Is the elusive Fed pivot actually on the way?

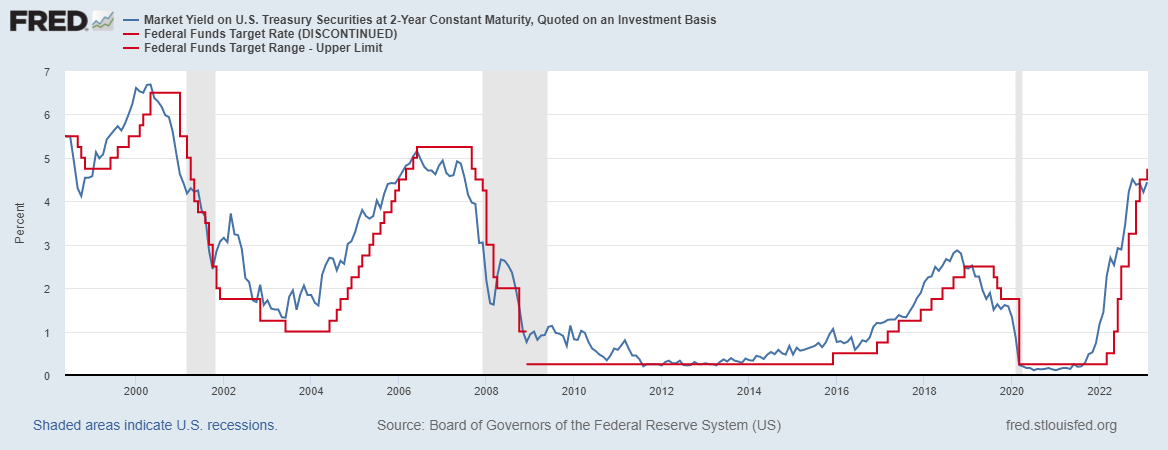

Figure 1 shows two time series, the first is the 2 year US treasury yield (blue) and the second is the federal funds rate (red).

Historically, the Fed will look to the market as a method for signaling when to change the federal funds rate. You'll notice, the 2 year yield leads the fed funds rate — up and down. During hiking cycles, when the 2 year yield falls below the fed funds rate, the Fed pauses the hiking cycle almost immediately (see 2000, 2006, and 2019 in Figure 1). This has now happened in the current hiking cycle for the first time.

In Figure 2, I show the spread between the 2 year treasury yield and 3 separate short term funding rates, the effective federal funds rate (1st pane), SOFR (2nd pane), and LIBOR (3rd pane). The spread between the 2 year yield and all 3 short term funding rates is now negative. This is signaling to the Fed that the bond market believes it's time to pause the hiking cycle.

Will they pause? We shall see.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.