Chart(s) of the Day: March 7, 2023

Soft landing still on the way? Maybe it never was.

Today’s Chart(s) of the Day will be presented as a series of charts and largely without comment.

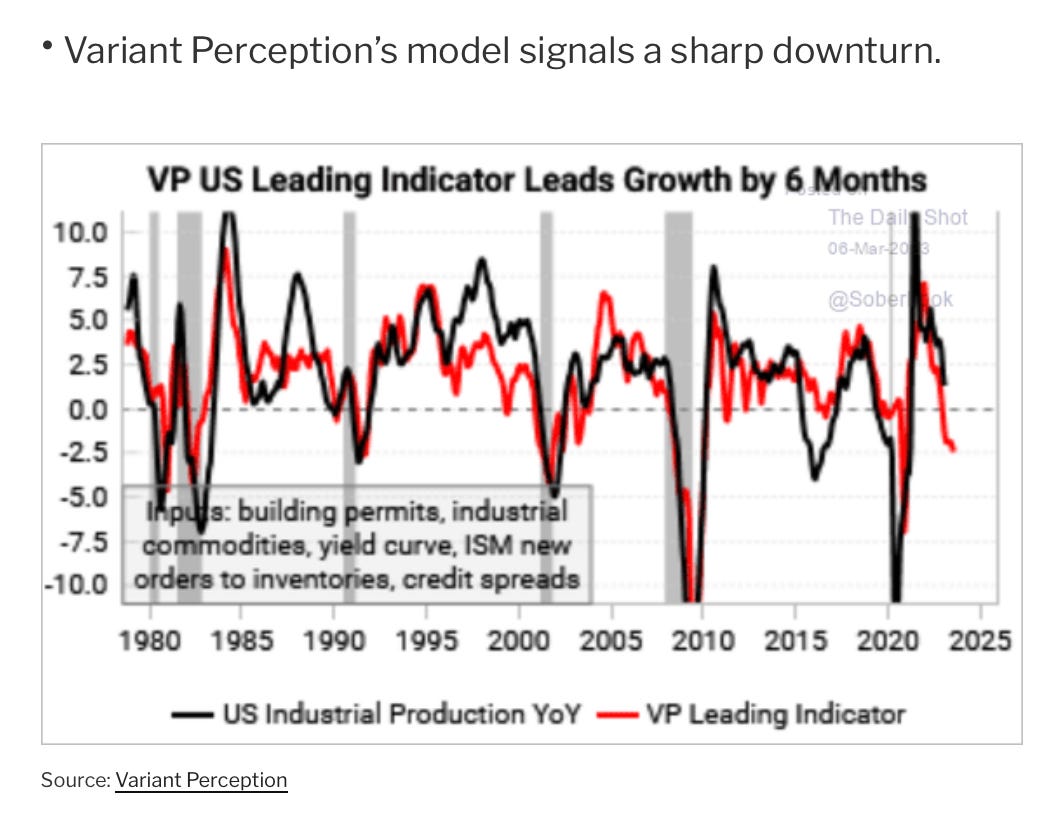

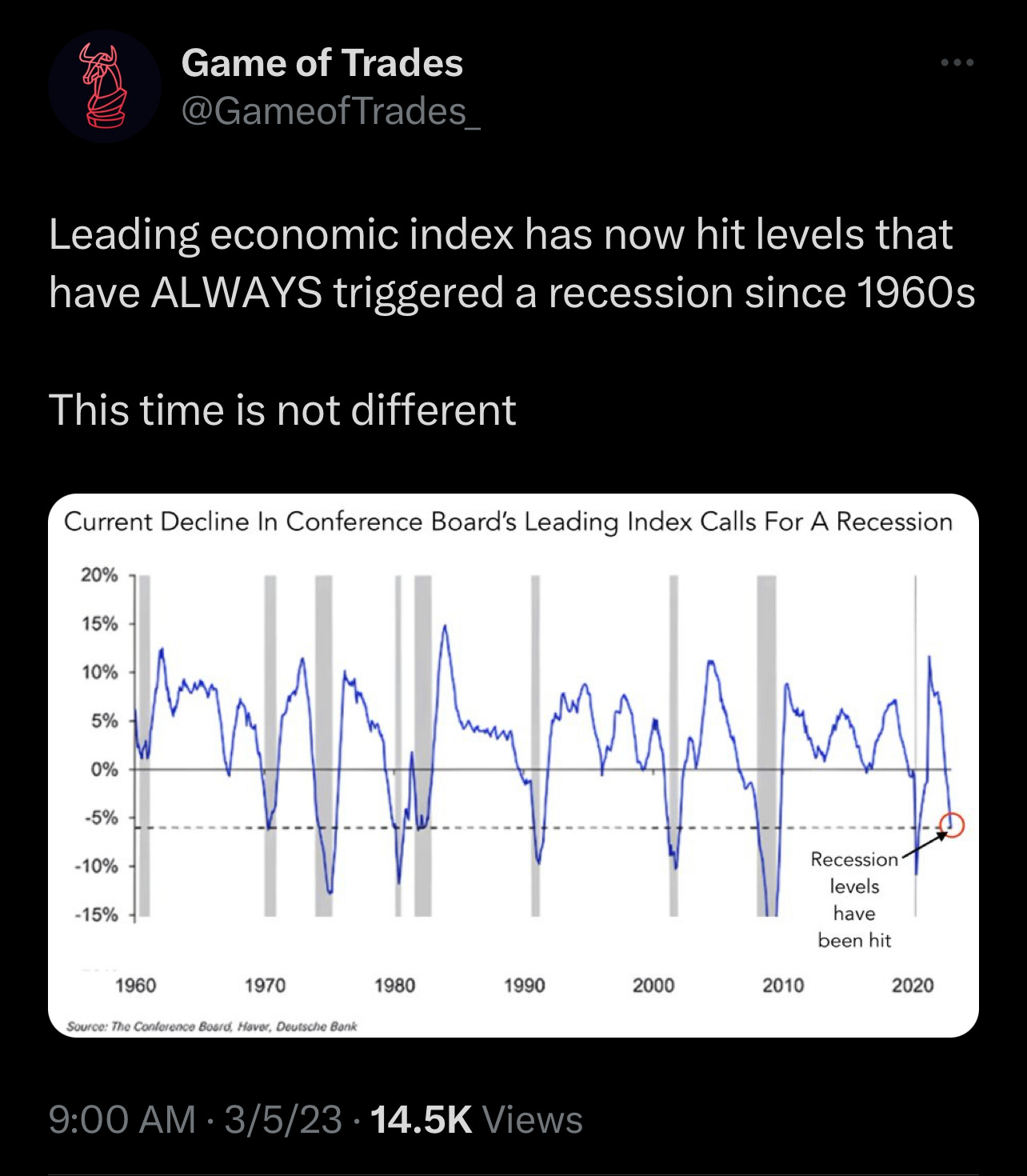

The following is a series of charts that all provide data and evidence suggesting a recession is likely in the cards for sometime in 2023 or early-2024.

Bridgewater’s change in real PCE model is predicting a decline in real growth.

Deutsche Bank recession probability model now above 90% — in other words, there is a 90% chance of recession sometime in the next 12 months.

The 3 month average of the Chicago Fed National Activity Index now at levels that are historically consistent with the start of recessions.

The OECD Leading Indicators have fallen to a level similar to 8 of the last 8 global recessions.

European real M1 growth tends to lead Euro area real GDP growth by 4 quarters. Right now it is forecasting -5% real GDP growth — consistent with a deep recession.

J. Powell and the Fed have their work cut out for them…..

Lastly, I want to reiterate a message I posted on LinkedIn approximately 3 months ago. Everything I said at that time, along with the data I provided, is still true at this time.

The Fed will pivot and begin cutting rates once it has become glaringly obvious that economic growth is deteriorating and the unemployment rate is rising. We are not there yet.

If historical relationships hold true, there is still great deal of potential risk in the current market environment. In a situation like this, when recession risk is high, monetary policy is continuing to tighten, and valuations are still elevated, investors must pay very close attention to the price they’re paying for any assets they purchase. A proper margin of safety must be observed.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.