The Debt Ceiling

It's here -- US Treasury cash may run out before June.

X-Date could arrive sooner than many expected. The latest figures show the US Treasury’s checking account holding approximately $188 billion while it has been burning through approximately $20 billion dollars per day. That’s potentially less than 10 days of cash remaining.

Why does this matter? What is the debt ceiling? Here is a brief overview.

The debt ceiling is a legal limit imposed by Congress on the amount of debt the US federal government can accumulate to finance its operations. It matters for the US Treasury because it affects their ability to borrow money and fund essential government programs. The debt ceiling often becomes a political football, with lawmakers using it as leverage to push for their preferred fiscal policies or to make partisan points.

The bond market is officially announcing that the debt ceiling problem is a major issue. One month bill yields are up 21% today alone.

At yields much higher than this, it becomes unsustainable for the government to finance itself without the Federal Reserve stepping in to monetize the debt -- i.e. what they did during the record COVID year deficits.

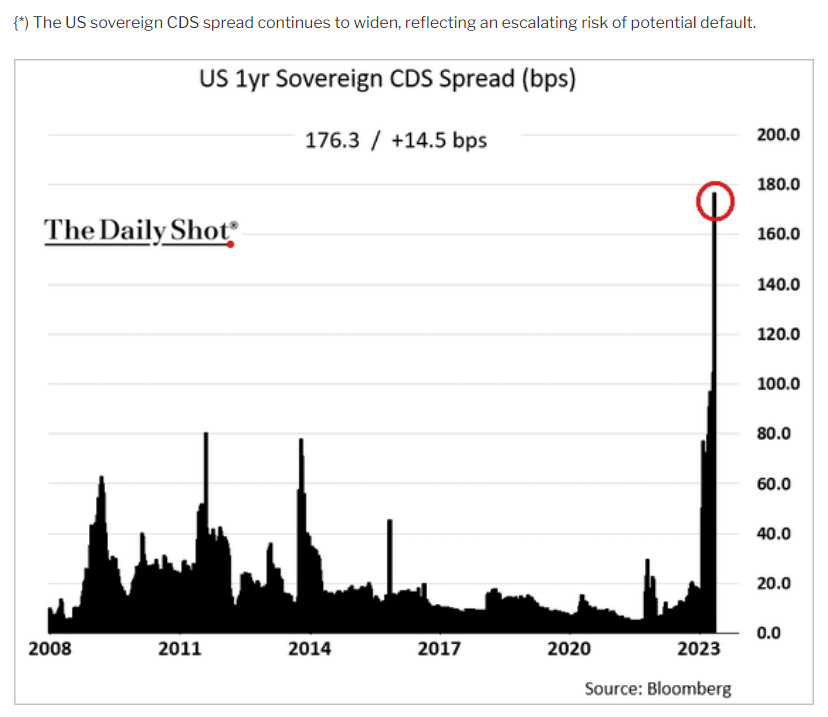

United States CDS spreads have also reached highs not seen in decades. In other words, it's more costly today to insure yourself against a US sovereign default than at any point throughout all of the prior debt ceiling dramas.

I suggest putting some popcorn in the microwave and kicking back to watch the show.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.