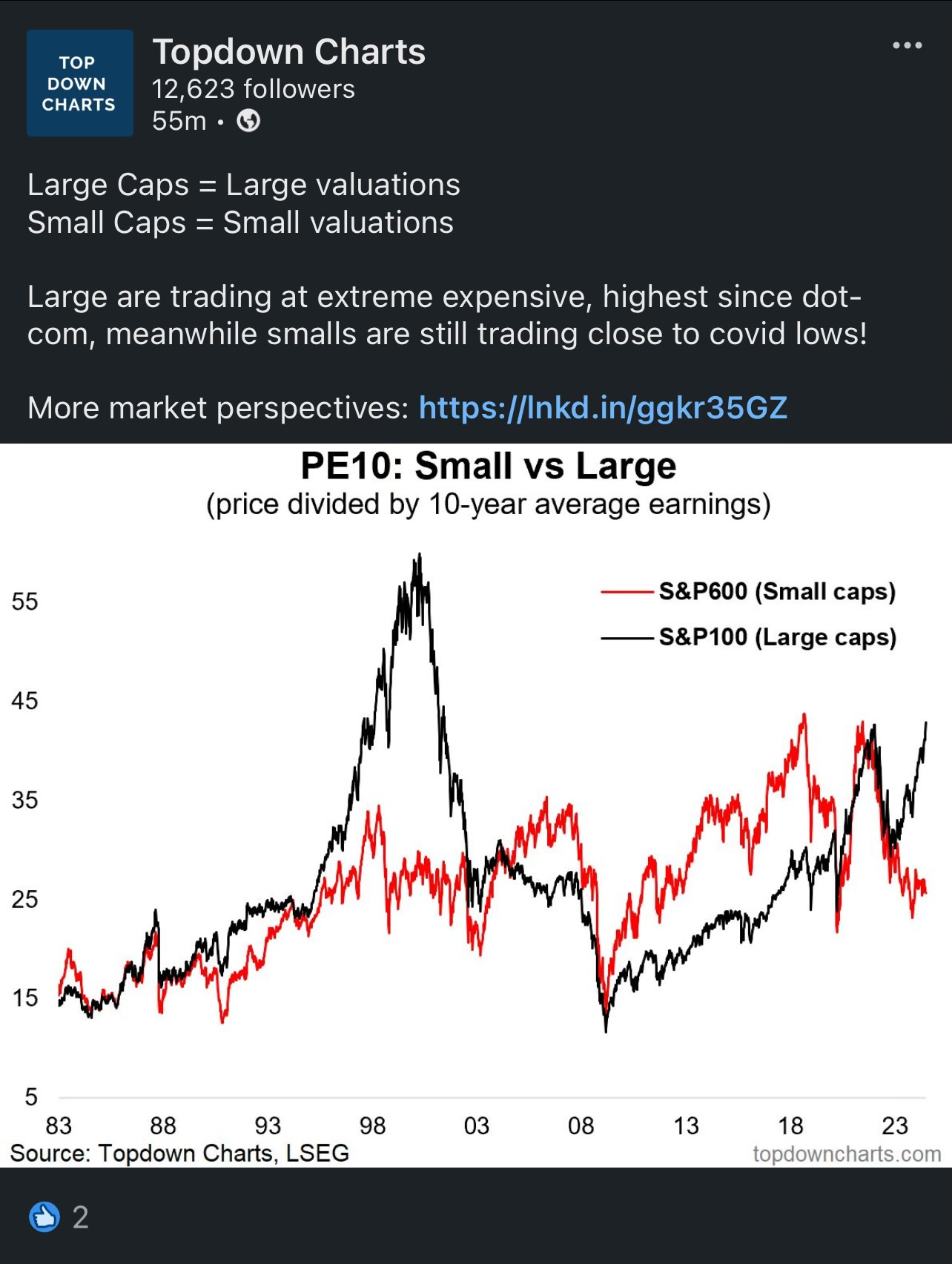

Large cap stocks appear rich compared to small cap stocks.

💡Capital Notes: If I were hunting for value I would absolutely be looking at small cap stocks.

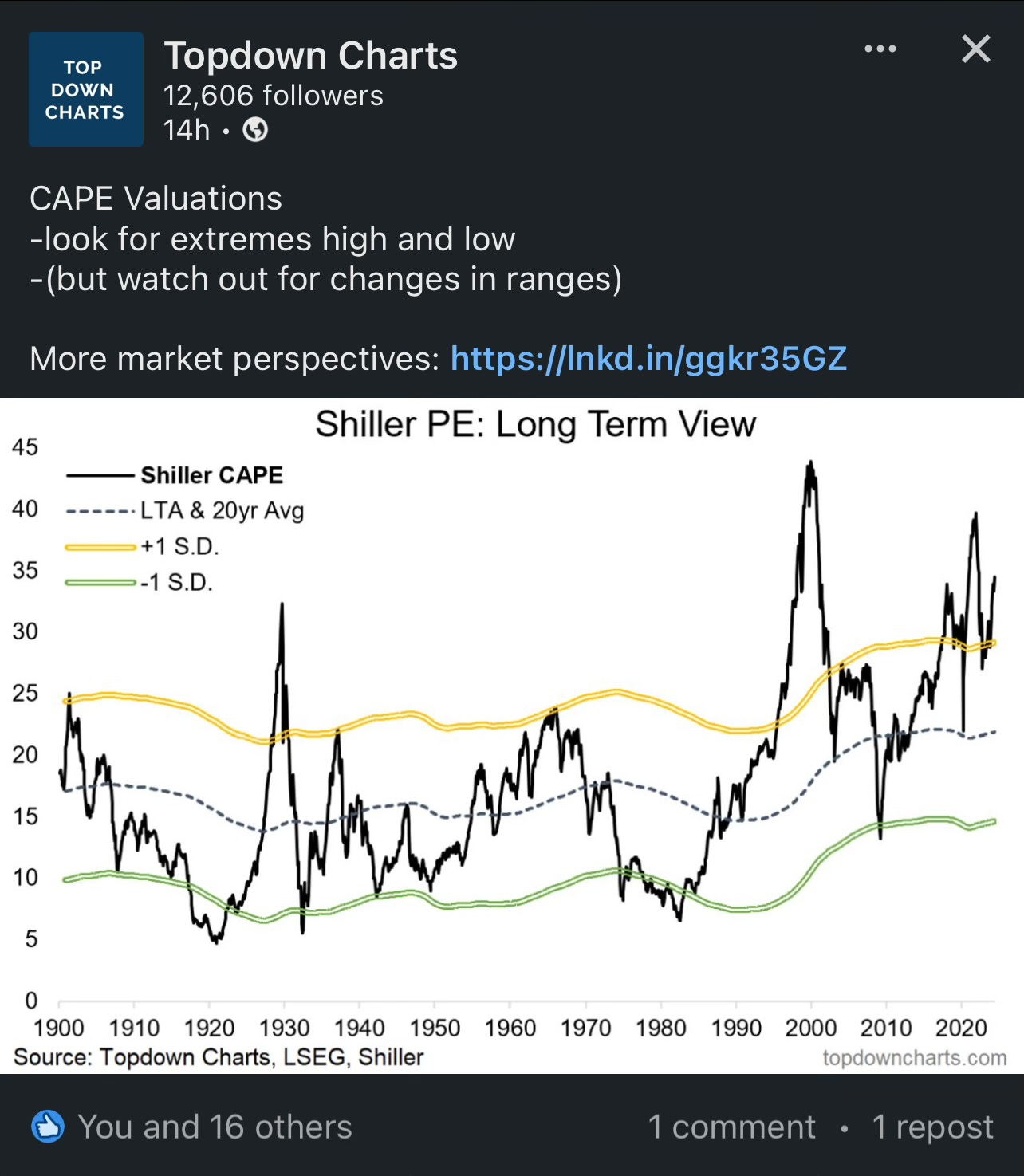

Market valuations are at extremes when measured using the Shiller PE.

💡Capital Notes: This is not a great timing tool. However, it is useful in trying to determine how far stocks could eventually fall in a real bear market.

US stocks have never been more expensive versus the rest of the world.

💡Capital Notes: There is value to be found in international developed and emerging markets.

Real Estate:

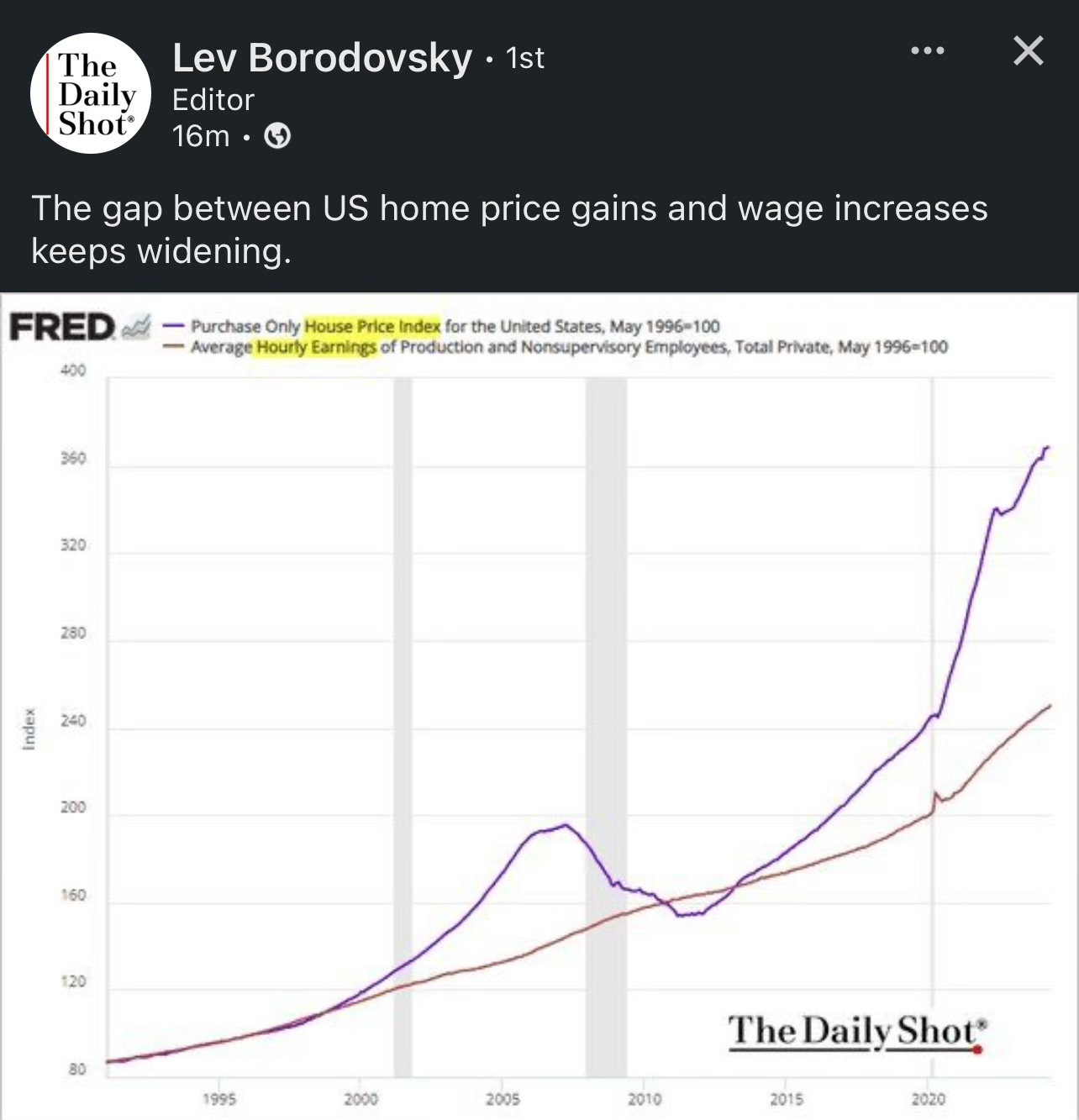

The gap between home prices and wages has never been larger.

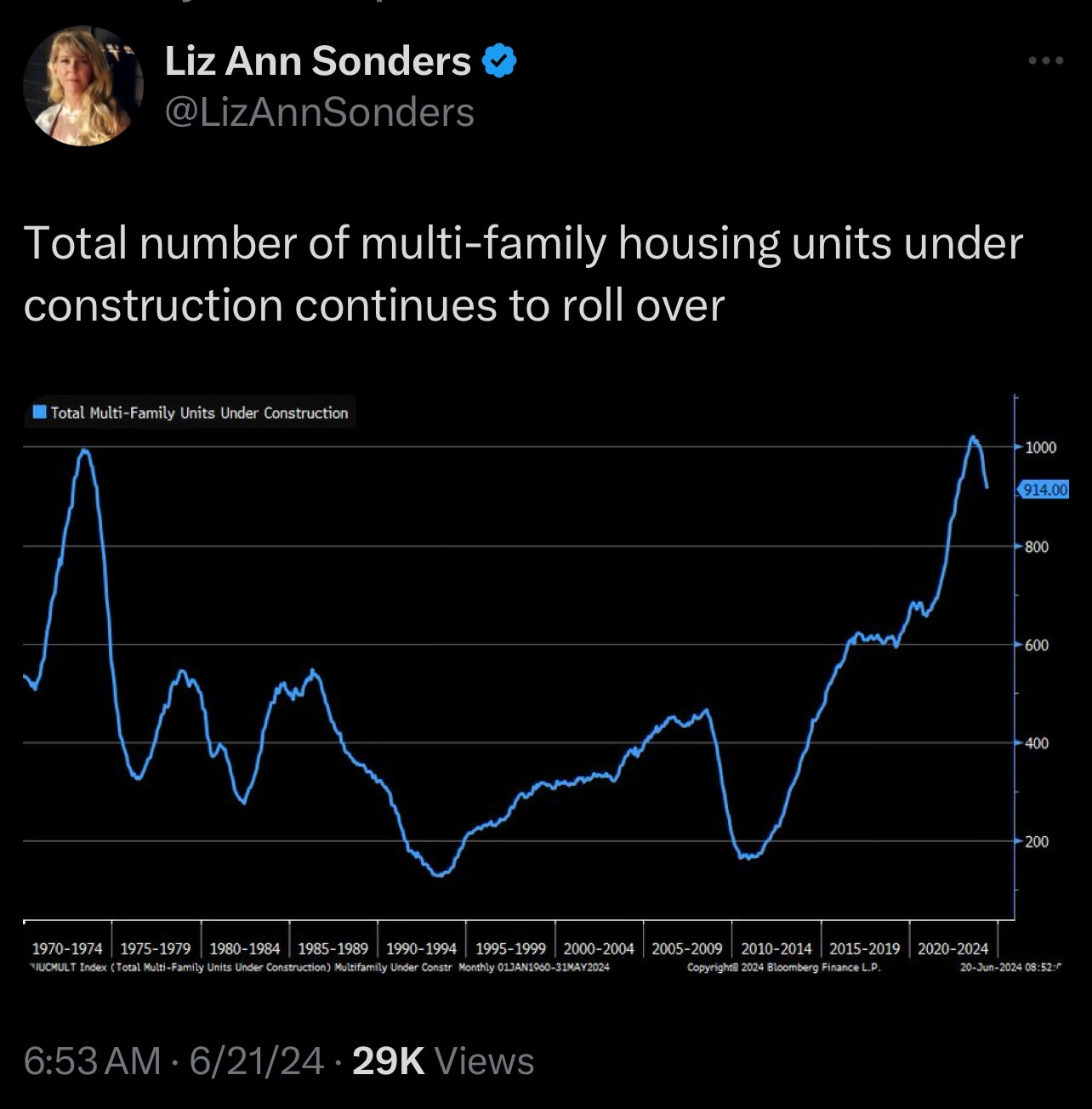

Multi-family units under construction appears to have peaked.

💡Capital Notes: We need more supply to solve the affordability issue with housing. A peak in units under construction is not a good sign.

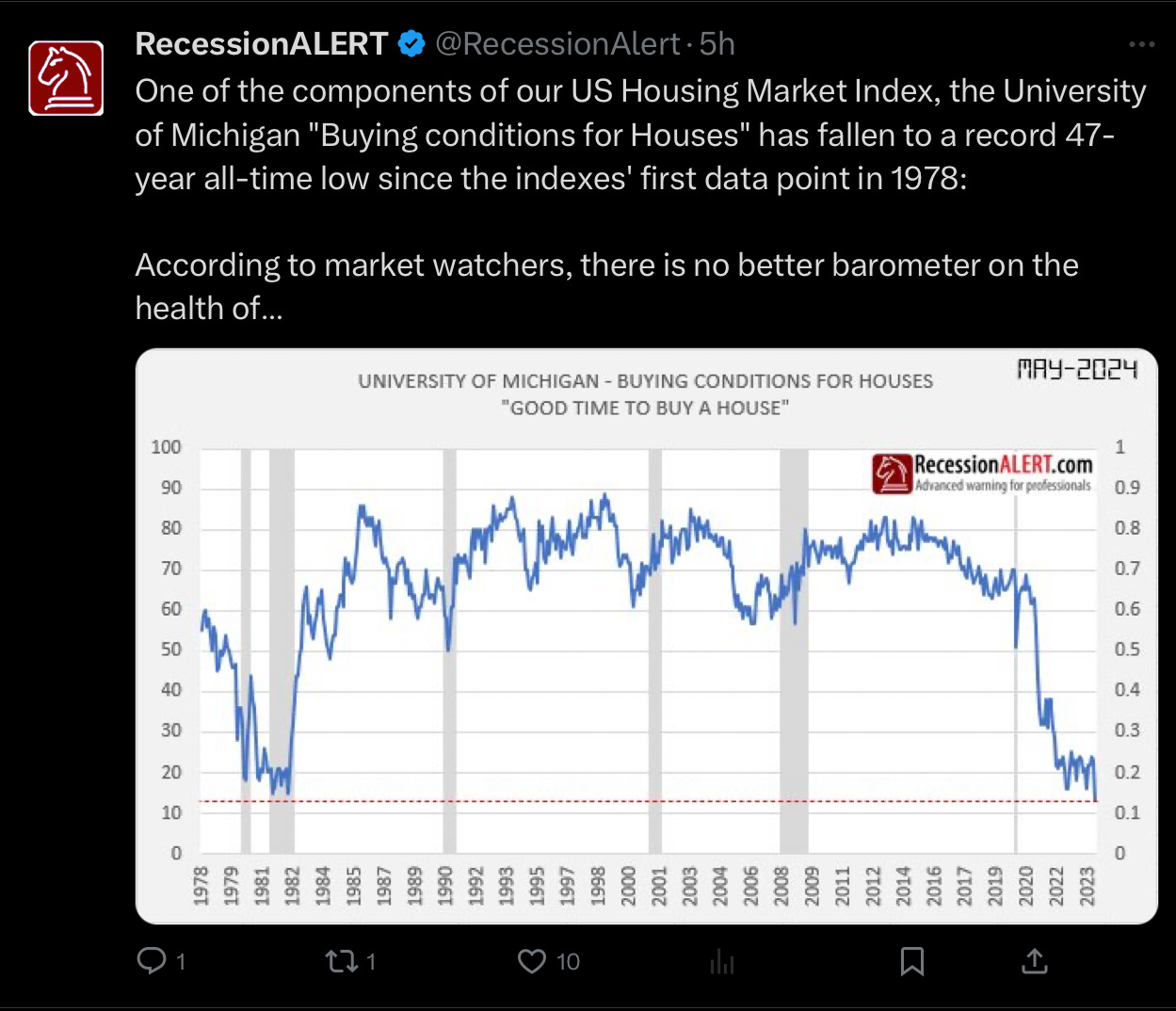

This is the worst time in history to purchase a home, according to the UofMich “Buying Conditions for Houses” survey.

Lumber continues to decline, nearly erasing the entire post-COVID rally.

💡Capital Notes: Lumber demand from housing construction doesn't appear to be enough to arrest this decline.

Other Interesting Topics:

New car prices have peaked.

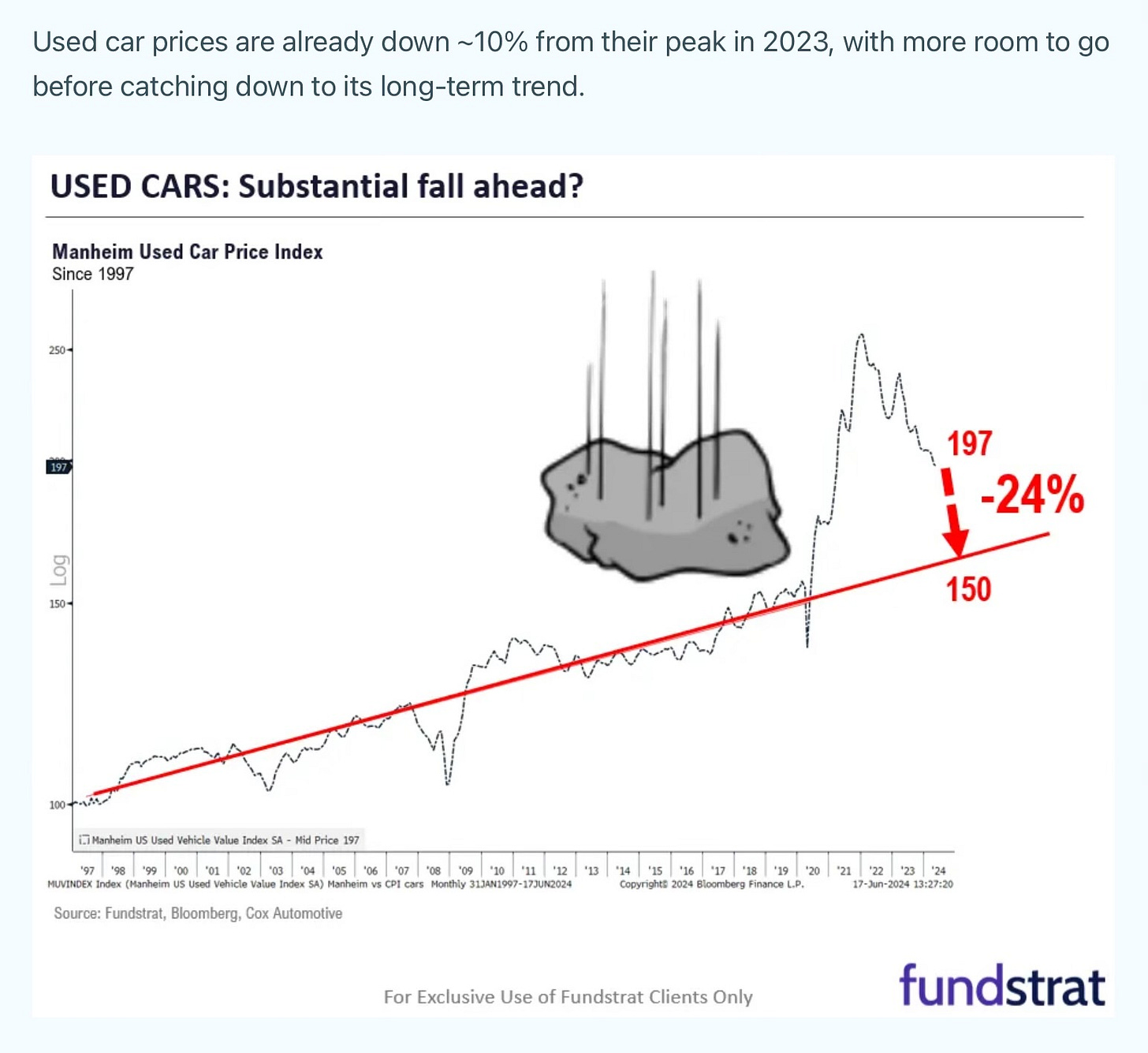

Used car prices are on track to return to normal levels.

The NFL lost its antitrust trial over its Sunday Ticket product.

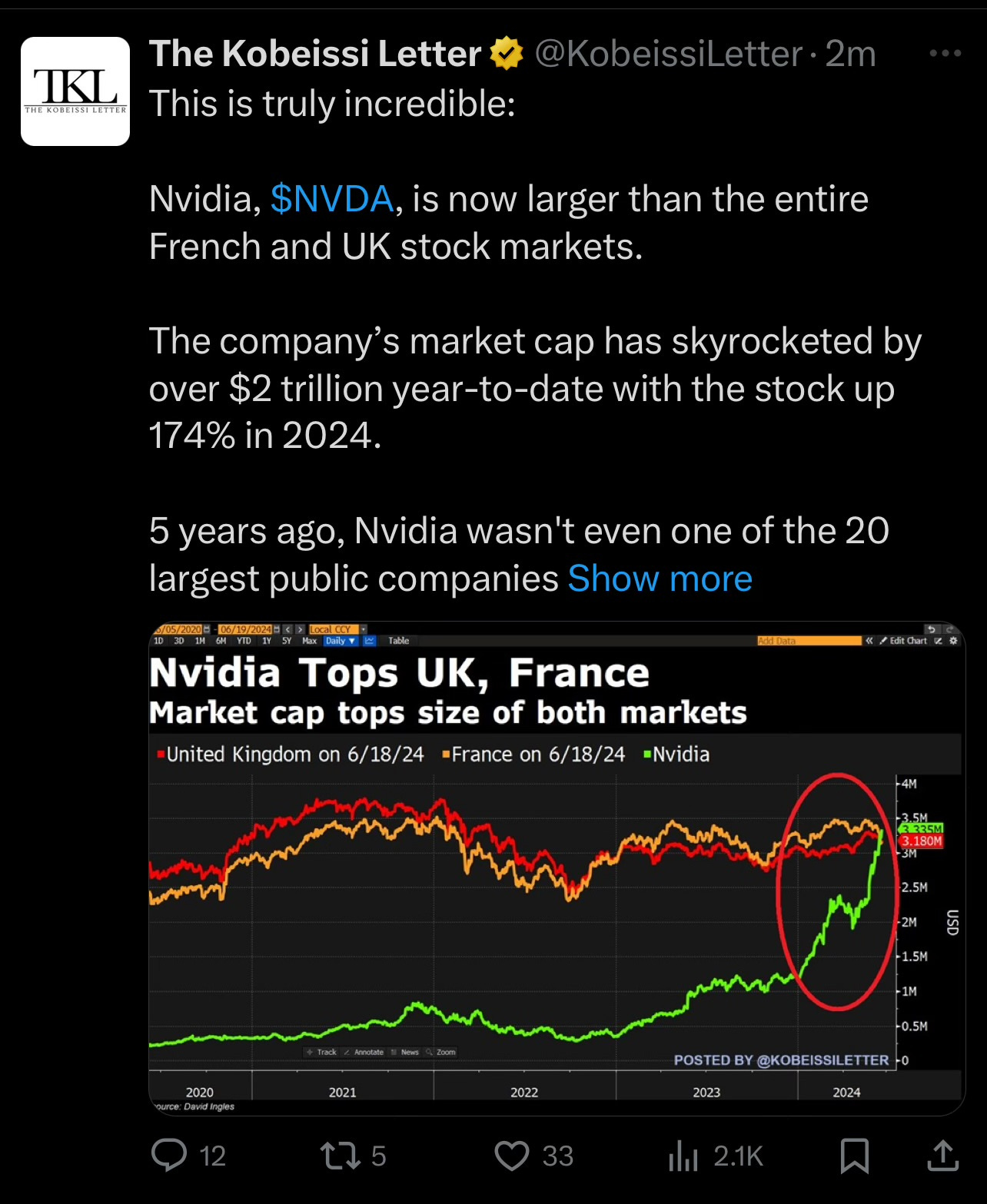

Nvidia is now one of the largest stock markets in the world, by itself.

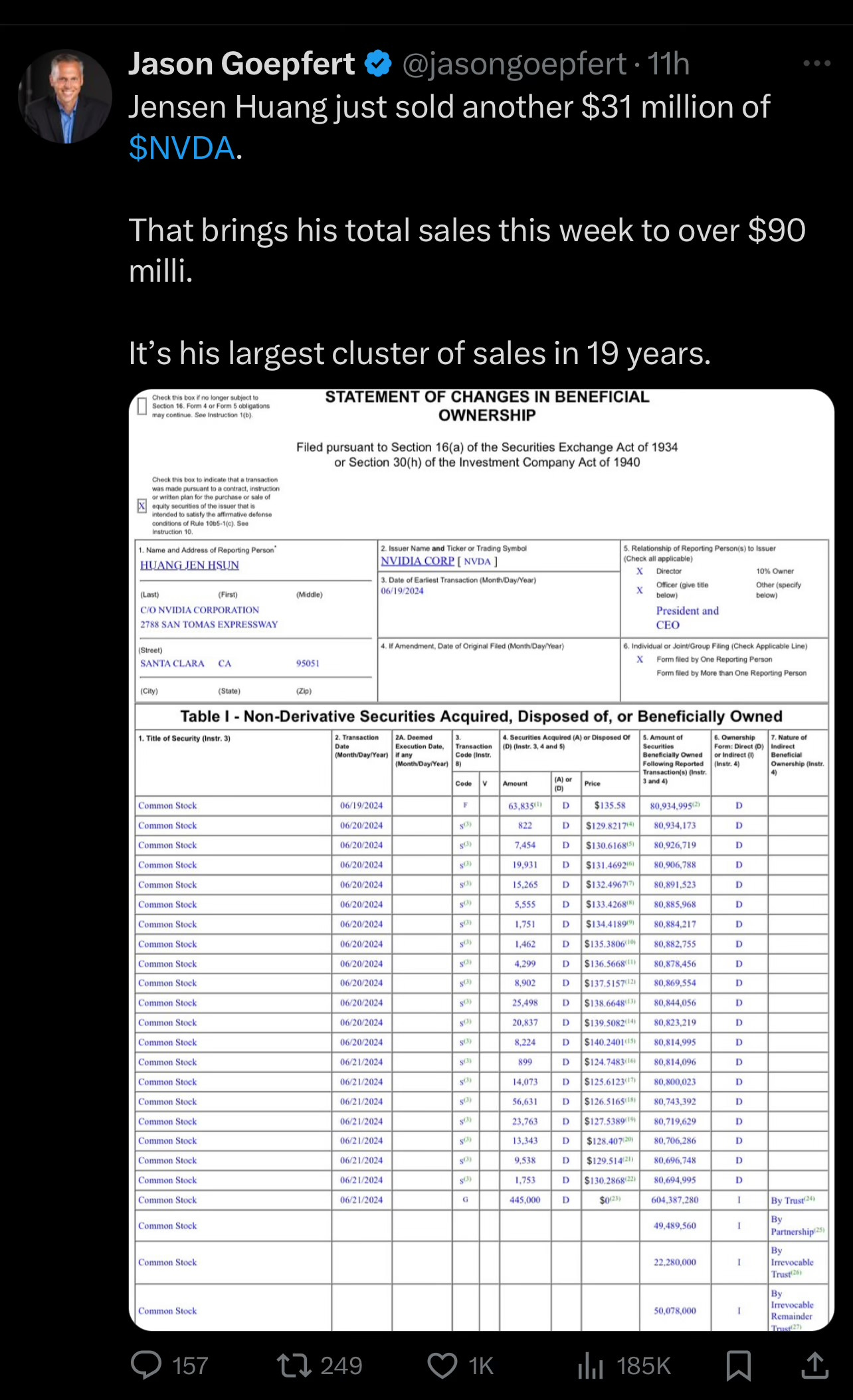

Nvidia insiders are selling stock.

💡Capital Notes: Insiders sell for all kinds of reasons, but its never good to see the leaders of a company dumping their stock.

Interesting analysis.

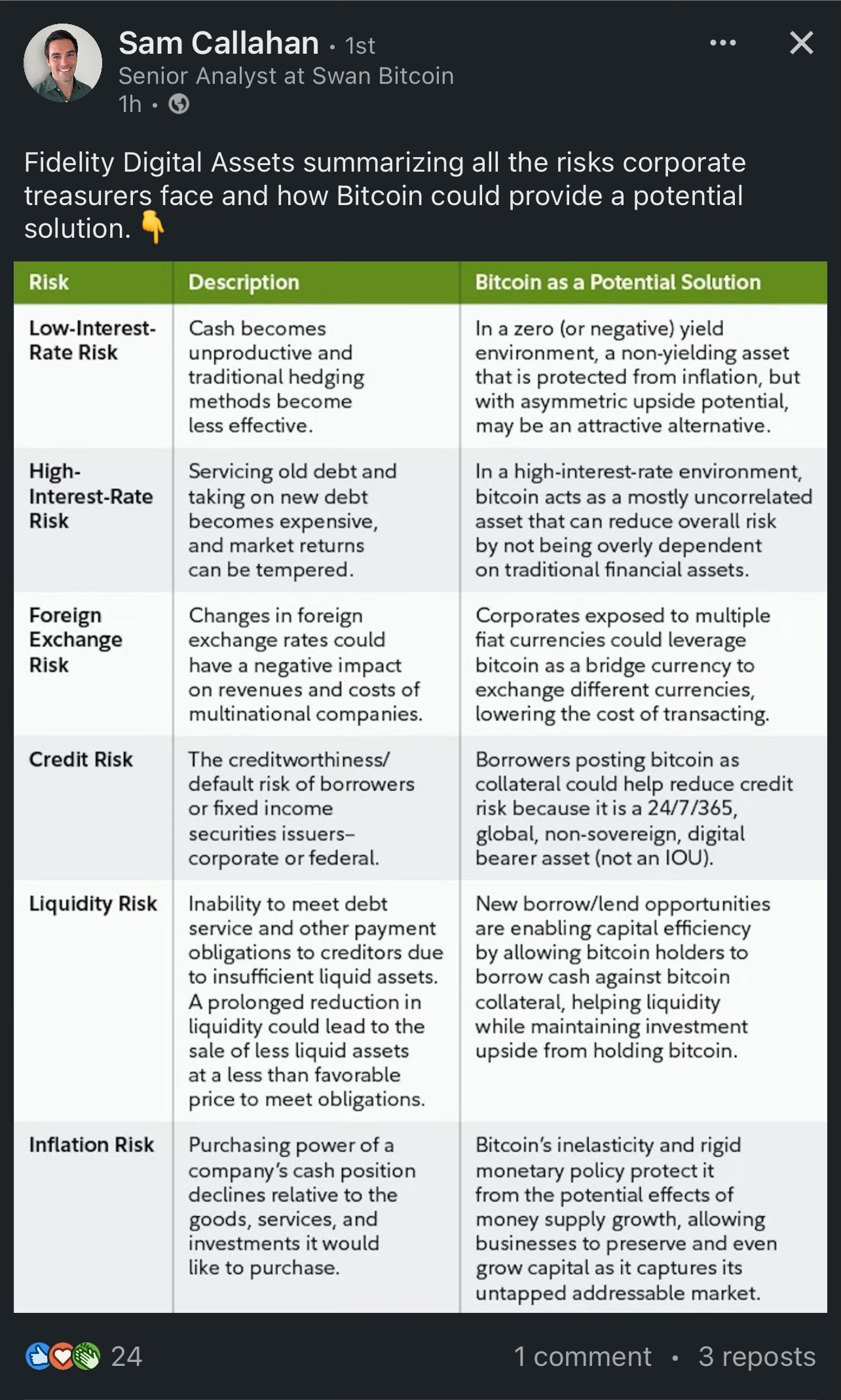

Fidelity research note summarizing all the potential areas where Bitcoin might be useful to a corporate treasurer.

💡Capital Notes: Bitcoin is here to stay.

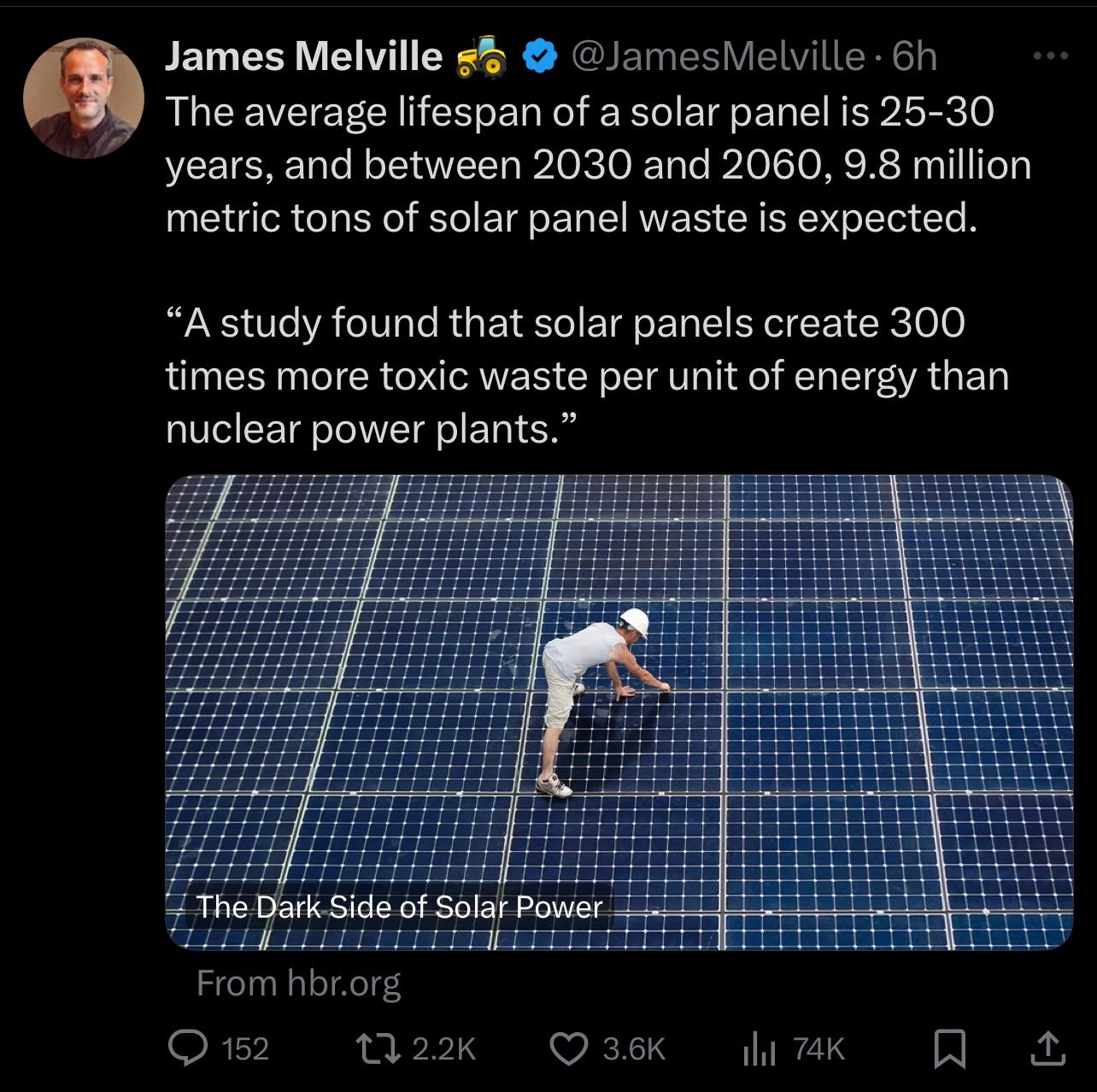

Solar panels are not as green as we once thought.

💡Capital Notes: Long nuclear.

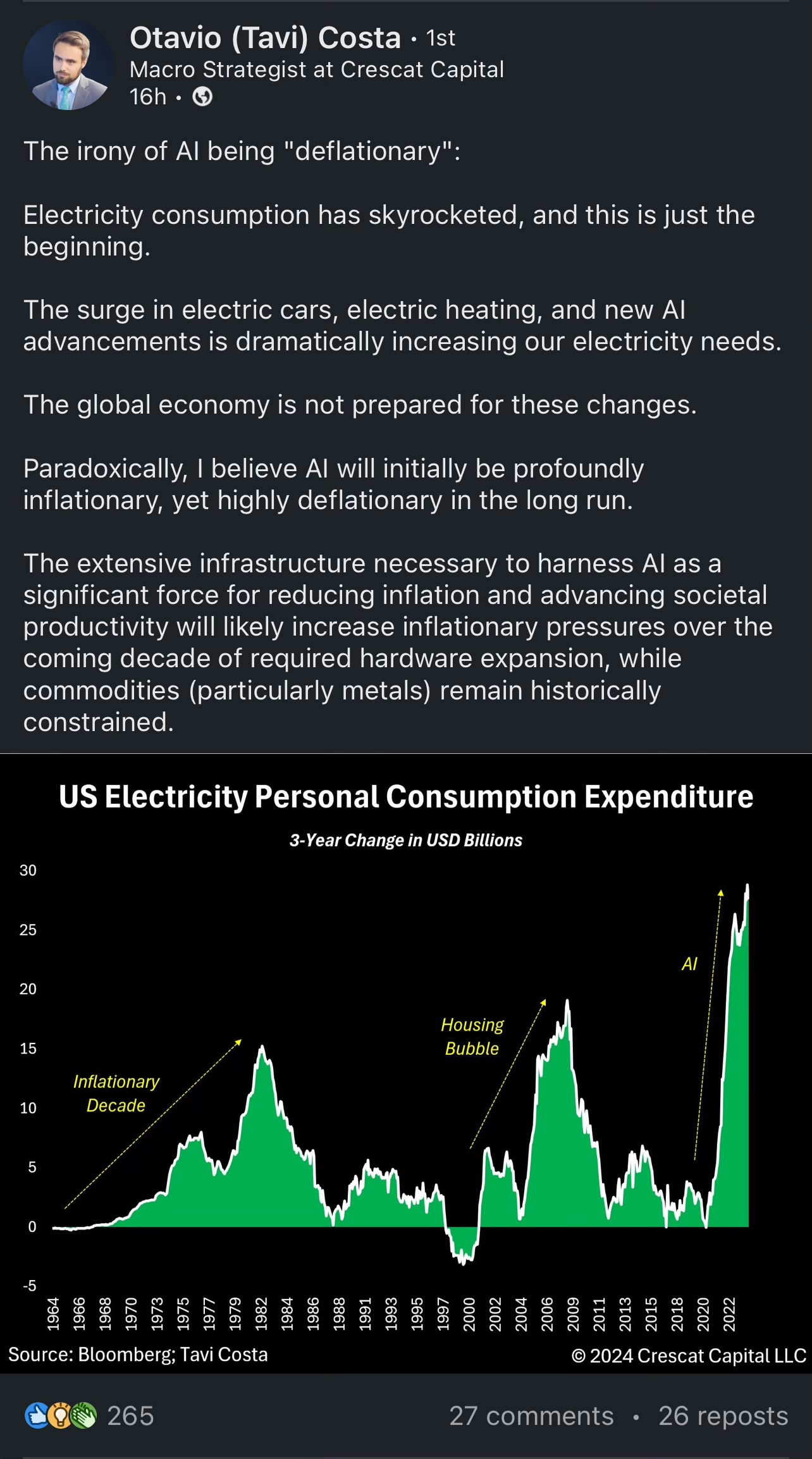

AI uses quite a bit of electricity.

💡Capital Notes: Long nuclear.

BlackRock pumping Bitcoin.

💡Capital Notes: Bitcoin is here to stay.

No comment necessary.

I hope you enjoyed the first installment of The Capital Notes Media Digest! Please be sure to like and subscribe.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.