A quick post tonight — and maybe controversial. I should preface by saying this is not me proclaiming it safe to push all your chips back into the market. Now that we have that out of the way, let’s explore why it makes sense in my mind to rotate some risk back to the long side.

It’s the difficulty of explaining my strategy during post such as this one why I’m considering the Capital Notes Model Portfolio. If you haven’t already. Please visit and vote on the poll I posted yesterday. You can find it here:

Now — on to the post!

The Nasdaq is holding up quite well in the face of strong negative sentiment, bank failures, and collapsing commodity prices.

In Figure 1, the weekly Nasdaq chart is hanging on above its 200 day moving average, bouncing off support after a period of consolidation. Its resilience in the face of challenging market conditions is encouraging.

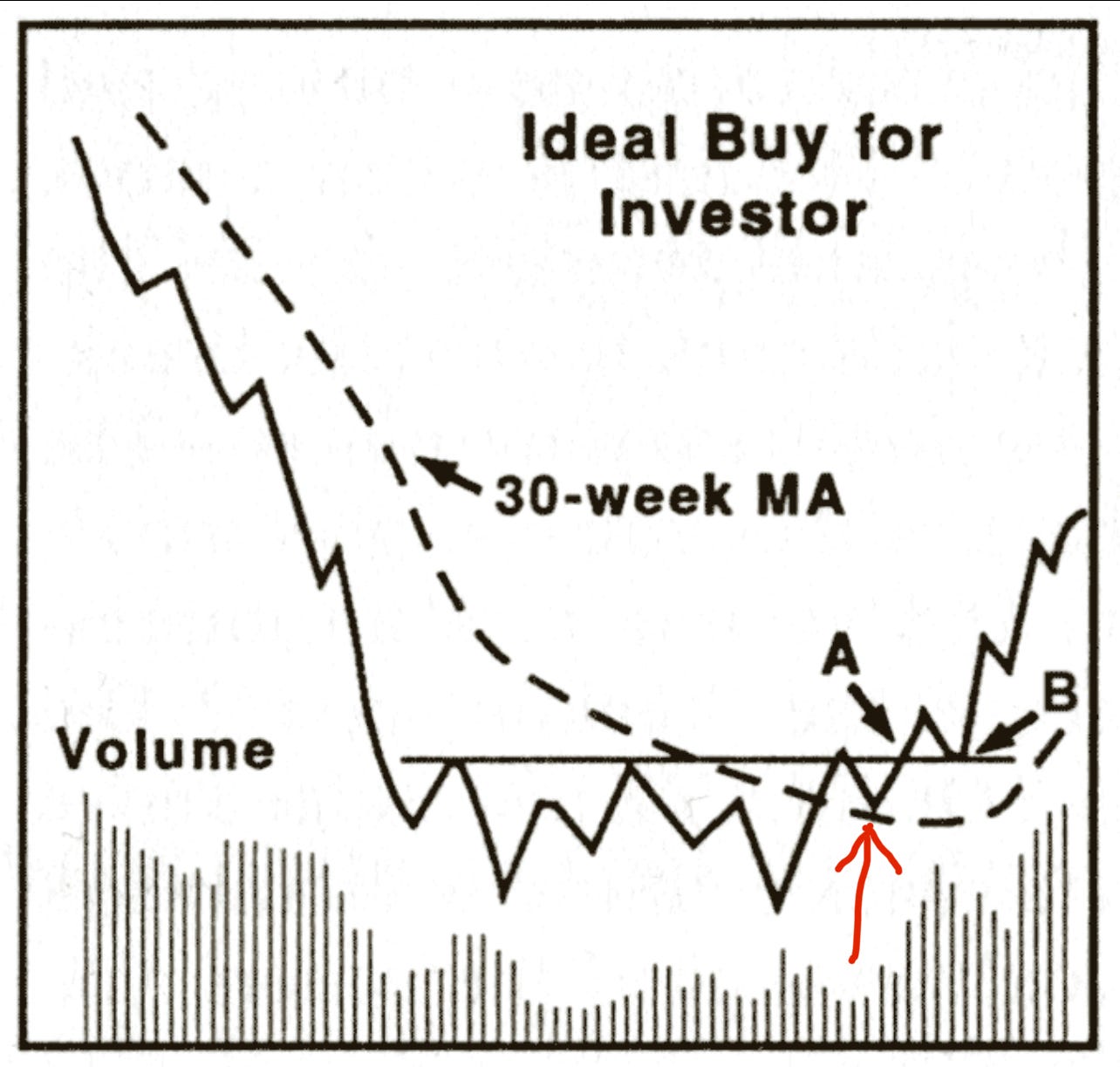

The current Nasdaq chart looks quite similar to Figure 2, a chart of the “ideal investor buy point”.

Historically, the best time to purchase stocks is at sentiment extremes. When the majority is pessimistic, forward returns are statistically higher. I personally like to invest when the market is deeply pessimistic and prices are somehow not continuing to move lower. It seems now may be one of those times — at least for the Nasdaq 100 Index.

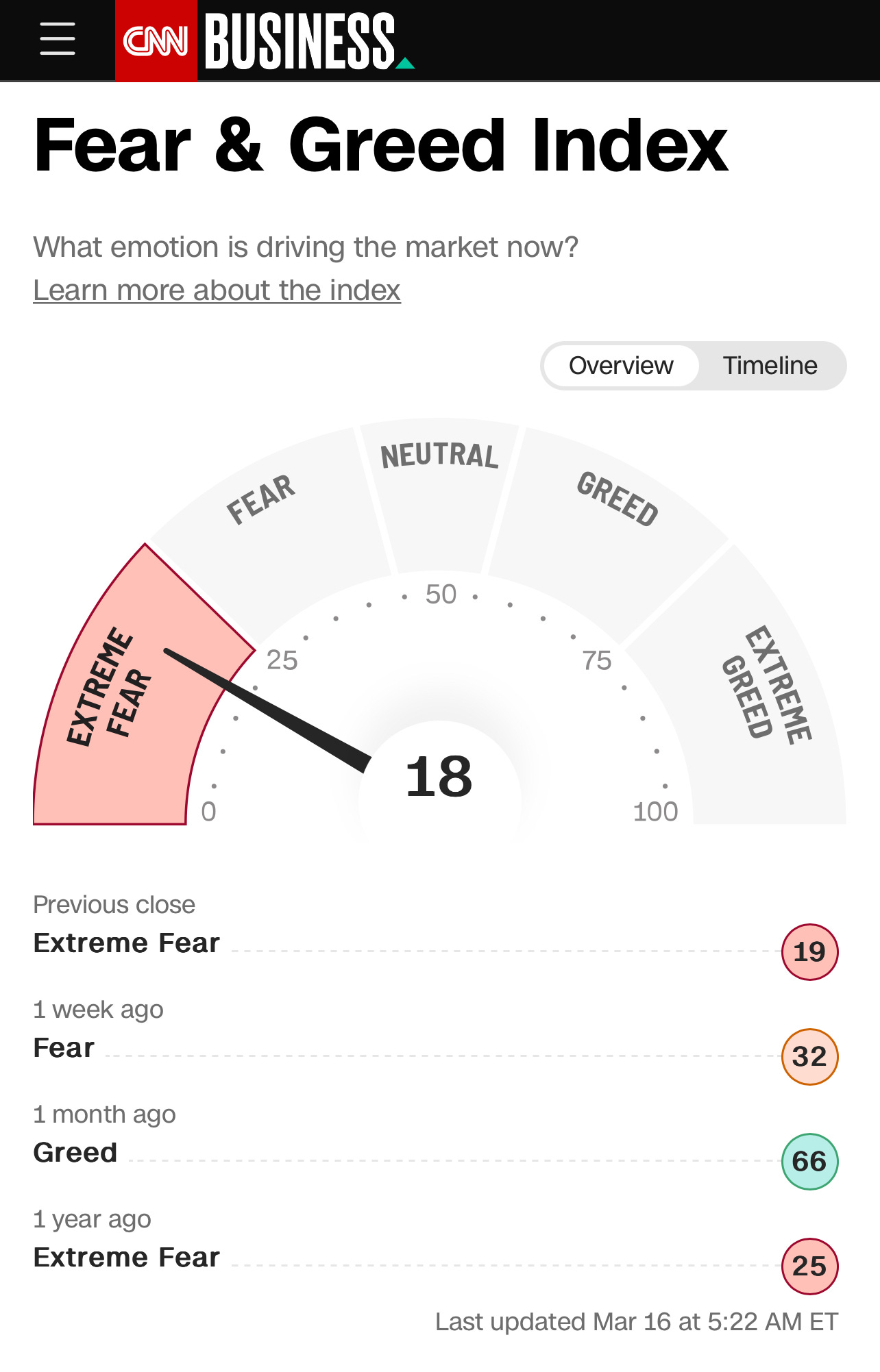

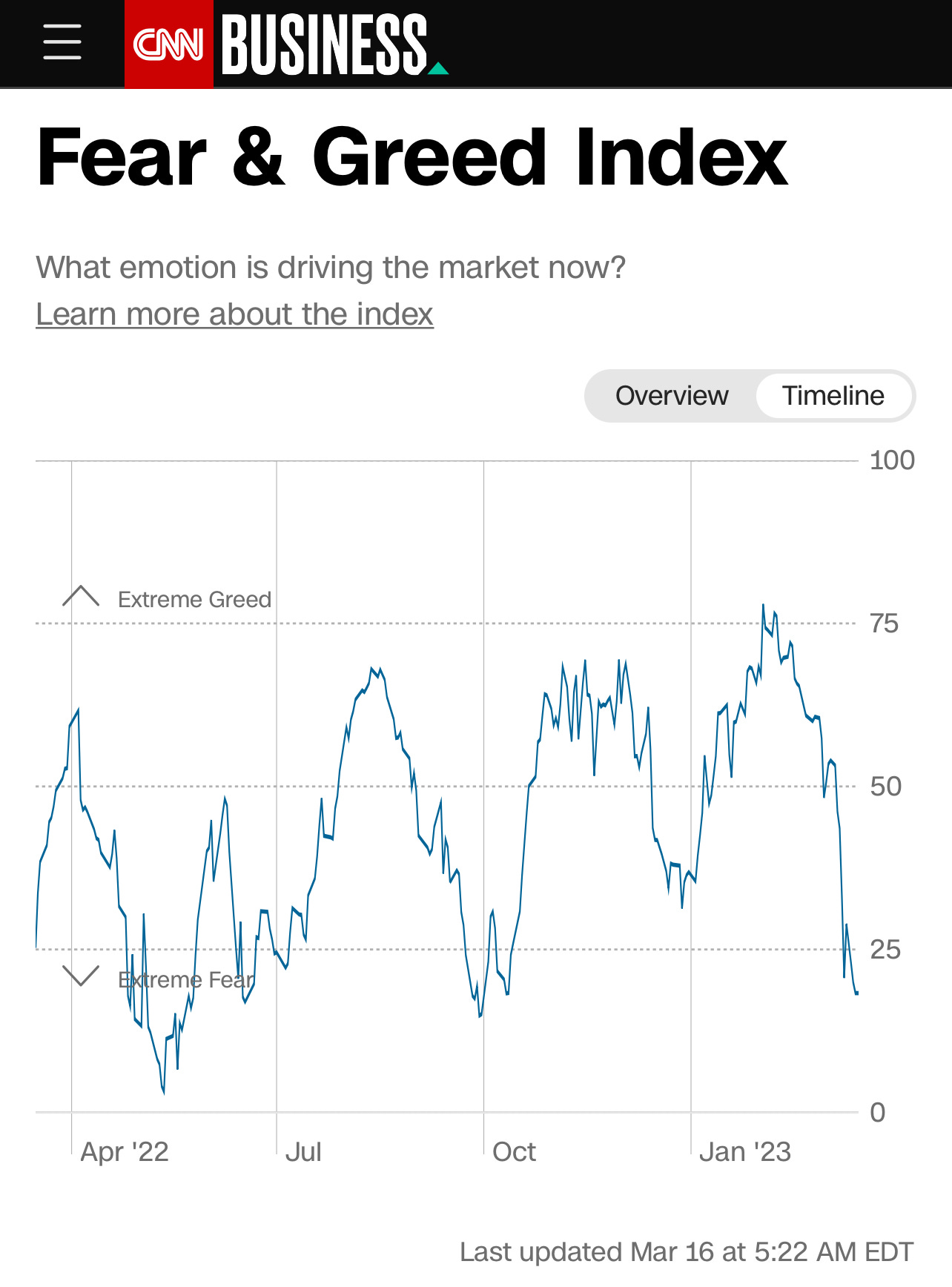

Both Figure 3 and Figure 4 show the CNN Fear & Greed Index has dipped back into extreme fear territory. Figure 4 shows the index is pushing levels that rival the October 2022 low in stocks.

Let me be clear, this index can stay in fear / extreme fear territory for quite awhile before finally bottoming — and it doesn’t mean it is a permanent bottom (see April-July 2022 in Figure 4). However, it risk assets usually bottom when sentiment is at a level of extreme fear.

The recent collapse in oil and commodity prices is driving inflation expectations lower (Figure 5). If the BTFP rolled out by the Federal Reserve, and the uninsured deposit back stop provided by the Treasury and FDIC, results in a prevention of further Bank runs — a reduction in inflation expectations should be a net positive for markets. Dare I say it — inflation moderating, and the prevention of financial system contagion increases the chances of a “soft landing”.

I’m not placing a high probability on this, but when the charts provide a reason to be bullish who am I to argue with the price?

Risk remains high, but it’s always easy to find many reasons to be bearish near market bottoms. Purchases can be made selectively in undervalued equities where evidence exist for a significant margin of safety, and stop losses can protect investors from a further unraveling of prices.

Investing is about playing probabilities. I prefer to place bets on the long side when others find the same action uncomfortable. However, caution is still warranted.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.