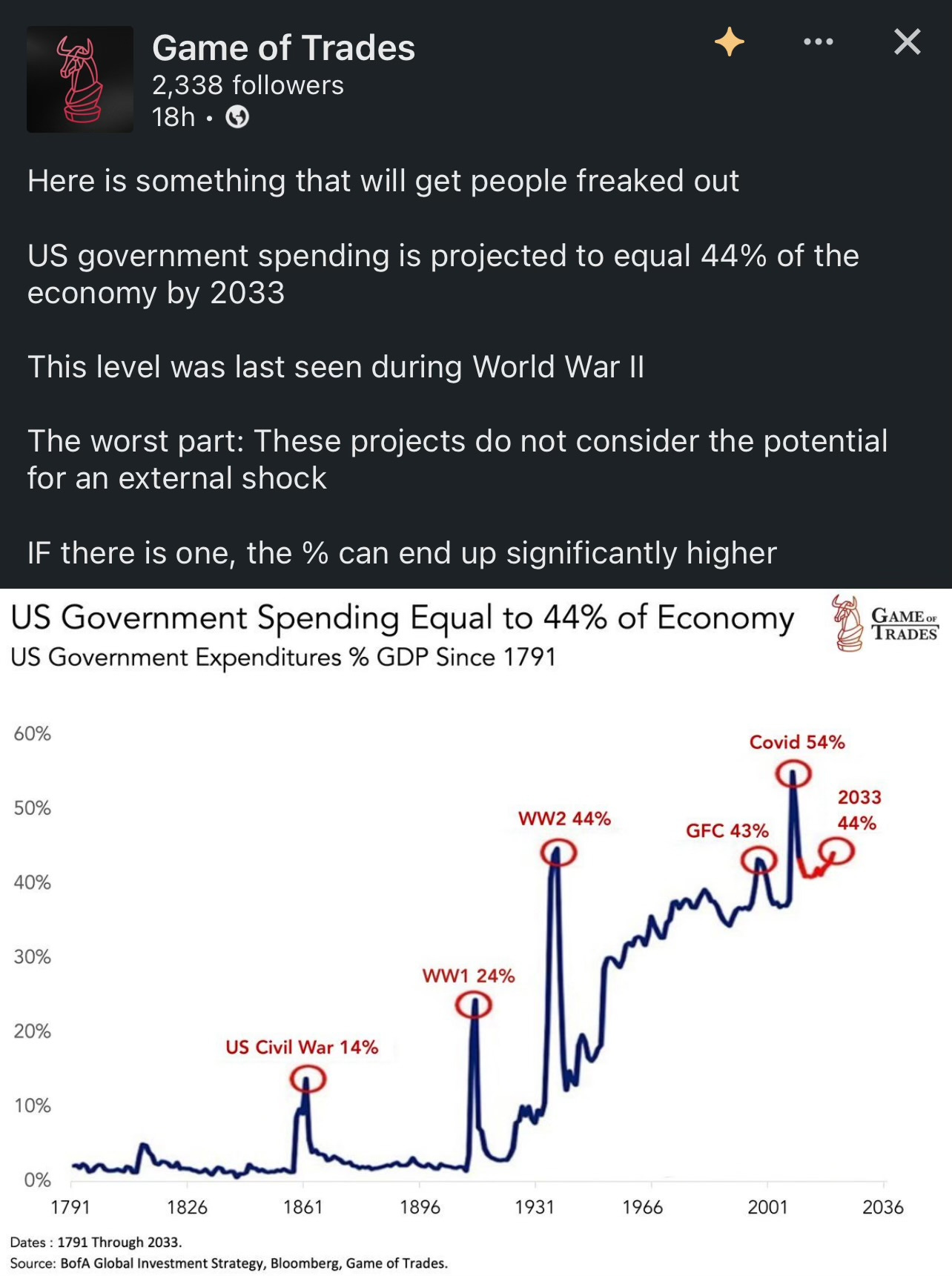

The CBO Projects Government Spending Equal to 44% of Economy

Is this a path to economic inefficiency?

This post / chart from Game of Trades ’s LinkedIn account continues to intrigue me. Charts like this are often posted with negative implications, but the mechanisms that lead to these negatives are rarely discussed.

💡This post is me “thinking out loud” and attempting to present how and why high government spending as a % of GDP can have significant long-term consequences.

🚨This is not designed to be political. Unfortunately, in today’s world investors cannot possibly ignore politics (as nice as that would be). Government spending is such a large % of the economy that policy has a consequential impact on what sectors, industries, and companies will benefit from changes in the flow of government funds. This has a direct effect on who the winners and losers will be.

A Path to Economic Inefficiency

Figures 1 & 2 indicate a significant trend of increases in U.S. government spending as a percentage of GDP, reaching unprecedented levels not seen since World War II. Projected to reach 44% by 2033, this trajectory signals that the government will be responsible for nearly half of all economic transactions in the United States. While government spending can be crucial in times of crisis, such as during the COVID-19 pandemic or the Great Financial Crisis, a persistent high level of government intervention raises concerns about the efficient allocation of resources.

The Economic Machine Model

Ray Dalio’s economic machine model provides a foundational framework for understanding how economies function from a first-principles perspective. According to Dalio, the economy is essentially the sum of all transactions occurring within various markets. Each transaction involves a buyer and a seller exchanging money or credit for goods, services, or financial assets. These transactions collectively determine the size and direction of the economy.

Imagine the economy as a complex web of markets: the housing market, the copper market, the beer market, the bread market, the SUV market, and the stock market, among others. In each of these markets, countless transactions take place daily. For instance, in the housing market, a buyer exchanges money or credit for a home from a seller. In the copper market, manufacturers buy copper from suppliers. In the beer market, consumers purchase beer from retailers. Each transaction, no matter how small or large, contributes to the overall economic activity.

Figure 3 illustrates this concept beautifully. Each small circle represents a market where transactions occur, forming the larger economy. The sum of all these transactions equals the total economic activity. The concerning trend highlighted in the chart is that government spending is projected to account for 44% of the U.S. economy by 2033. This implies that the government will be one of the two parties in nearly half of all transactions within the economy.

The projection that the government will be on one side of nearly half of all transactions in the near future suggests a potential for misallocation of resources, inefficiencies, and broader economic consequences. This perspective is crucial for analyzing the implications of rising government spending on overall economic health and efficiency.

Government Inefficiency in Resource Allocation

Murray Rothbard's Perspective

Rothbard posited that government operations are inherently wasteful because they lack a profit motive. In the private sector, businesses must operate efficiently to survive and thrive; they are driven by competition and the need to make a profit. Without the pressure to be profitable, government agencies have little incentive to minimize costs or improve services.

Moreover, Rothbard highlighted the issue of bureaucratic self-interest. Bureaucrats often prioritize expanding their departments and securing their budgets over serving the public efficiently. This expansionist tendency leads to overpaying for goods and services, contributing to rising prices (inflation).

Ludwig von Mises' Perspective

Mises elaborated on the consequences of government intervention in markets, noting that it leads to mismanagement and unintended economic consequences. He famously stated, "Every government intervention [in the marketplace] creates unintended consequences, which lead to calls for further government interventions". Mises argued that these interventions disrupt the natural price signals and resource allocations that occur in a free market, leading the misappropriation of scarce resources.

A lack of accountability compounds these inefficiencies. Unlike private businesses that suffer losses and risk bankruptcy from poor decisions, government entities often face no such consequences. This lack of repercussions for inefficiency can lead to continued poor management and waste of scarce resources.

Example

Consider a scenario where both a government agency and a private construction firm are bidding for a limited supply of steel. The private firm plans to use the steel to build a factory that will create jobs and produce goods, driving economic growth. The government agency, however, intends to use the steel for a less economically beneficial project, such as an over-budget and underutilized public building. Due to its ability to secure funding through taxation rather than profit, the government can outbid the private firm, securing the steel at a higher price.

This misallocation has several negative consequences:

Inflation: The government’s willingness to pay above-market prices drives up the cost of steel, leading to inflation in construction materials.

Crowding Out: The private firm, unable to compete with the government’s high bid, is forced to delay or cancel its project, resulting in lost economic opportunities and jobs.

Inefficient Resource Use: The steel is used in a less productive manner by the government, resulting in lower overall economic benefits compared to if it had been used by the private firm.

As government spending as a % of the economy continues to rise, these inefficiencies become more pronounced.

Recap: The Downsides of Resource Misallocation

Reduced Efficiency: Government spending often lacks the profit motive and competitive pressures that drive efficiency in the private sector. This can lead funds to be directed towards less productive or politically motivated projects rather than areas that would yield higher economic returns.

Crowding Out the Private Sector: High levels of government spending can crowd out private investment. As the government borrows more, it can drive up interest rates, making it more expensive for businesses to finance new projects. This can stifle innovation and reduce the overall growth potential of the economy.

Increased Debt Burden: Sustained high levels of government spending often lead to increased public debt. As debt levels rise, more government revenues are directed towards servicing this debt, leaving less available for productive investments. This can lead to a vicious cycle of borrowing and debt repayment, which can be unsustainable in the long run. As annual interest expense crosses $1 trillion dollars, it’s exceedingly obvious spending on debt service is crowding out other, potentially productive spending, see Figure 5 below.

Figure 5: @SoberLook Inflationary Pressures: Large government spending, particularly if financed by borrowing or money printing, can lead to inflation. This reduces the purchasing power of consumers and can erode savings, which is detrimental to long-term economic stability. Figure 6 and Figure 7 highlight this point.

Figure 6: Source @CapitalNotes

Figure 7: Truflation Impact on Living Standards: Misallocation of resources can have a stunting effect on the growth of living standards. When resources are not used efficiently, the economy grows at a slower pace, leading to fewer job opportunities, lower wages, and reduced wealth creation. Over time, this can lead to a decline in the overall quality of life for the average citizen. This point is hard to capture or highlight in a chart. However, through a recent X thread and article (Figure 8), economist Niall Ferguson does an incredible job portraying my thoughts on this point. I highly encourage you to take the time to read the thread and his article.

Conclusion

The increasing share of government spending in the economy, projected to reach 44% of GDP by 2033, raises significant concerns about the efficient allocation of resources. Drawing on the insights of Ray Dalio, Murray Rothbard, and Ludwig von Mises, it becomes clear that high levels of government intervention can lead to inefficiencies, crowd out the private sector, increase the debt burden, and have inflationary consequences. These factors collectively contribute to a misallocation of resources, which can stunt economic growth and hinder improvements in living standards. As such, it is crucial to critically assess the role of government spending and strive for a balance that supports economic stability and growth.

So, where do we go from here?

Stay positive, work hard, and focus on what you can control. But fasten your seatbelt just in case.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.