A few days ago in “The Economic Cycle. Where are we?” I described the current state of the economy and provided a framework for monitoring its status moving forward.

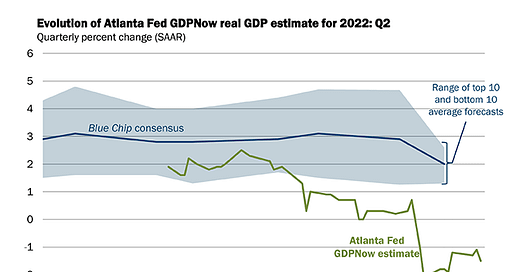

Today, more data on economic growth was released, leading to an update in the Atlanta Fed’s GDPNow indicator. The model is now forecasting real GDP growth of -1.5%.

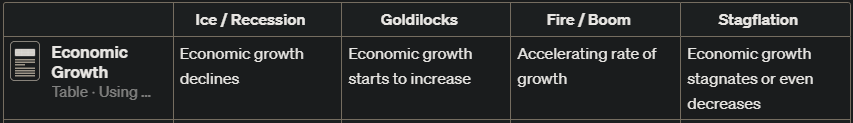

From my economic cycle identification framework:

If growth comes in below 0%, it will represent 2 consecutive quarters of negative real GDP growth — which is typically associated with recession.

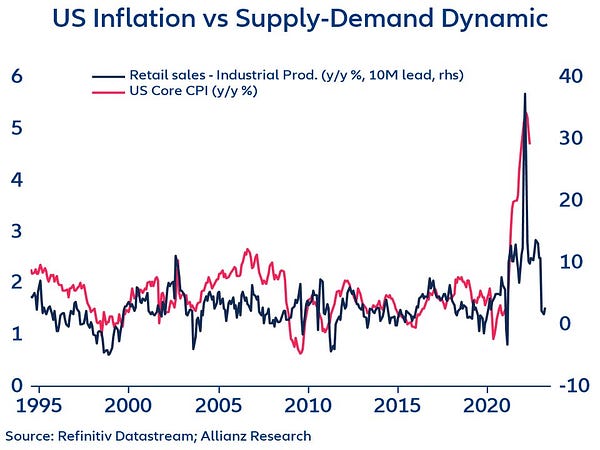

I also saw some interesting forecast data for the CPI (consumer price index) today. The data suggest we are at or very near a peak in the inflation rate.

From my economic cycle identification framework:

This is the type of leading data an analyst expects to see in a stagflation / late-cycle environment that is rotating toward recession.

Over the next day or two, I’ll post a full update of my economic cycle framework and walk through the indicators I analyze in each step of the process.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.