“The more I work with markets, the more it becomes apparent that prices are determined by one thing and one thing only, and that is people’s changing attitudes toward the emerging fundamentals.”

— Martin Pring

Quickly. If you’re accessing this post from email, particular Gmail, it may be truncated for being “too long”. Therefore, to see the full post and all of the charts you’ll need to click “view entire message”.

What determines market prices?

Asset markets are often described as “discounting mechanisms”. The prices you see are a reflection of what market participants believe is going to happen in the future. More specifically, how is the future going to impact the production of cash flows. The changing perceptions of what estimated future cash flows will be, how uncertain those cash flow estimates are, and the time value of money all come together to determine the value of the asset(s) in question.

To put it simply — asset prices are based on our collective forecast of the future, not the present. According to Martin Pring:

“it is the attitude of market participants toward the emerging fundamentals rather than the fundamentals themselves that is important.”

Therefore, to produce a useful forecast of market prices the key is not solely in predicting future fundamentals, but in predicting how other market participants are going to feel and react to those emerging fundamentals. I like this quote and simple diagram, both from Macro Ops:

“Our collective thinking is what moves markets and produces winners and losers. Meaning, what we think about reality affects the reality we are thinking about. And the reality we’re thinking about affects our thinking about it.”

As information (which includes market prices) becomes available, the vision and perception of the future held by market participants changes. Shifting opinions of the future lead to edits and reforms in the consensus view of emerging fundamentals, thus influencing the price the market is willing to pay for assets. Prices move, more information is received, and perception is altered again. This is a continuous process and explains, at a high level, why market prices are constantly changing.

All of this first section is to say — the stock market is continuously pricing in events that have not yet happened, but that market participants believe will happen. The following diagram represents this pricing process.1

Stock market prices reflect how market participants believe economic activity, 6-9 months in the future, will impact the future cash flows of the businesses that collectively make up “the market”.

What are markets telling us today?

So, what are market prices, as well as other forms of information, telling us today about the perceptions of market participants?

The remainder of this post is going to contain numerous charts and snippets of commentary from myself and other market participants, divided into six sections based on information type. I’ll apologize now for the length of this post — but hopefully the information synthesized within provides value.

The following sections will cover:

Technical analysis of price action

Intermarket relationships

Sentiment

Quantitative finance

Valuation

Business cycle

Remember, it is normal for a asset market to bottom long before the fundamentals / economy bottom. Therefore, when the market hits a bottom most market participants don’t believe it is possible because the economy they’re surrounded by on a daily basis is likely continuing to worsen. Keep this in mind as we walk through the charts and figures in the remainder of this post.

Technical Analysis of Price Action

Markets trend. This is a fact driven by how information is disseminated throughout society and the psychology of human behavior. Discussing the behavioral finance behind market trends could be an entire book, so I will not spend time on it here.

The primary purpose of technical analysis is to help a market participant identify price trends. Uptrends, downtrends, sideways price action. Below I will attempt to market’s current trend.

Figure 1 is a daily “ribbon” chart of the S&P 500. Price has recently broken above the moving average ribbon, showing a positive change in the character of price action.

Bear markets, downtrends, typically do not end until offensive sectors take leadership from defensive sectors. In other words, at a major bottom we expect to see economically sensitive sectors lead the way higher.

Figure 2 displays the performance of the 11 S&P 500 sectors over the previous one month (the S&P 500 bottomed on June 17th). The top 5 sectors, particularly the top 2, are considered offensive sectors. The recent rally has been led by consumer discretionary and technology — exactly the two sectors one wants to see leading at a bear market bottom.

Figure 3 is a weekly chart designed to identify the direction of the short, medium, and long-term trends. This chart was created by the Chief Market Strategist at StockCharts.com, David Keller, CMT. The chart uses moving averages and 3 separate oscillators to come to a conclusion on the question of trend direction.

The top pane shows the S&P 500 in a downtrend as evidenced by the configuration and slope of the moving averages. The oscillators in the following 3 panes show a long-term downtrend, medium-term downtrend, and short-term uptrend.

The take away — price action is improving but still has some work to do before confirming a significant change of trend.

Technical Analysis Conclusion: Neutral to Negative

Short-term price action is strengthening and is supported by the outperformance of offensive sectors. The primary and intermediate term time frames are still in downtrends. More evidence of a important change in trend needs to be accumulated before the rally is to be believed.

Intermarket Relationships

According to Investopedia, intermarket analysis is:

“the method of analyzing markets by examining the correlations between different asset classes.”

Typically, this is thought to be the analysis of relationships between stocks, bonds, commodities, and currencies. However, I think the term “intermarket” can be broadened to include “intramarket“ analysis — which I define as the study of relationships within a single asset class. The charts examined below contain both intermarket and intramarket relationships.

Figure 4 shows a commonly analyzed “risk on / risk off” intramarket relationship — the ratio of the consumer discretionary sector to consumer staples. A rising ratio indicates discretionary is outperforming staples, and a falling ratio the opposite. Here is a description of the ratio’s interpretation from StockCharts.com:

“Chartists can also compare the performance of the consumer discretionary sector to the consumer staples sector for clues on the economy. Stocks in the consumer discretionary sector represent products that are optional. These industry groups include apparel retailers and producers, shoe retailers and producers, restaurants and autos. Stocks in the consumer staples sector represent products that are necessary, such as soap, toothpaste, groceries, beverages, and medicine. The consumer discretionary sector tends to outperform when the economy is buoyant and growing. This sector underperforms when the economy is struggling or contracting.”

Figure 4 shows the discretionary-to-staples ratio in a clear downtrend, having topped out in late-2021. This ratio often leads the market and the economy at key turning points. In late-2021 it was not clear to many that economic weakness and falling asset prices were close at hand. However, this ratio provided a prescient warning sign investors.

Currently, the ratio’s stretched far below the negative sloping 200 day moving average. It bottomed in late-May and has since worked on building a base from which to attempt a rally. If price can break above dual-resistance (2019 highs and downtrend line) and find its way back above the 200 MA, it would be a bullish development for risk assets.

Figure 5 is another intramarket indicator, similar to consumer discretionary vs consumer staples — the ratio of high beta stocks vs low volatility stocks. When the high beta to low volatility ratio declines, demand for less risky stocks outpaces demand for more risky stocks.

This ratio also peaked in late-2021 and has been in a downtrend ever since — although recently it has found support at the mid-2020 highs. High beta is looking more constructive, however, a move above the downtrend line and the 200 MA is necessary to confirm a risk on signal from this ratio.

Figure 6 compares the price of copper to the price of gold. To explain the meaning of this ratio, we need to quickly review the differences between copper and gold.

From Drew Wells, CMT of the Potomac Fund:2

Copper is an industrial metal used in nearly every application from electronics to construction sites—it touches almost every part of the global economy. The reddish-orange soft metal is a longstanding indicator of global economic demand; increasing Copper prices speak to that demand while decreasing prices speak to the decreasing global demand.

Copper is economically sensitive. Demand rises as global economic growth expands. What about gold? Also from Drew Wells, CMT:3

Gold has limited industrial applications and is typically used by market participants to store wealth in uncertain times. Rising gold prices often indicate fear in the marketplace, while falling gold prices signify investors prefer riskier assets. The yellow metal is one of the earth’s oldest mediums of exchange, and many countries continue to store and hold vast quantities for various purposes.

As the copper to gold ratio rises it suggest market participants are favoring risky assets. The ratio bottomed in early-2020, rising rapidly into spring 2021 as fiscal and monetary policy were highly accommodative all around the globe. From May 2021 a year long top formed, which broke down in June 2022 — this signaled a rapid shift in preference towards gold and away from copper. In other words, this was a risk off signal to investors.

The ratio has found support at the pre-Covid highs but remains in a clear downtrend.

Intermarket Analysis Conclusion: Negative

All three ratios reviewed remain in clear downtrends — this is a negative for the stock market and other “risk on“ assets such as junk bonds, emerging market currencies, and bitcoin. Some signs have appeared suggesting the ratios are bottoming. However, a strong risk off trend should be considered guilty until proven innocent.

Sentiment

“Buy when there’s blood in the streets, even if the blood is your own.”

— Baron Rothschild

Market sentiment refers to the overall attitude of investors toward a financial market. Think of it as crowd psychology — the overall feeling of a market as revealed through the activity and price movement of the securities traded in that market.4

There are various methods used by traders and investors for gauging market sentiment. Whatever the method, when sentiment reaches extremes it can be used as a contrary indicator. For instance, if nearly all market participants are bearish and the prevailing attitude is that the economy can not possibly improve and stocks are worthless — chances are the market may be nearing a bottom as the selling has almost certainly been overdone and the pessimism is exaggerated.

The same can be said for the upside. When markets appear as if they will never go down again and investors are overly optimistic, stocks are other risk assets are probably nearing an important top. However, it is important to point out that in bull markets this “irrational exuberance ” can last for longer anyone may expect.

“Be fearful when others are greedy and greedy when others are fearful.”

— Warren Buffett

The following tweets and charts provide a look at the prevailing market sentiment as of July 2022.

Figure 7 shows two separate ways to measure the amount of risk fund managers surveyed by Bank of America are taking. Right now, fund managers are showing extreme risk aversion — similar to levels seen in the depths of the 2008 financial crisis meltdown. These are survey results usually seen near major stock market bottoms.

Figure 8 shows the futures positioning of large asset managers and hedge funds. Right now they have massive net short positions — one of the largest cumulative net shorts positions seen in the last 15 years. In other words, they are overwhelmingly bearish. Similar to Figure 7, this is what would be expected near a market bottom.

Figure 9 shows the bets being made against the market. This is done by measuring the $ amount of assets inside leveraged short ETFs. As you can see, since early 2022 over $6 billion has flowed into these leveraged short ETFs. This is another indication of high pessimism and a trade that is becoming quite crowded.

Figure 10 shows the results of another BofA fund manager survey. 50%ish of all fund managers surveyed believe a recession is likely. This is both good and bad news. First the bad news — when this survey moves above the 0 level on the Y-axis, a recession almost always occurs. Second the good news — when most respondents believe a recession is certain this becomes a contrarian indicator and these points in time tend to be a great long-term buying opportunity for risk assets.

The next two sentiment figures are what an investor may consider “longer-term”. It is not often that they reach historical extremes.

Figure 11 shows the equity allocation % for Bank of America private clients. This currently sits at approximately 62% down from a high of 66% in late-2021. Even after the decline, investors are still holding near record amounts of equities compared to other possible asset classes. After the 2008 global financial crisis, this value reached a level of 39%. Therefore, in a severe economic collapse this measure could fall significantly from current levels.

Figure 12 measures the amount of cash in investor portfolios. During times of economic and market stress, investors “de-risk”. Risky assets are sold in favor of the safety and future optionality of cash. Cash levels reached above 35% in the 1990 recession, the Dot.com bubble collapse, and the 2008 global financial crisis. During the COVID crash, cash levels only reached 25% for a brief time.

Currently, cash levels have increased from below 15% to slightly above 20%. This is a sharp increase but it does not represent anywhere near the negative sentiment shift seen in 1990, 2000-2003, and 2007-2009.

Sentiment Conclusion: Neutral to Positive

After 6 months of negative financial market returns in nearly every asset market, many measures of investor sentiment have reached pessimistic extremes typically associated with market bottoms. However, some longer-term measures of sentiment are still not showing a negative shift in sentiment — such as equity portfolio allocation and portfolio cash levels.

Quantitative Finance

I’m not going to spend much time on this section. Quantitative finance is a form of statistics. Investors can analyze the mountains of data produced by financial markets and see if it can provide an “edge” in predicting future outcomes.

Figure 13 is a study performed by Sentiment Trader. The study looks at the future 12 month returns on the S&P 500 every time a specific sequence of events occurs. In this case, the following has to be true:

The S&P 500 is within 30 days of setting a new 52-week low. In other words, the market has been in a downtrend.

At least 2 of the last 3 days have seen >85% up volume.

This has happened 13 times since the mid-1960s. In every past occurrence, the S&P 500 has experienced positive returns over the next 12 months, with a median return of 23%.

A word of caution. This does not mean the market bottoms immediately upon receiving the signal. Two of these signals occurred in late-2008 and the market fell almost another 30%, into the March 2009 low, before eventually bottoming and heading higher

The following two figures, Figure 14 and Figure 15, are from PredictIt. PredictIt is a prediction market where participants bet money on the outcome of certain events. In the case of Figure 14 and Figure 15, the outcome of the 2022 Congressional elections.

Right now, the prediction market is expecting the Republican Party to win control of both the House of Representatives and the Senate. However, the outcome of the Senate race is much closer to a toss up than the House race.

Figure 16 will explain why this matters.

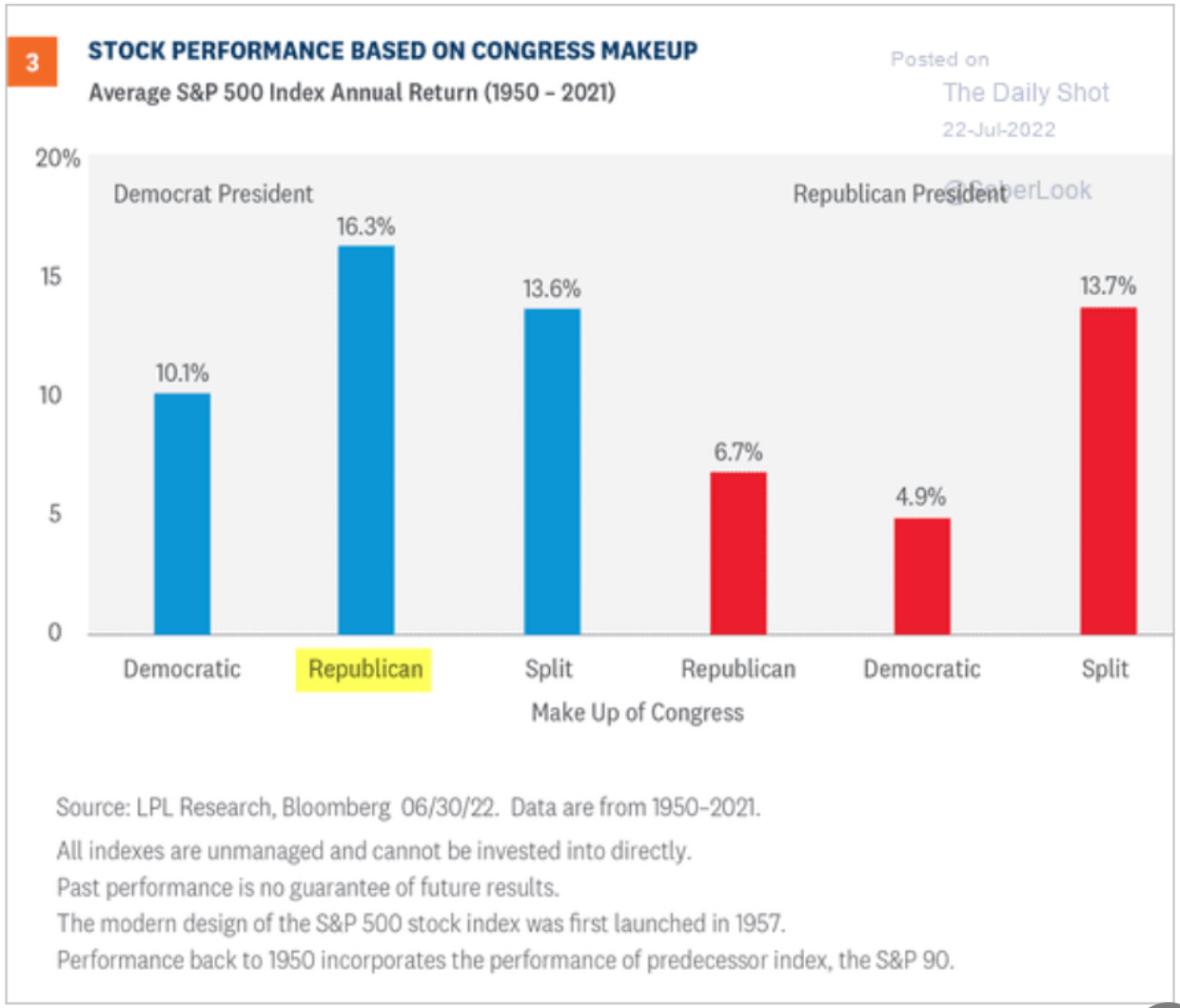

Figure 16 is a chart produced by LPL Research and courtesy of The Daily Shot, a newsletter I highly recommend.

This chart shows the performance of the S&P 500, since 1950, based on the make up on Congress. In 2023, we are guaranteed to have a Democrat President — as Joe Biden’s term is not over until 2024. What we see below is, when the US has a Democrat President, stock market returns are best when the Republican Party controls Congress — averaging a 16.3% return. The second best outcome is when Congress is split, a 13.6% average annual return. The worst outcome for the market, statistically speaking, is a Democrat President and a Democrat controlled Congress, a 10.1% average annualized return.

The prediction markets currently suggest this relationship may be a positive tailwind for equity prices in 2023.

After two statistical studies suggesting positive future outcomes, Figure 17 tilts negative. However, Figure 17 is more of a short-term statistical relationship.

The tweet below explains the study performed by Steve Deppe, CMT.

Out of 21 occurrences, the average return over the following 12 weeks is -2.36% with only 30% of future 12 week returns being positive. The outcome of this study is highly suggestive of more short-term downside before a major long-term bottom is established.

Quantitative Finance Conclusion: Neutral

Two of the studies reviewed suggested a significant likelihood of positive equity returns over the next 12-24 months for new funds deployed today. However, based on the final study, continued negative returns in the short-term are not unexpected.

Valuation

Asset valuation is a highly subjective topic. Some investors use discounted cash flow and others rely on relative valuation. I’m personally a proponent of using both methods, however it is much easier to compare the current environment with the past by using common relative valuation ratios such as price to earnings (P/E).

In the following figures we’ll explore the valuation of the stock market from the perspective of three different, but common, valuation metrics.

12 month forward price to earnings (P/E) ratio — Figure 18

Price to book (P/B) ratio — Figure 19

Cyclically adjusted price to earnings ratio (CAPE) — Figure 20 & Figure 21

Figure 18 shows the forward P/E ratio of the equal-weight S&P 500 index compared to its average level since 1990. Earnings estimates have started to adjust lower, but the majority of this drop in forward P/E is driven by investors’ risk appetite returning from excessive optimism to more normal levels.

Using forward P/Es, the stock market is now fairly valued and potentially undervalued. However, this valuation is dependent on earnings remaining at current levels or even rising from recent levels. It is highly likely Q3 and Q4 earnings estimates are in for a wave of downgrades. The final section will explain why, as does my recent post: “The Economic Cycle. Where are we?”. If earnings estimates drop, and price remains at current levels, the forward P/E ratio will rise and stocks will no longer represent a good value.

Figure 19 is an interesting chart to think about. Global financial market price to book ratios are compared across three time periods.

Fall 2007 — at the stock market high before the global financial crisis

March 2009 — at the stock market lows after the global financial crisis

July 2022 — today, after global financial markets have already dropped 20%

What jumps out is that the US stock market still has a price to book ratio of nearly 4x AFTER a 20% decline is stock prices. This is a higher price to book ratio than what the US stock market had at the 2007 peak.

Major stock market bottoms tend to occur with price to book ratio’s below 2x.

Important note — While US stocks continue to appear overvalued, European and Emerging Market stock markets are currently trading at price to book ratios below 2x.

The next metric is a longer-term valuation methodology. The cyclically adjusted price to earnings ratio (CAPE) is displayed in both Figure 20 and Figure 21. The CAPE has declined rapidly since early-2022 but still remains far above the 1950 to present average of 20x. Above average CAPE levels are associated with below average equity market returns in the following decade. In other words, when CAPE is far above average investors should plan to experience below average returns, on average, over the next 10 years.

Major stock market bottoms can and do occur at above average CAPE levels. However, generational buying opportunities typically happen at CAPE levels below 15x — and often in the single digits. The S&P 500’s CAPE now sits at approximately 29x, 45% above average.

The remaining chart in the valuation section also looks at CAPE, but using another visualization method. What Figure 21 shows is the S&P 500’s price needs to fall to approximately 2,700 for CAPE to return to average levels. This would be a decline of 32% from current levels.

Let me be clear. CAPE is a long term valuation metric and should not be used as a short-term timing tool for investing in the stock market.

Valuation Conclusion: Neutral to Negative

Forward price to earnings ratios have adjusted lower, moving rapidly back to fair-to-undervalued territory. However, forward P/E valuations are heavily reliant on earnings estimate revisions. Earnings estimates are likely to be revised lower in the near future, putting the undervaluation evidenced by forward P/E’s at risk.

At the same time, longer-term valuation metrics are still showing significant levels of overvaluation, even after a 20% decline in stock prices.

Business Cycle

On July 11th I published “The Economic Cycle. Where are we?”. In that post I provided evidence suggesting the economy was in the Stagflation stage of the economic cycle and rapidly moving toward Ice / Recession.

Here is a description of the Ice / Recession stage:5

“Features a contraction in economic activity. Corporate profits decline and credit is scarce for all economic factors. Monetary policy becomes more accommodative and inventories gradually fall despite low sales levels, setting up for the next recovery.”

In a recession economic activity will contract. The economy will shrink. Corporate profits will decline. As mentioned in the previous section, this would put the undervaluation evidenced by forward P/Es at risk. Therefore, the big question investors need to ask ourselves is:

How close is the United States economy to a transition from Stagflation to Recession?

The following figures will provide an array of methods for examining the near-term direction and health of economic activity.

First — let’s refresh our memory with the definition of recession. The following is from the New Oxford American Dictionary:

If you asked for a one sentence definition of a recession, most market participants and practicing economist would say: “a recession is a decline in real GDP in two consecutive quarters”. Essentially, a recession is a decline in the real, inflation-adjusted value of economic activity that last for a prolonged period of time. Two consecutive quarters is 6 months.

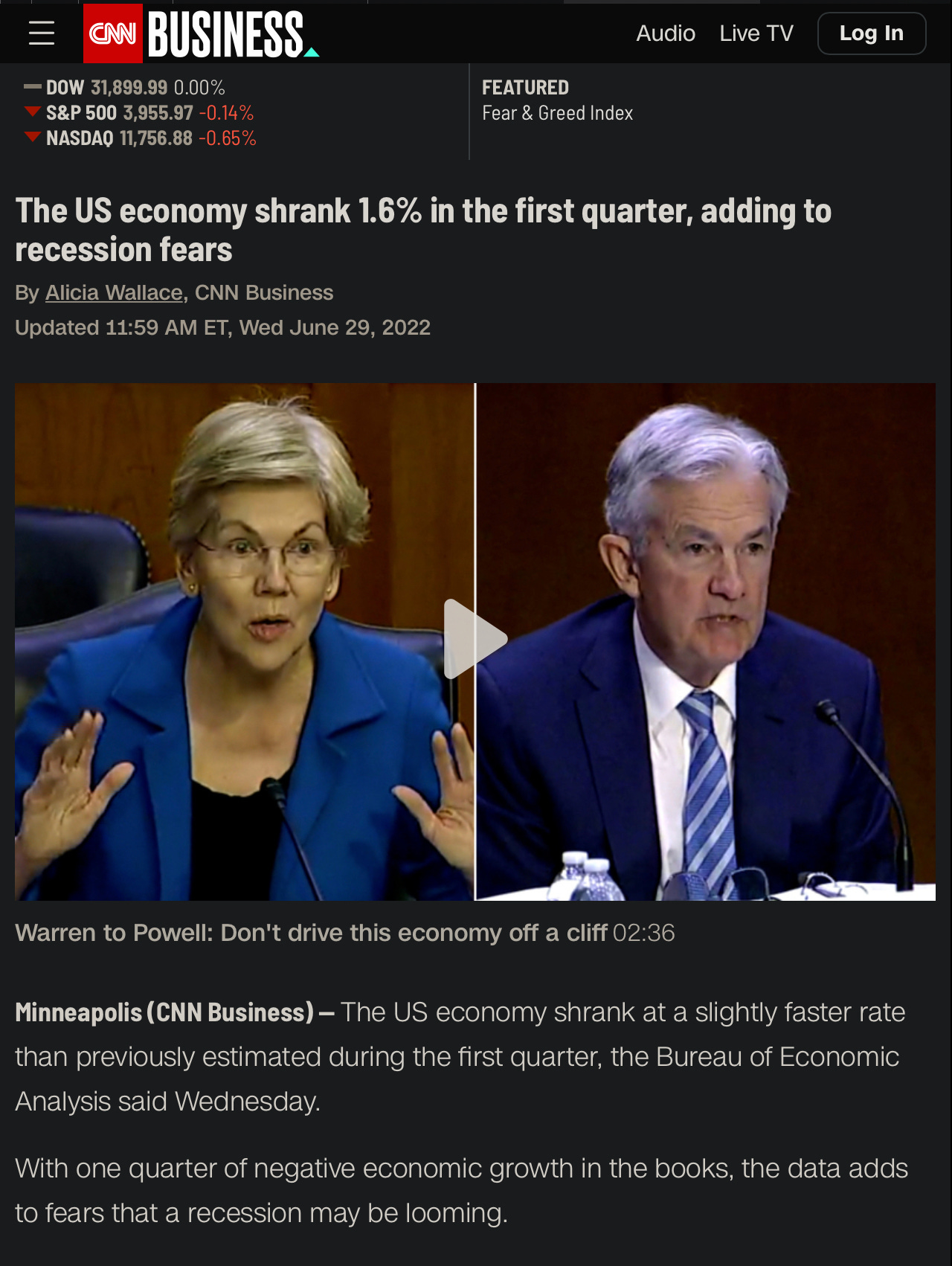

In the United States, real GDP for Q1 2022 declined by 1.6%. Real GDP growth makes an adjustment for inflation. Nominal GDP does not adjust for inflation. In high inflation environments, nominal GDP can increase, but if it rises at a slower rate than inflation the country’s economy is shrinking.

Real economic growth declined in the United States during Q1 2022. Will it continue to decline in the future — leading to a full blown recessionary environment? On to the evidence.

Figure 22 is a fantastic visual to show the difference between “real” and “nominal” values. Patrick Krizan, economist at Allianz Research, posted a chart comparing nominal retail sales vs real retail sales. Consumers and investors care about real values. In other words, we care about how much our money can buy. During high inflation environments our money doesn’t buy as much, measured in goods and services, as it did in the past.

In early-2021, nominal retail sales began to diverge from real retail sales. It is no coincidence that CPI inflation began to increase rapidly in early-2021. US consumers are now buying less goods and services than they were in Spring 2021. Salaries and wages are not increasing enough to keep up with inflation (real wages are falling) leading to the fall in real retail sales seen in Figure 22.

In the US, 60%+ of economic activity is consumption. If real retail sales are declining, the consumption component of GDP is going to have as hard time making a positive contribution to economic growth.

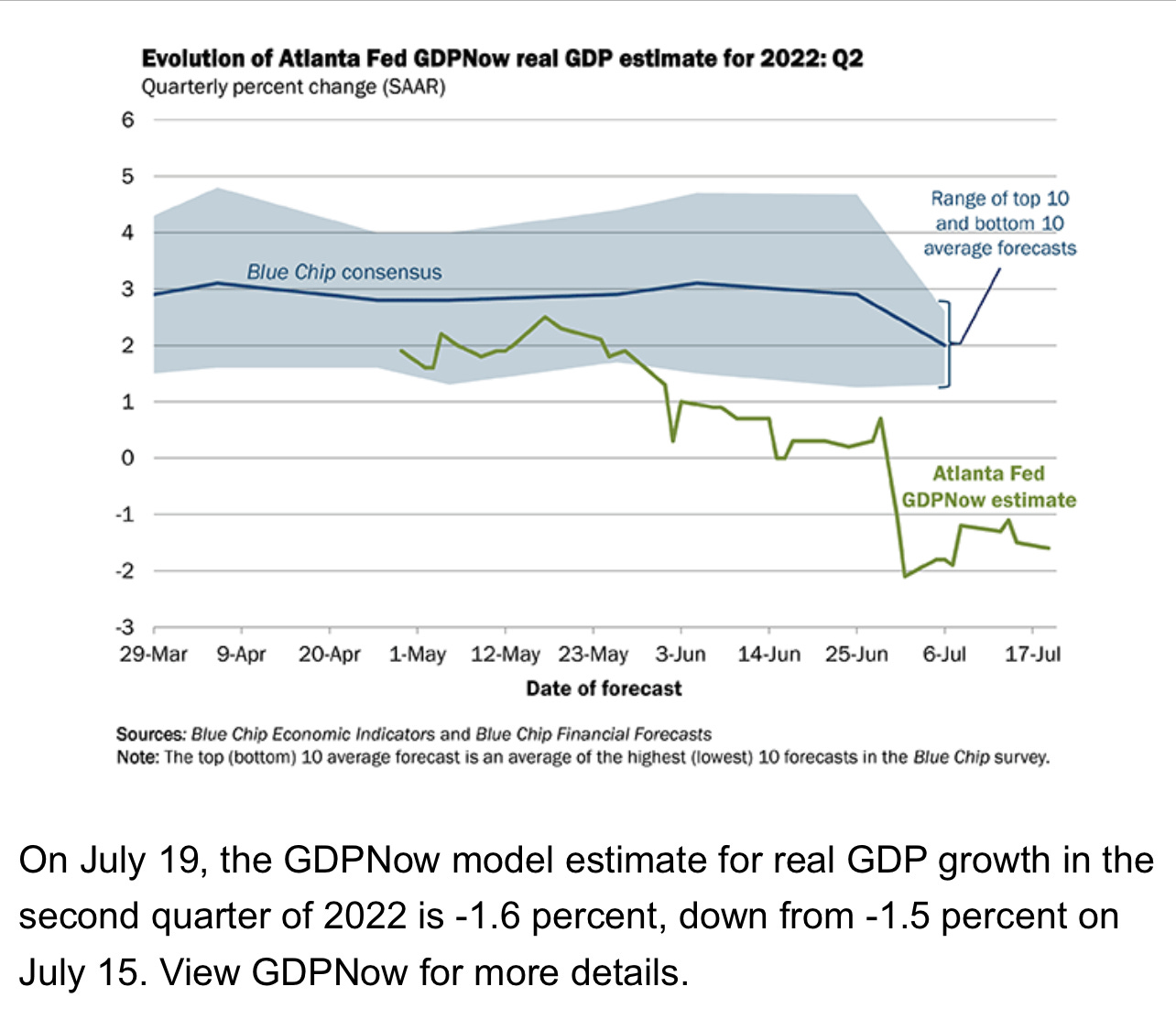

The Atlanta Fed publishes a real-time model of forecasted real GDP growth for the coming quarter. Here is a quick description of the model:

“The growth rate of real gross domestic product (GDP) is a key indicator of economic activity, but the official estimate is released with a delay. Our GDPNow forecasting model provides a "nowcast" of the official estimate prior to its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis.”

Figure 23 shows the current estimate for real GDP growth in Q2 2022, as produced by the GDPNow forecasting model. The forecast is for a decline in real GDP growth of -1.6%. If the model is accurate — this will mark the 2nd consecutive quarter of negative real GDP growth. In other words, it will confirm the US economy has almost certainly entered a recession.

I’m going to move over the remaining figures quickly. They are provided as further evidence of weakening US economic activity in support of the current GDPNow forecast.

Figure 24 is a chart provided by Raoul Pal, founder of Global Macro Investor & Real Vision, comparing the YoY rate of change in the Philadelphia Fed Business Outlook Survey’s General Conditions Index. The significant correlation between the two time series is obvious. The rate of change recently came in at -12.30% and this prices the Institute for Supply Management’s PMI at 44.

The ISM PMI is a widely used indicator for measuring the state of the business cycle. Anything below 50 is considering contractionary and below 45 is usually agreed to mean recessionary.

In Figure 25, Danielle DiMartino Booth, CEO and Chief Strategist of Quill Intelligence, points out that the Conference Board’s leading index fell for the fourth consecutive month. A fall in this index for 4 consecutive months almost always leads to a recession. The red shaded areas in the chart below represent recessions.

In Figure 26, Cheng-Wei Chin points out that every time the new orders component of the Philadelphia Fed’s manufacturing index falls below -20 the US is either in a recession or about to enter one. This indicator is not always useful for timing purposes, but it has been correct in 7 out of the last 7 instances at confirming a recession is in progress.

In Figure 27, David Rosenberg, President of Rosenberg Research & Associates, points out that the Empire State Manufacturing Survey is currently at levels that historically indicate a recessionary environment.

The next four figures are an attempt to explain and forecast the future health and direction of unemployment.

Unemployment, along with inflation, is one of the primary measures of the economy the Federal Reserve has stated as its focus. Currently, the Fed is most concerned with bringing the CPI inflation rate back down to target levels of approximately 2-2.5%.

Let’s quickly define why watching unemployment is important as investors attempt to determine the current state of the economic cycle and its relation to the direction of financial markets.

The Fed measures its success bringing inflation down using the YoY change in the consumer price index (CPI). It’s primary tools in this fight are designed to tighten financial conditions, inducing a decline in aggregate demand, and hopefully a decrease in prices. The downside to this strategy is the main consequence of falling economic growth, rising unemployment.

A serious problem for the Federal Reserve is the lagging nature of the two measures both it, and politicians, are insistent on putting into focus — the consumer price index and the unemployment rate. The consumer price index always peaks after an inflation has started. However, the Federal Reserve is likely going to continue tightening financial conditions until the consumer price index has officially peaked — probably due to political pressure to combat inflation. In other words: the Fed will over-tighten.

Overly tight financial conditions are going to have a serious negative effect on the unemployment rate. Again, the Fed is going to be late in realizing this due to their focus on the highly publicized unemployment rate figure. They’ll be busy in their fight with inflation and by the time they realize inflation is improving, the damage to employment in America will be done.

Ultimately, watching both inflation and employment is important for forecasting when the Fed is likely to pivot and shift from actively tightening financial conditions to loosening. It’s when market participants become confident this pivot is coming that risk assets will likely put in a durable bottom.

So — all that was a long winded way of saying it’s important to have a forecast for future unemployment so its possible to anticipate the changing perception of market participants regarding emerging Federal Reserve action.

Figure 28 comes to us from Otavio Costa, a portfolio manager at Crescat Capital. Otavio points out that copper prices, for reasons we discussed in the intermarket section of this post, can forecast the seasonally adjusted level of job openings. The rapid collapse in copper prices over the last 30 days is forecasting the number of job openings to fall from 6.9 million to 5.0 million.

In Figure 29, Lance Roberts (by way of The Daily Shot) points out the relationship between consumer sentiment and US cyclical unemployment. Recently, consumer sentiment has declined to record low levels and this projects to a significant increase in cyclical unemployment in then near future.

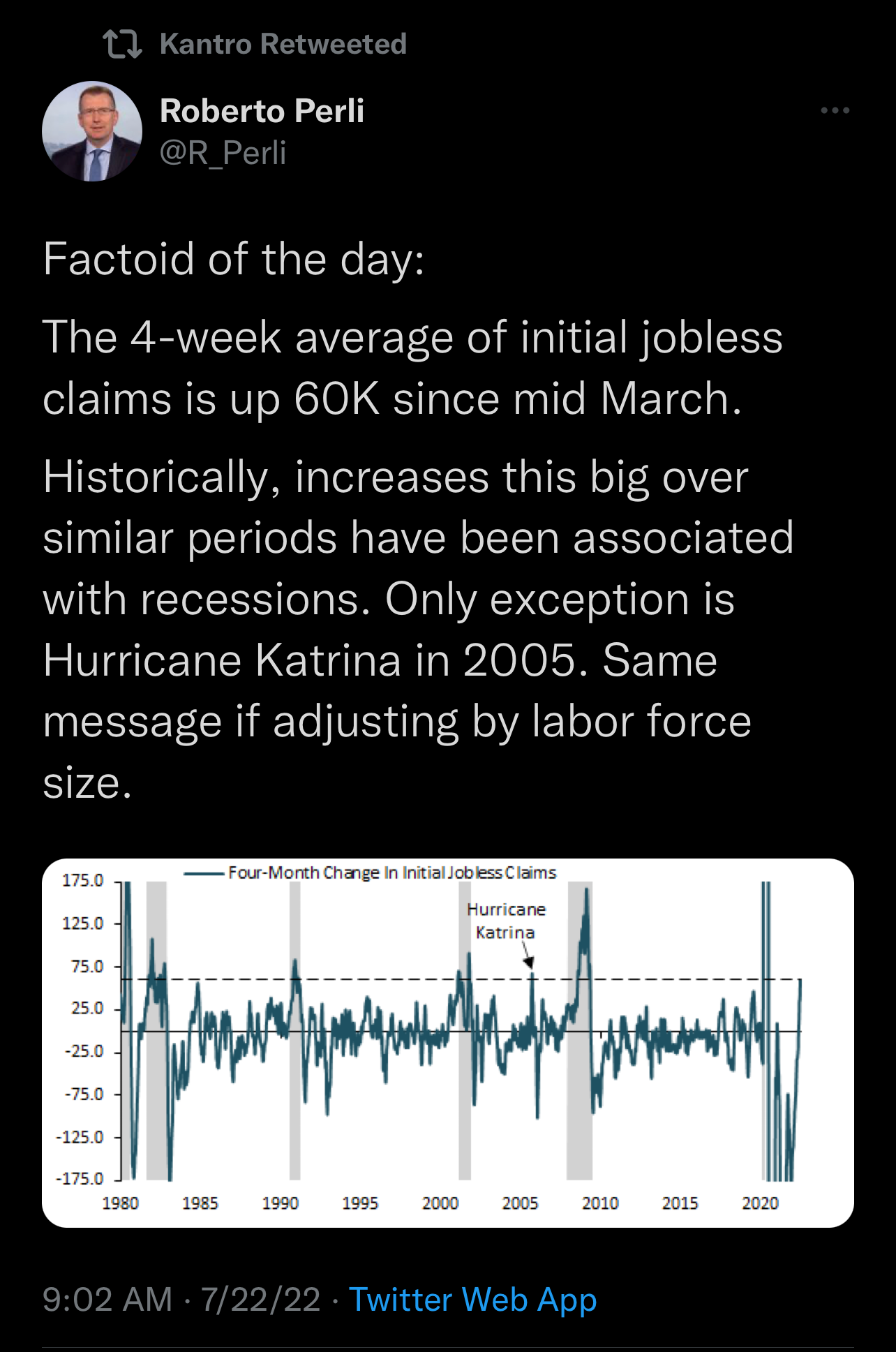

Initial jobless claims, which is the amount of people applying for unemployment insurance for the first time, has recently experienced a significant increase. In Figure 30, Roberto Perli, the head of global policy research at Piper Sandler, points this out by showing that then 4-month average of initial jobless claims has increased by 60,000 since mid-March. This level of increase is typically associated with a oncoming recession. The only outlier in this data was due to Hurricane Katrina in 2005.

Mr. Blonde, a macro commentator and author of the Stuck in the Middle Substack, points out a tweet by Ian Harnett, co-founder of Absolute Strategy Research, in Figure 31 the relationship between the housing market and unemployment.

It is widely known the housing market has a significant impact on the business cycle due to the influence of real estate on the balance sheet of the typical American. When housing prices rise, homeowners feel wealthier and have new equity they can tap as a source of low-cost cash they can use for investment or consumption. When the housing market declines, the reverse is true — falling home prices can generate a negative wealth effect and exacerbate the fall in aggregate demand.

Figure 31 shows the relationships between the NAHB builder homebuyer traffic index (inverted) shifted forward by 12 months and the US unemployment rate. There is a clear correlation between the health of the housing market and future unemployment. The housing market has been weakening rapidly and this points to a notable increase in unemployment rates over the next 12 months.

I have provided Figure 32 to emphasize the relationship discussed above in Figure 31. The housing market has a outsized impact on the health of the United States economy and by proxy, unemployment. Rising interest rates, tightening financial conditions, and weakening economic growth is absolutely having a noticeable negative impact.

Nick Gerli, the owner of the top real estate focused YouTube channel, points out the 46% collapse in homebuyer traffic over the last 6 months. A decline of this speed and magnitude is rivaled only by the initial phase of the COVID lockdowns in 2020.

Business Cycle Conclusion: Negative

The business cycle is a net negative at the moment. Leading indicators of all sorts continue to suggest negative real economic growth in the future, including in Q2. Unemployment is nearly certain to increase and the housing market is weakening rapidly — both of these will create a negative wealth effect that can reinforce the down cycle. Once it becomes obvious that negative economic growth and unemployment is the largest threat to stability, the Fed will pivot its focus away from inflation and work to stabilize the decline. The increase in liquidity resulting from the Fed’s pivot will be a positive for risk assets.

The key is knowing before others when market participants will begin pricing in expectations for a pivot to an increasing liquidity environment.

This leads us to the final section — when will the pivot occur?

Don’t Fight the Fed

The following chart, Figure 33, was produced by TXMC Trades, a trader and widely followed commentator on macroeconomics and financial markets. TXMC points out a relationship between the S&P 500 and unemployment — including a couple items that are almost always.

We discussed this earlier in the post — the stock market leads the economy and bottoms before the economy, as well as the peak in unemployment — which can be thought of as a proxy for the bottom in the economy.

The market, almost always, does not bottom until the unemployment rate is greater than 0.50% above its low and is rising.

These relationships hold true because the Federal Reserve does not pivot monetary policy to an accommodative stance unless it is pressured to do so by higher levels of unemployment, caused by declining economic activity. Market participants typically do not price in a pivot to loose financial conditions until there is a reason for the Fed to pivot — regardless of how small that reason may be — such as a 0.5% increase in the unemployment rate.

As of July 25, 2022, the US unemployment rate is 3.6%, which is the low for this cycle. The direction of the unemployment rate is flat. With history as a guide, this indicates a Fed pivot is not imminent.

On the same line — Ian Harnett points out in Figure 34 that bear markets do not end until the Fed has “capitulated” — pivoted.

The shaded red areas represent bear markets in the S&P 500. The beginning of the shaded area is the market top and the end of the shaded area is the market bottom. The blue line is the Federal Funds rate — the short-term policy rate controlled by the Federal Reserve as a way to influence financial conditions. Notice that the Fed lowers the federal funds rate before the end of every bear market — sometimes years before the market bottoms.

The key points is this — the stock market is unlikely to bottom until the Fed reverses course and cuts the federal funds rate. This reinforces the discussion from Figure 32.

We have established the primary concern of the Federal Reserve is now inflation. The Fed is highly unlikely to pivot monetary policy and cut interest rates until it is sure inflation has peaked. This is being reinforced by the current politics of the day — making the Fed even more dedicated to this policy stance.

The stock market is unlikely to form a durable bottom until the Fed has pivoted monetary policy.

Therefore, investors need an accurate, timely way to monitor inflation expectations. There are two intermarket relationships I watch as a proxy for the market’s estimate of inflation expectations. These charts will turn lower before inflation has reached levels where the Fed will consider pivoting, providing a warning the pivot could be on the way. Knowing this makes these intermarket relationships a valuable addition to the toolkit of any investor.

Figure 35 is a ratio chart showing the relationship between TIPS Bonds and 7-10 Year Treasury Bonds. TIPS are bonds issued by the US government that have shifting coupon payments based on changing inflation rates. If this ratio is moving up it represents increasing inflation expectations and if it moves down it suggest inflation expectations are declining.

Currently, this relationship is still holding above its 200 day moving average and support from the late-2021 highs. This needs to break both of these support levels and begin to trend lower before the Fed is likely to pivot monetary policy.

Figure 36 is a similar indicator, but accomplishing the goal of the TIPS/Treasuries relationship in another way. Here is another intermarket chart, but this ratio is formed from the relationship between industrial metals and 30 year treasury bonds.

Similar to Figure 35, the direction of this ratio is representative of the market’s expectations for future inflation. This ratios looks better than Figure 35. The uptrend has broken and it is below the 200 MA. However, it has paused its decline at support from the late-2021 lows. Should this support level break, the ratio could fall rapidly from approximately 3.0 down to 2.1, which represents support from the pre-COVID highs. A move in this direction would project to much lower inflation expectations ahead and give the Fed support for making a pivot in monetary policy.

The final chart is another that can help investors monitor the actions of the Federal Reserve and the direction of monetary policy and liquidity flows. Figure 37 is the Eurodollar Index plotted against the 50 day moving average. When the Eurodollar Index is above the 50 day MA and trending higher it is representative of a global environment with improving liquidity — the opposite is true, a downtrend is suggesting tighter liquidity.

As you can see, since late-2021 the Eurodollar Index has been below its 50 day MA and trending lower. Stock markets can rally with this index trending lower, but it is much easier for risk assets to form a durable bottom if the Eurodollar Index is confirming a positive shift in global liquidity conditions and monetary policy.

The Federal Reserve and global liquidity conditions are unlikely to provide support to risk assets, including the stock market, at the present time. This will change if inflation and inflation expectations begin to improve significantly and / or there is a dramatic deterioration in economic activity and the US unemployment rate.

Final Conclusion

This post analyzed six important areas in relation to the direction of risk assets and the stock market. Here is a summary of the conclusion from each section:

Technical analysis of price action = Neutral to Negative

Intermarket relationships = Negative

Sentiment = Neutral to Positive

Quantitative finance = Neutral

Valuation = Neutral to Negative

Business cycle = Negative

There are some bright spots beginning to form. The short term price action is positive and offensive sectors are leading the way over the last month. Sentiment is reaching levels on some indicators that is consistent with major stock market bottoms. Certain statistical price patterns have occurred that project to higher future asset prices. The political picture and its impact on stock market returns is also improving, as discussed in the quantitative finance section. Also, a couple of valuation metrics have improved substantially during the 20% decline seen in the first 6 months of 2022.

However, this analyst believes the negatives currently outweigh the positives.

At this time, overall market conditions are not supportive of a durable stock market bottom. Based on the information analyzed within this post, the probability is on the side of continued volatility and asset market weakness.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Schmidt, Marty. “Business Cycle Phases: Defining Recession, Depression, Expansion.” Business Case Website, 1 July 2022, https://www.business-case-analysis.com/business-cycle.html.

Wells, Drew. “Delving Deeper into Intermarket Analysis.” Potomac Fund, 23 Dec. 2021, https://potomacfund.com/delving-deeper-into-intermarket-analysis/.

Wells, Drew. “Delving Deeper into Intermarket Analysis.” Potomac Fund, 23 Dec. 2021, https://potomacfund.com/delving-deeper-into-intermarket-analysis/.

Smith, Tim. “Market Sentiment.” Investopedia, Investopedia, 29 June 2022, https://www.investopedia.com/terms/m/marketsentiment.asp.

“Sector Rotation Strategies.” Fidelity, Fidelity Learning Center, 17 Nov. 2020, https://www.fidelity.com/learning-center/trading-investing/markets-sectors/intro-sector-rotation-strats.

Bookmarked to read during a long and cold winter night.