“We must recognize that the psychology of the speculator militates strongly against his success. For, by relation of cause and effect, he is most optimistic when prices are highest and most despondent when they are at bottom.”

— Ben Graham, 1934

After more than a year and a 75%+ decline, the price of bitcoin is finally looking constructive. This is the case from 3 perspectives. Technicals, sentiment, and fundamentals.

Technical Analysis

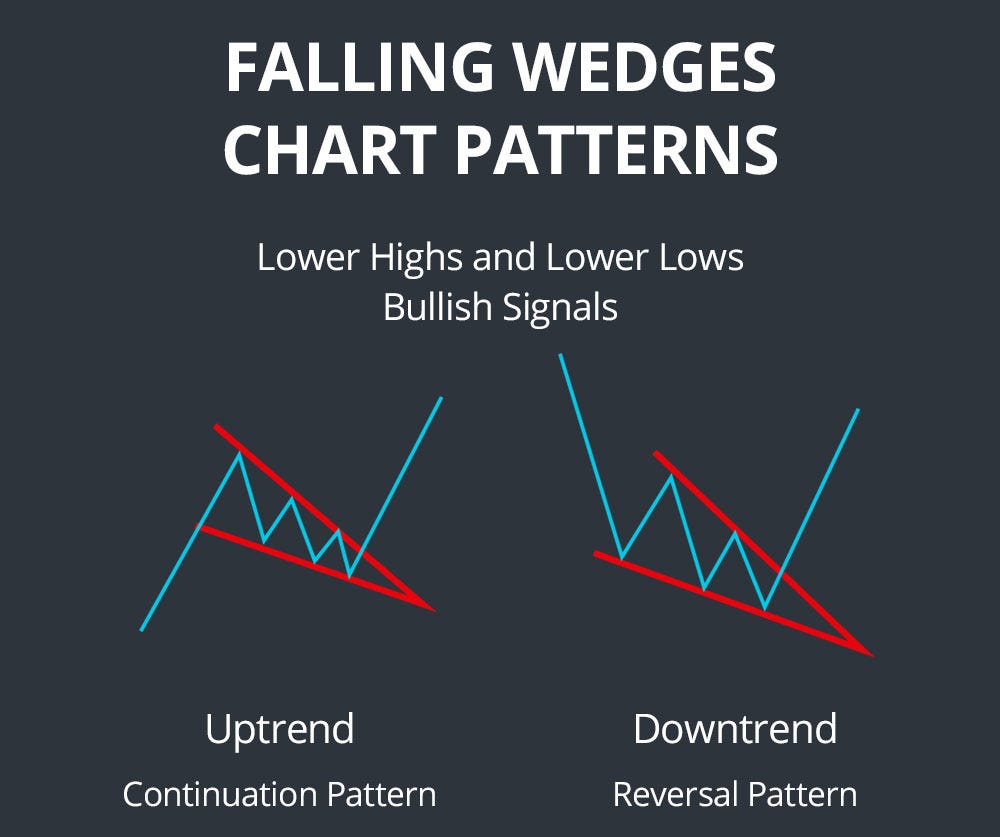

Figure 1 shows the weekly chart, going back to late 2016. Since July 2022, price has formed a bullish falling wedge formation (Figure 2) that has recently broken to the upside. During the breakout, price has also regained the falling 40 week moving average for the first time since the bear market began in late-2021. Price has also recaptured the prior cycle highs (2017 high).

The price from a technical perspective is now bullish. This is the first time I could honesty say this since mid-2021.

Figure 2 shows a stylized example of a bullish falling wedge reversal pattern that forms at the bottom of a downtrend. You can see this clearly on the bitcoin chart in Figure 1.

Sentiment

The magazine indicator has been particularly accurate calling turning points in the bitcoin price. This is another feather in the bullish cap.

Popular magazines will often have an extremely positive or extremely negative cover story right at times when market sentiment has reached an extraordinarily high or low level. This provides evidence the market in question may be turning soon, as it is an overcrowded trade and no one is left to continue pushing the asset in the direction of the prevailing sentiment.

In Figure 3, we see Time magazine asking "Is Fiat Dead?" In April 2021 and The Economist proclaiming "Crypto's Downfall" in November 2022. Each marked a major sentiment extreme -- one a euphoric top and the other a despondent bottom.

It’s not difficult to understand why sentiment in the bitcoin and overall cryptocurrency market is so negative. The last 12-15 months have been some of the worst for the industry as the increase in increase rates and withdrawal of liquidity from global markets has exposed much fraud and excess. The fall in price and loss of confidence in Terra Luna precipitated an industry-wide leverage unwind and cascading collapse of 3AC and their associated counterparties — eventually causing the failure of nearly every major CeFi platform. This included Celsius, Voyager, BlockFi, FTX, and Genesis. As the quote from Ben Graham that kicked off this piece explains — market psychology is usually the most despondent near the point that price bottoms.

Something to note — market’s are typically near a turning point when the response of price to news flow shifts. Recently, bad news and ceased to have a negative impact on bitcoin’s price. The collapse of Genesis and recent bankruptcy filing had almost zero negative impact on bitcoin. In fact, bitcoin’s price is now trading above the levels of the FTX bankruptcy announcement. This is a change worth noting.

Fundamental Analysis

Analyzing bitcoin from a fundamental perspective is not the same as projecting earnings and discounting forecasted cash flows.

Bitcoin analysts often look at blockchain information, such as hash rate and difficulty, to gauge the health of the bitcoin network’s security framework. They also review many custom indicators, created using “on-chain data” to measure the relative value of the network. Think of this as relative equity valuation using a P/E ratio. You can compare an asset to itself across time to see if it is under- or overvalued compared to where it has typically traded in previous cycles.

Network Health

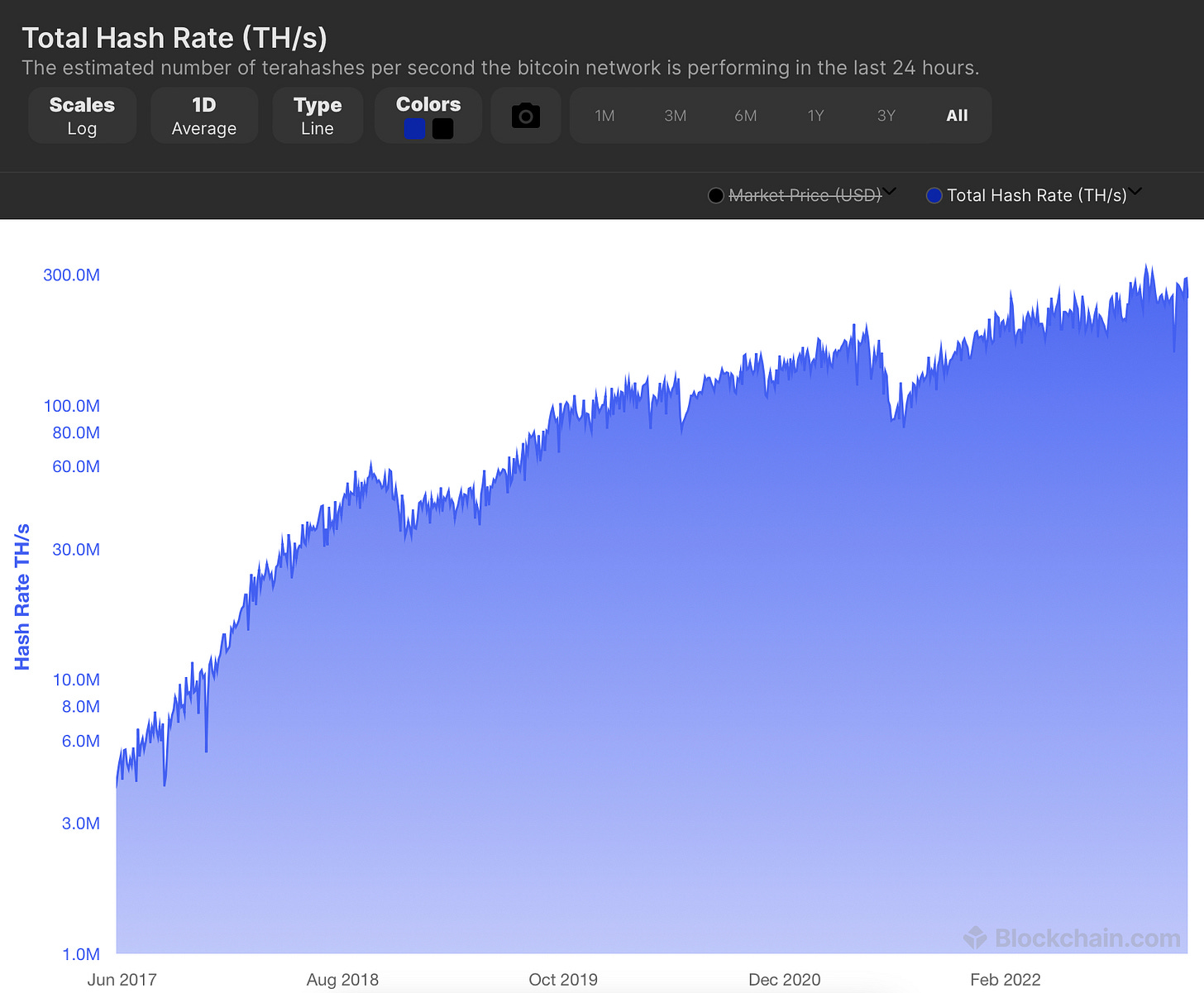

Figure 4 shows bitcoin’s hash rate has recently hit a new all-time high. From Blockchain.com:

Mining hashrate is a key security metric. The more hashing (computing) power in the network, the greater its security and its overall resistance to attack.

Figure 5 shows that network difficulty has also recently moved to a new all-time high. From Blockchain.com:

The difficulty is a measure of how difficult it is to mine a Bitcoin block, or in more technical terms, to find a hash below a given target. A high difficulty means that it will take more computing power to mine the same number of blocks, making the network more secure against attacks.

Relative “Valuation”

Many long-term relative valuation metrics, derived using “on-chain data” are signaling that bitcoin is at levels in its cycle where it has historically formed a significant bottom.

Below I will provide a few indicators that all point to a similar conclusion — bitcoin, after a year + of decline in a industry riddled with bankruptcy, negative sentiment, and leverage unwind, has reached levels that have historically represented a low-risk opportunity to accumulate a position in the asset.

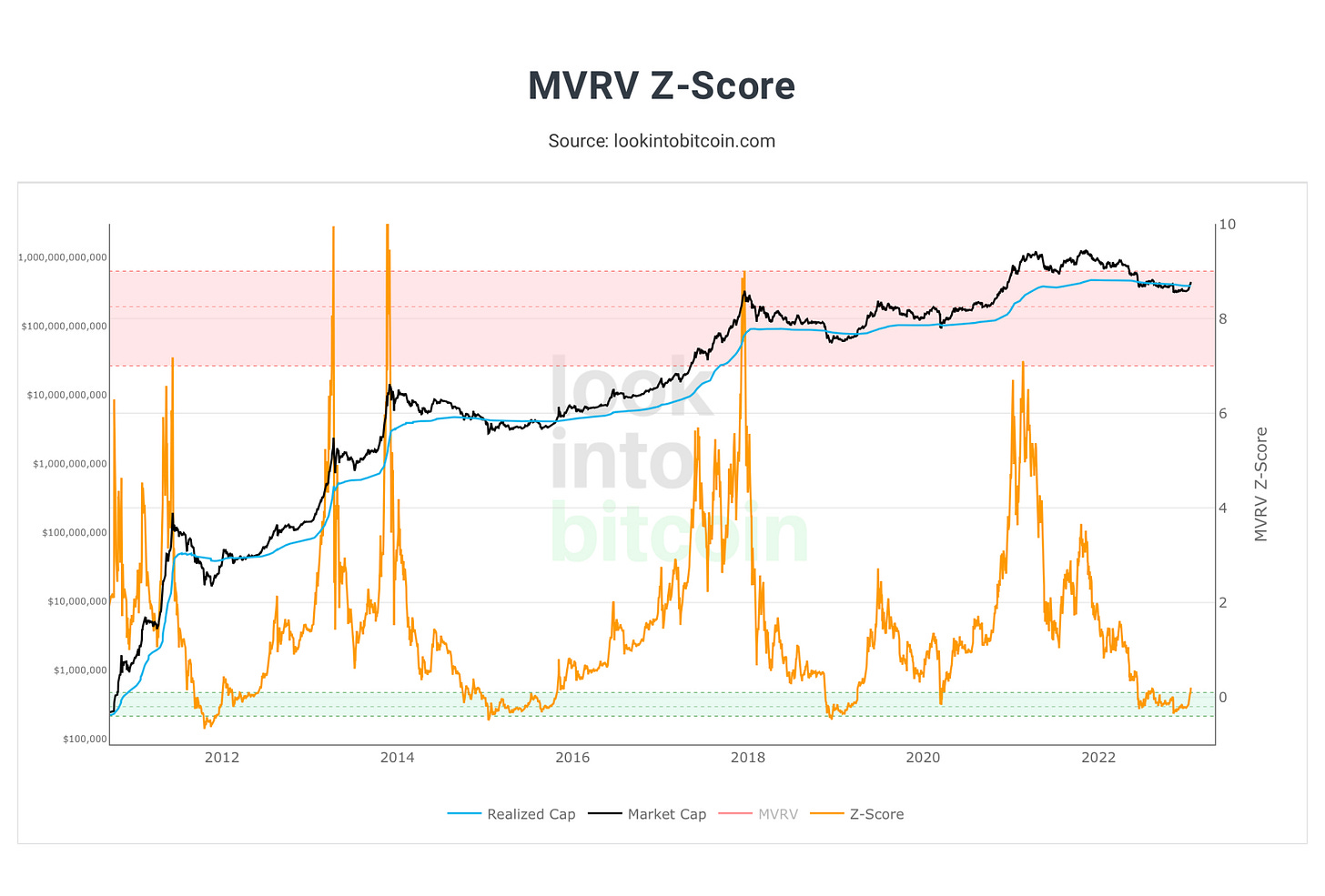

MVRV Z-Score

Figure 6 shows the MVRV Z-Score. This has been one of the most accurate measures throughout the life of bitcoin at identifying periods of over- and undervaluation. Price has been in the green undervaluation zone since mid-2022 and is now moving back to the upside — a buy signal.

Learn more about and follow the indicator for yourself here and here.

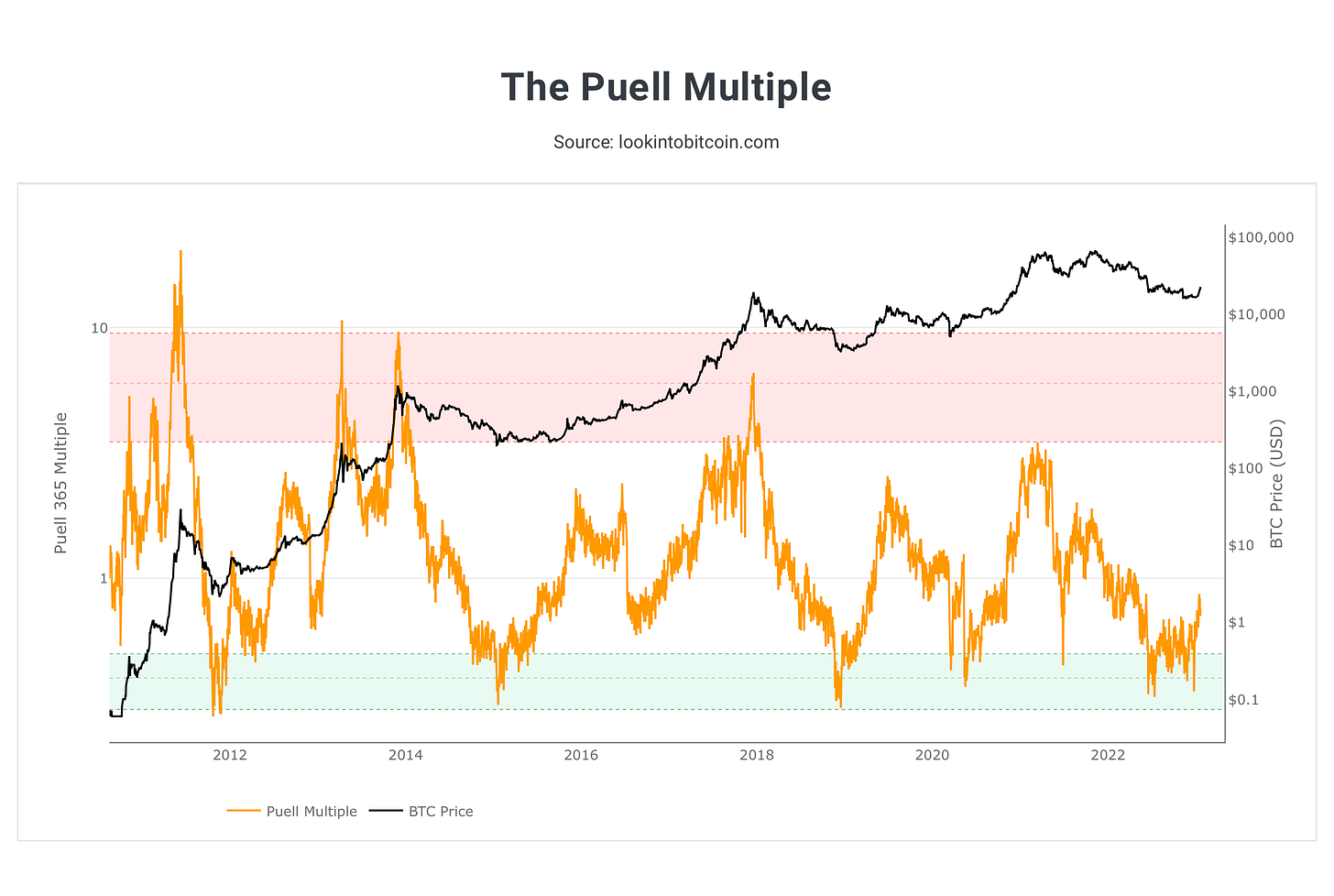

The Puell Multiple

Similar to the MVRV Z-Score in Figure 6, the Puell Multiple (Figure 7) also suggest bitcoin has been in a significant value zone.

Learn more about and follow the indicator for yourself here and here.

Price Forecast Tools

Last we have Net Unrealized Profit/Loss, NUPL (Figure 8). This indicator is also providing a similar signal to the others, even though it uses different input data than the Puell Multiple and a different calculation than the MVRV Z-Score.

Learn more about and follow the indicator for yourself here and here.

Conclusion

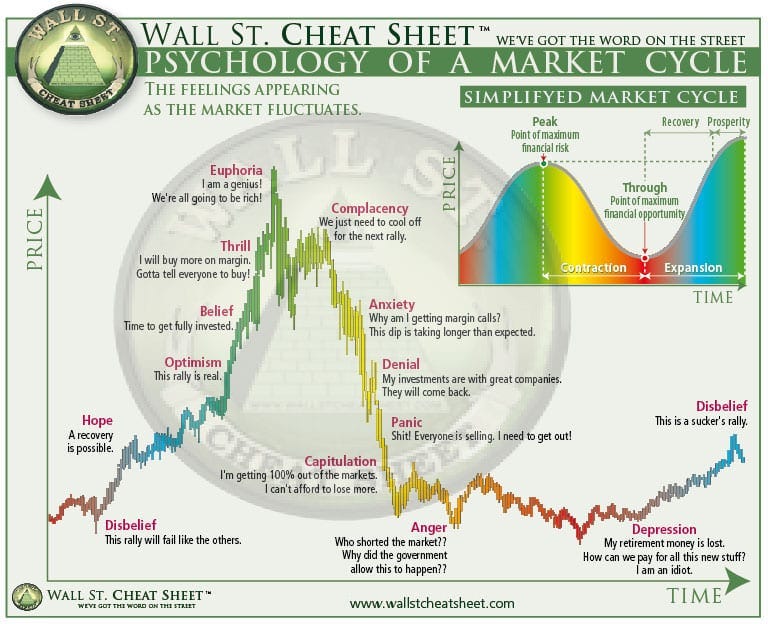

Bitcoin may well be exiting the final phases of the market cycle — moving from anger and depression towards disbelief. See Figure 9 below. Given the severe negative sentiment and the dismal news flow full of bankruptcy proceedings and regulatory risk, it’s almost certain any major rally in bitcoin’s price will be met with disbelief. Market participants will be unwilling to accept that price can possibly rise given what has transpired within the industry over the last year.

However, as put forward in this research note, bitcoin’s technicals, sentiment, and fundamentals are all supporting the bulls for the first time since the price peaked at approximately $68,000 during the last half of 2021.

It would not be surprising if bitcoin has bottomed.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.