Fallout from the Banking Crisis

Will Silicon Valley Bank's failure have destructive after shocks?

There has been countless articles discussing the reasons for the banking panic seen over the last few weeks that led to the demise of Silicon Valley Bank, Signature Bank, and Silvergate Capital. However, there's been far less discussion on what the bearish outcomes could be.

I want to keep this short and sweet using some simple bullet points.

By the way, I am not assigning a probability to this scenario. Only discussing it as it’s important to think through all possible outcomes when one is allocating capital.

Banking crisis: A banking crisis is a situation in which a large number of banks fail or are at risk of failing. This can lead to a loss of confidence in the banking system, which can make it difficult for businesses and individuals to get loans.

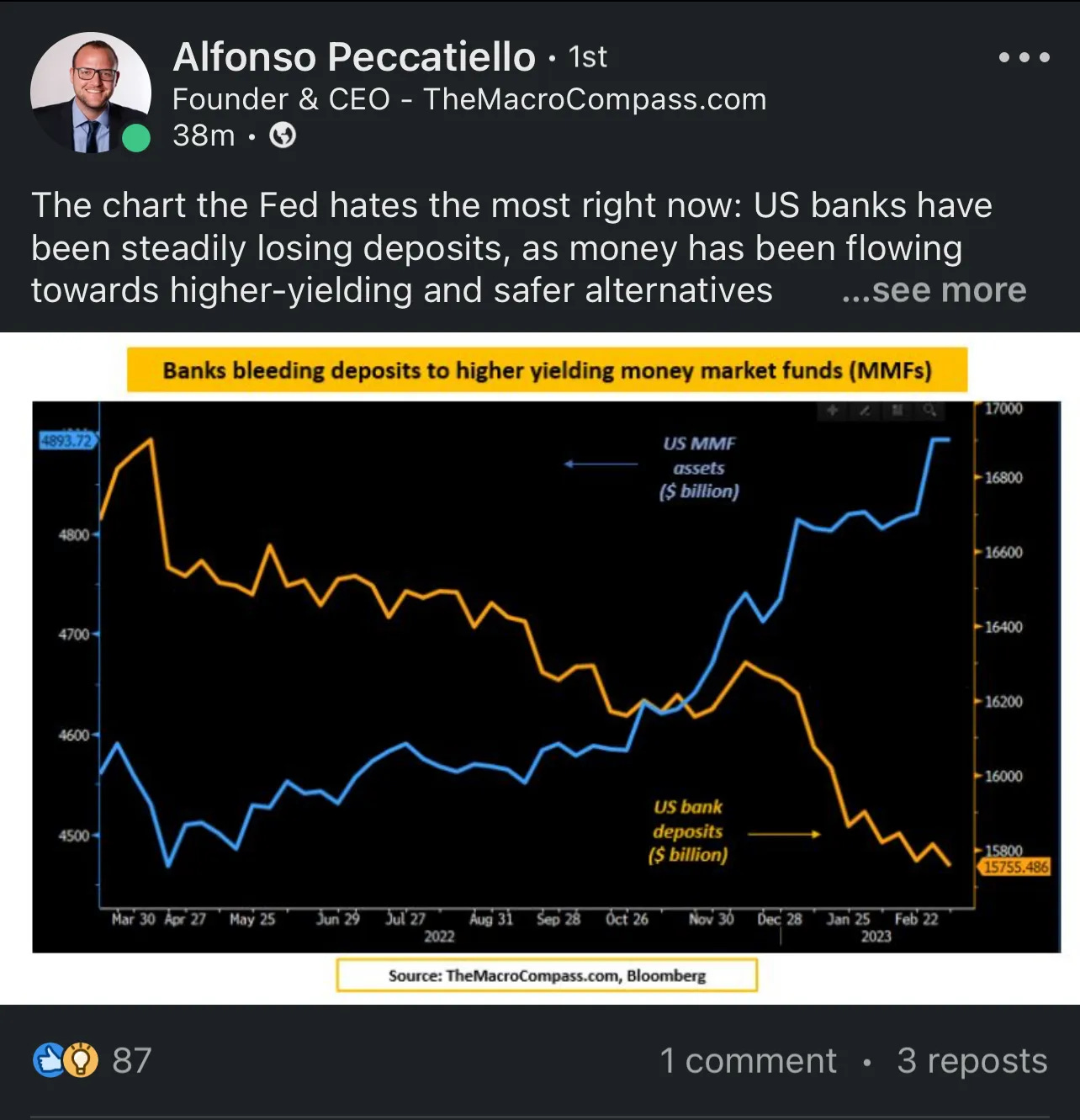

Figure 1 shows the banking crisis in one chart. The deposit flight is primarily out of regional and community banks.

Stress in the banking system: Stress in the banking system can be caused by a number of factors, including a decline in asset values, a rise in defaults, and a loss of liquidity (deposit flight). This can lead to a tightening of lending standards, a slowdown of lending, and a contraction of credit.

Figure 2 is proof of the stress this crisis is creating inside the banking system. The white line shows the performance of banks vs the rest of the market. Banks are significantly underperforming recently as their health is called into question.

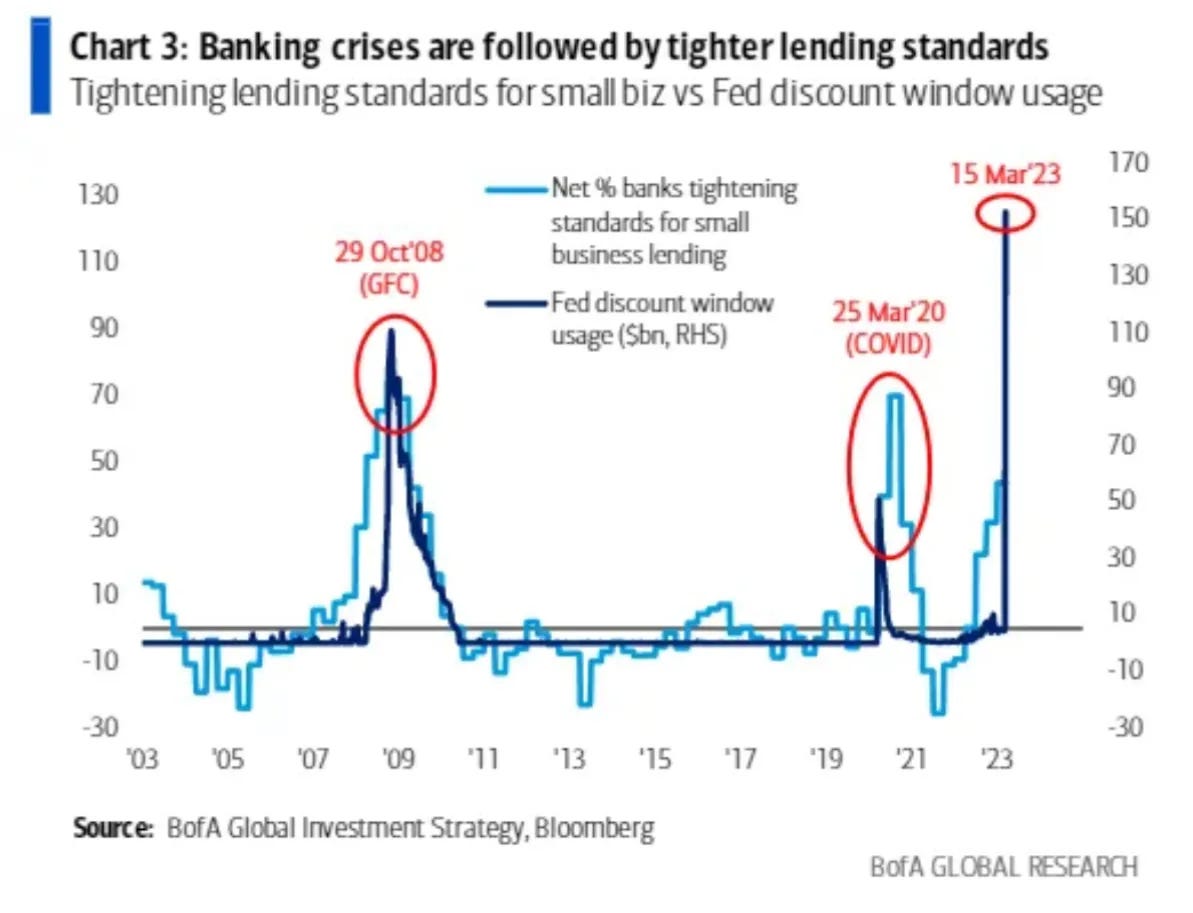

Figure 3 is also proof of this stress. Banks are borrowing billions from the Federal Reserve’s Discount Windows and the new Bank Term Funding Program. These are expensive forms of capital and banks only use these programs when having difficulty borrowing through more favorable methods.

Tightening of lending standards: When banks are under stress, they may become more cautious about lending money. This can lead to a tightening of lending standards, which means that it becomes more difficult for businesses and individuals to get loans.

Figure 4 shows the close connections between usage of the Federal Reserve’s Discount Window and tightening lending standards. When banks are under stress they go on the defense and are less likely to extend credit for deals on the edges of their loan policy guidelines.

Slowdown of lending: When banks are under stress, they may also slow down the pace of lending. This can lead to a slowdown of lending, which means that businesses and individuals are less likely to get new loans, and those who already have loans may find it difficult to refinance them.

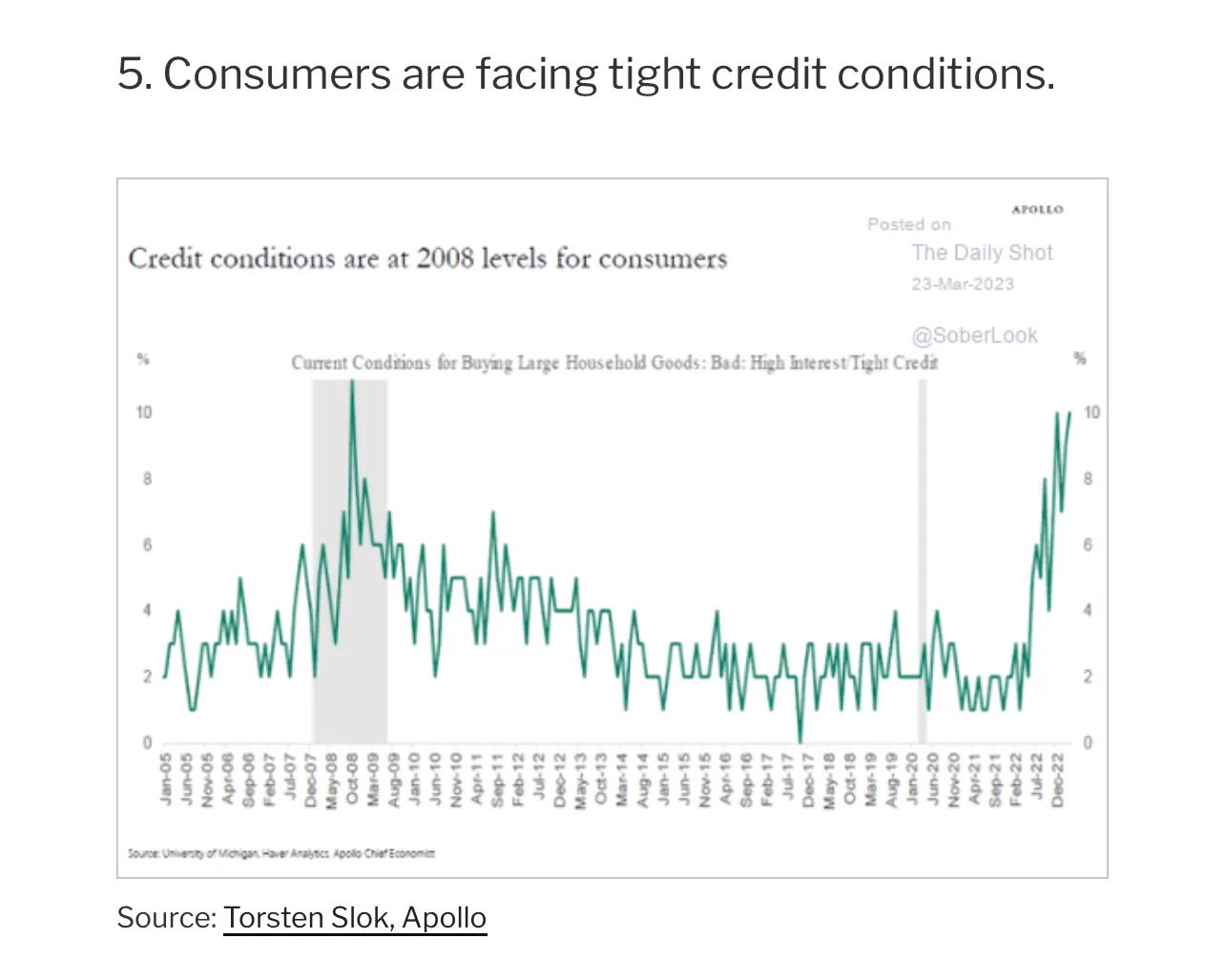

Figure 5 shows consumers are already finding it more difficult to access credit.

The commercial real estate sector is particularly at risk. Figure 6 and Figure 7 show the substantial reliance the commercial real estate industry has on community and regional banks.

Slowdown in the economy: A slowdown in lending and a contraction of credit can lead to a slowdown in the economy. This is because businesses and individuals need access to credit in order to invest, grow, and consume. When credit is tight, it becomes more difficult for businesses to expand, and individuals to buy homes and cars. This can lead to a decline in economic activity.

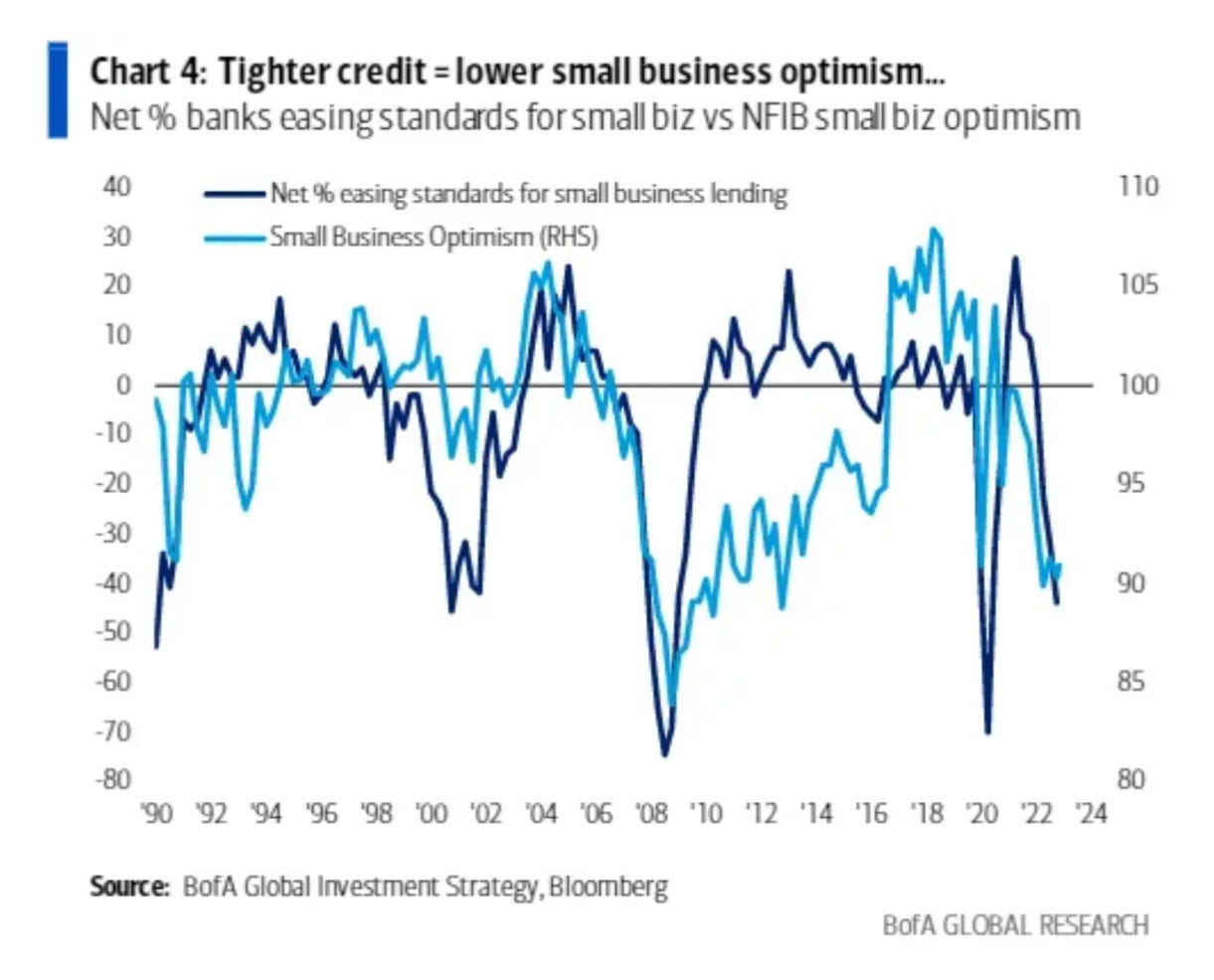

In Figure 8 the relationship between the ability to access credit and small business optimism is shown. This is an important point to understand as small businesses employ the vast majority of Americans. If small businesses, which are primarily banked by regional and community banks, have trouble borrowing it will have a negative impact on business investment, employment, and future economic growth. Due to the recent crisis, it’s likely small businesses are going to experience a difficult period of time for accessing funding.

Higher level of unemployment: A slowdown in the economy can lead to a higher level of unemployment. This is because when businesses are not investing and growing, they need fewer workers. This can lead to job losses, which can in turn lead to a decline in consumer spending. This can create a vicious cycle, where the slowdown in the economy leads to higher unemployment, which leads to a further slowdown in the economy.

Lastly, Figure 9 displays the relationship between small businesses availability of loans and initial jobless claims, a measure of employment health. When small businesses cannot access credit it tends to result in job losses and higher levels of initial jobless claims (people filing for unemployment for the first time). The chart below shows the availability of loans beginning to worsen, initial jobless claims is likely to follow if the historical relationship holds.

Conclusion

Banking crises are followed by tighter lending standards and lower risk appetite. Small businesses are the most negatively affected as they are the most reliant on regional and community bank lending.

US small businesses create ⅔ of jobs in America so a lower availability of credit could cause a surge in unemployment if historical relationships hold.

A final note: banks with under $250 billion of assets make up 80% of commercial real estate lending & with very high US office vacancy rates (18.7% in 4Q22) commercial real estate could be the next shoe to drop — which would further impair the health of regional and community banks and lead to another step increase increase in the tightness of lending standards.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Excellent recap