Today I’m delivering a follow-up to one of my recent long-form posts, “What's happening in the housing market?”.

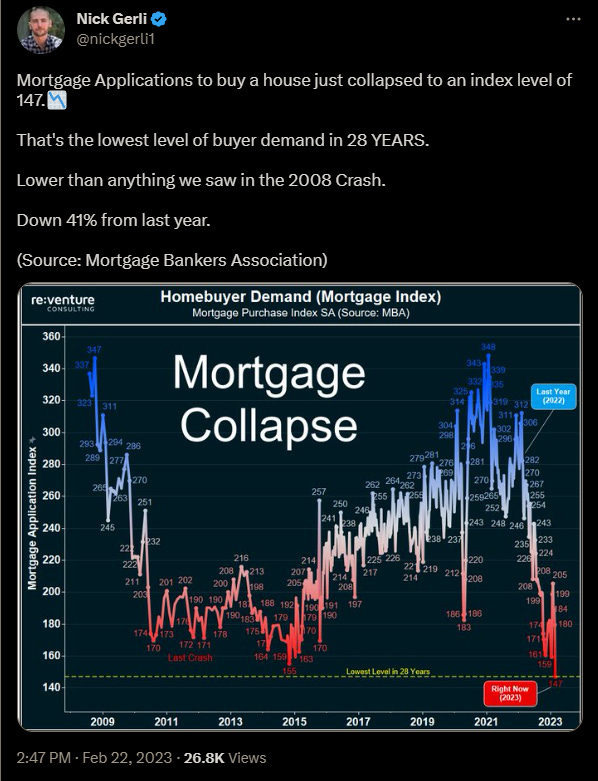

In the prior post, I argued the US housing market was likely to continue experiencing weakness for the foreseeable future. It appears this is playing out — at least for now. Figure 1 shows the US Economic Calendar for today and tomorrow. At 7:00 AM EST this morning we received the most recent MBA Mortgage Applications data. Analyst were expected -7.7% and the actual result was -13.3%, a significant downside miss.

The significant miss in mortgage applications tracks well with guidance out of Home Depot yesterday. In Figure 2, check out the headlines from the past two days related to Home Depot’s earnings guidance for 2023 — they’re not the most upbeat.

This brings us to Figure 3, today’s chart of the day. This chart was produced by real estate analyst Nick Gerli and it is a graphical representation of the mortgage application data we discussed at the beginning of the post. What we can see here is the magnitude of the demand collapse in the housing market.

If demand falls and supply stays the same, prices will ultimately decline. Demand is clearly in decline. If demand falls and supply increases, prices will decline significantly. In my prior post on the housing market I mentioned how there is a wave of new home construction under way that will be hitting the market in 2023 and 2024. A supply increase during a collapse in demand, at a time when home price to income levels are near all-time highs, could drive a major bear market in US home values.

Only time will tell….

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.