“The times they are a-changing.”

— Bob Dylan

This is a quick Chart of the Day to start the morning.

The US 2-Year Treasury Yield is in a tailspin this morning after the Fed and Treasury announced depositor bailout packages for Silicon Valley Bank and Signature Bank. It looks like First Republic will be joining the fallen soon as well.

For the Fed this effectively a stealth QE. It will be interesting to watch Net Liquidity data over the coming days and weeks.

That said, the 2 Year Yield is falling faster than I can keep up with. As I type this it’s down 10% this morning to 4.132%. Long term rates are also down substantially and bonds are rallying like meme stocks.

Figure 1 shows the implications of this rapid drop in short term rates.

The 2 Year Yield acts as a North Star for Fed policy, a market signal to guide moves in the federal funds rate. Typically, when the 2 Year moves rapidly above or below the Federal funds rate it signals a shift in policy is likely near. The move this morning is the market’s way of pricing in a pivot in Fed policy from aggressive tightening to neutral — and in the case of continuing bank failures, maybe even accommodative.

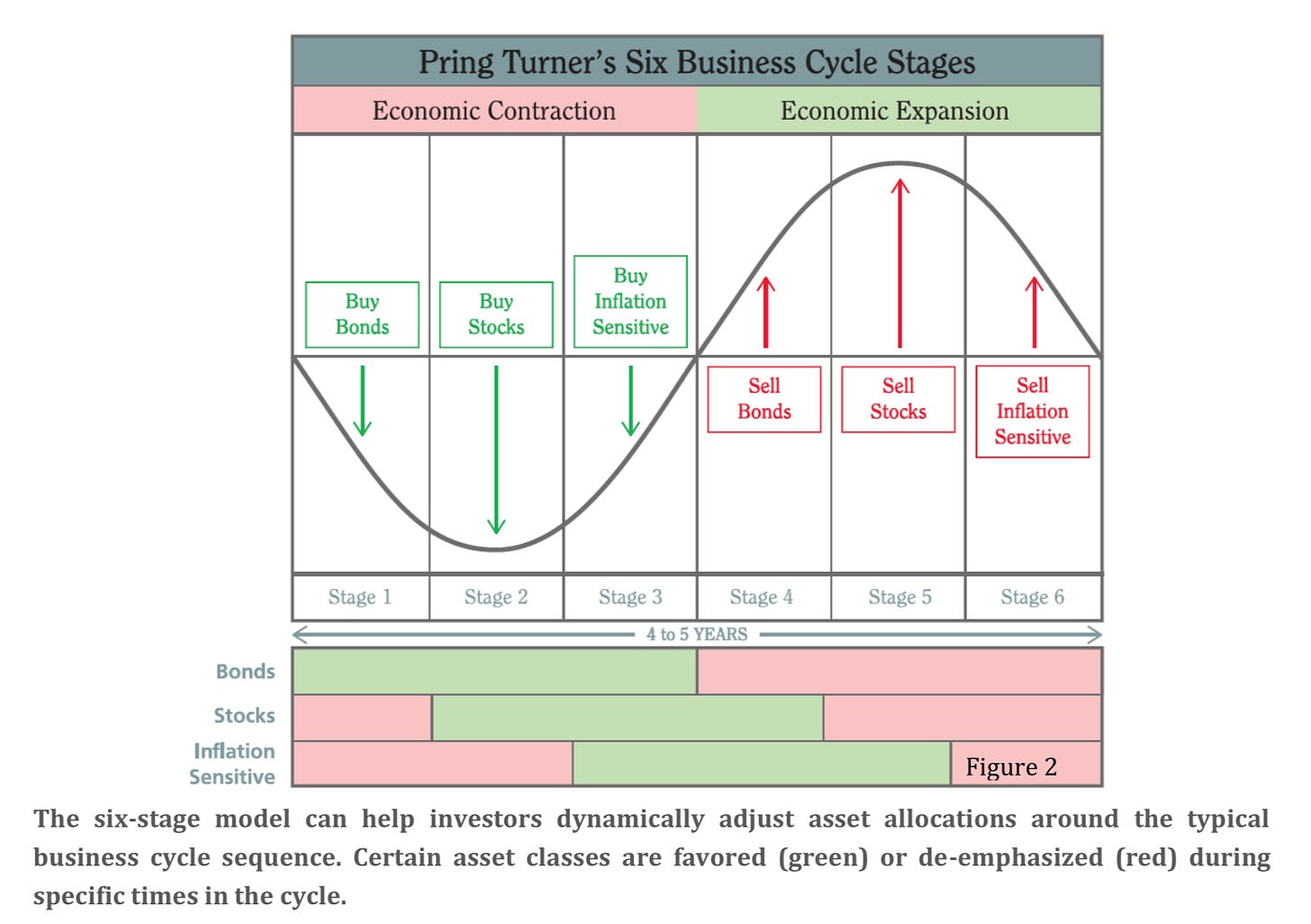

This also has implications for the broader macro picture. See Figure 2. The economy has been in a Pring Stage 6 for quite some time now, where stocks, bonds, and commodities have all been volatile with a downside bias. As the bond market finally catches a bid, we are likely rotating out of Stage 6 and into Stage 1, where investors would do well to rotate some capital away from T-bills and cash and into longer duration fixed income securities.

Stage 2 is where stocks finally find buyers and begin to rally. The length of Stage 1 is often quite short, therefore it is important to begin monitoring equities during Stage 1 and begin rotating some capital to select equities as the opportunity presents itself, even before the market fully confirms a move from Stage 1 to Stage 2.

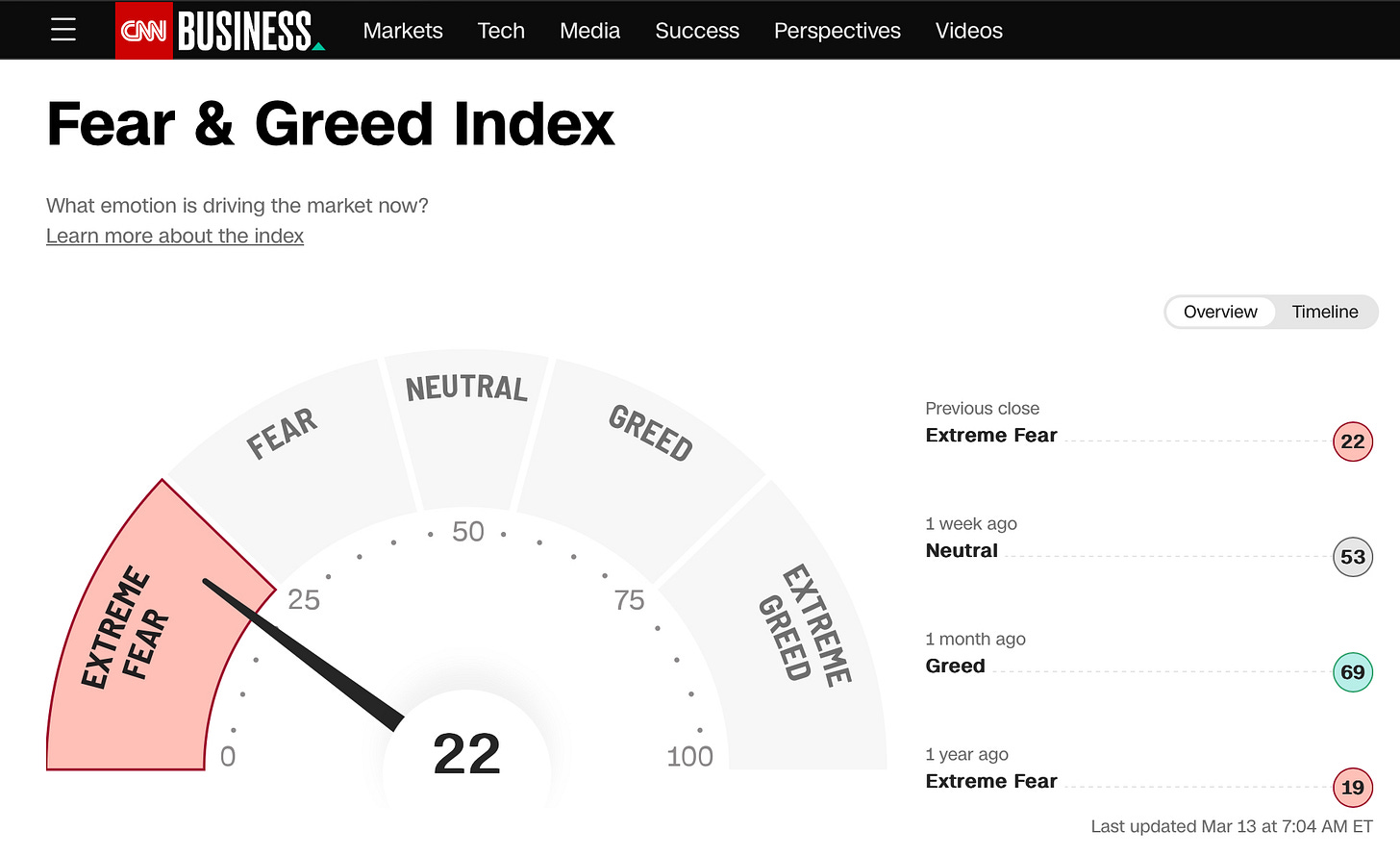

What does opportunity look like? The best investments are often made when one feels uncomfortable doing so. Buy when others are fearful, as Warren Buffet would say.

Fear has returned to the market.

However, fear and volatility can persist for days, weeks, and sometimes even months before the final wash out emerges. I believe we are likely now entering the final phase of the bear market, which is typically the most gut wrenching. Statistically, the worst returns occur in the final 1/3 of a bear market. This type of volatility generates strong emotions and emotional behavior results in bad decisions. Using data to drive investment decisions at this stage is more important than ever.

Remember that chaos creates opportunity. Patience and a level head are key.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Thanks Brant. My colleague at BOOM Finance & Economics monitors geopolitics and top-down markets & finance. Your nitty-gritty is welcome thank you as I too follow cycles, specifically from UK. I repost BOOM on Tuesdays and my weekly Letter on Saturdays: https://austrianpeter.substack.com/p/two-states-may-ban-mrna-technology?utm_source=post-email-title&publication_id=762792&post_id=106959066&isFreemail=false&utm_medium=email