Today’s Chart of the Day is another update to our analysis on the housing market that was put forth here on February 8th.

The post-Great Recession, and especially the post-COVID, housing market has been largely driven by institutional investors making cash purchases. Interest rates don’t typically impact this type of buyer as they’re not reliant on debt financing to fund purchases. As long as the risk-adjusted yield an investor can earn in rental real estate is greater than what can be earned on other opportunities, they’ll continue to accumulate investment properties.

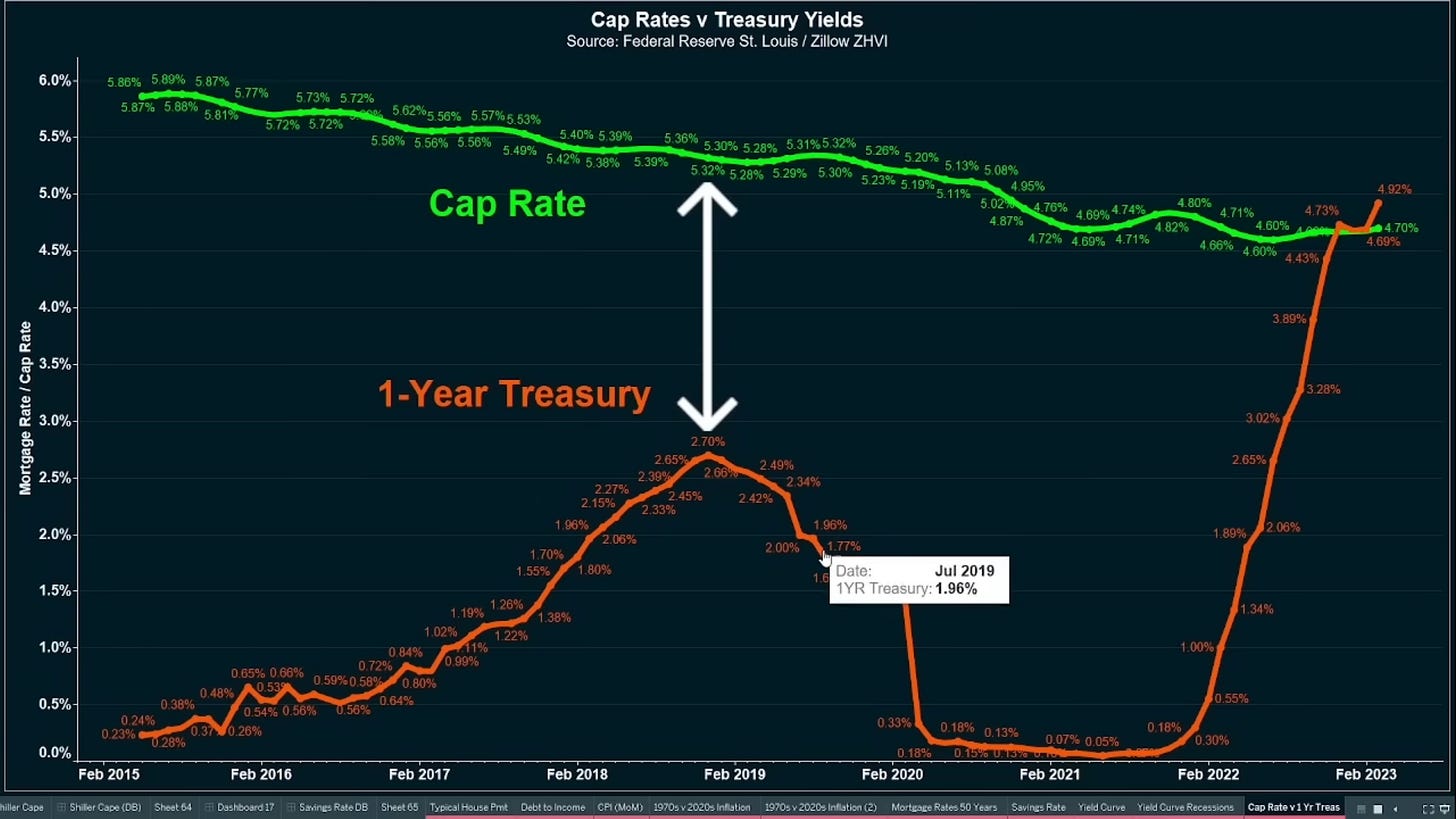

Not only has the increase in rates sent the demand for mortgages into a tailspin, it has changed the opportunity set available to institutional cash buyers. Figure 1 shows the current cap rate of the US housing market versus the yield on a 1-year treasury bill.

The capitalization rate (cap rate) is a proxy for the annualized yield a cash buyer can earn if paying the current price offered in the market for an investment. In this case, rental housing.

In Figure 1, notice the enormous gap between the cap rate and the 1-year treasury bill during the 2015-2018 period and especially the post-COVID 2020-2022 period. When the gap between risk free rates, such as treasury bills, and cap rates is large it is easy for real estate investors to justify deploying their cash into the housing market. However, when the gap is small or even completely disappears, justifying an investment in housing becomes more difficult.

Currently, large institutional investors can earn a higher rate of return by purchasing risk free T-bills than they can earn by making additional investments in rental properties. Not only is there more risk related to rental property investing (illiquidity, price risk, vacancy, etc), but at this point the investment return is less than what can be earned on liquid, essentially risk free government bonds.

For as long as the relationship displayed in Figure 1 remains, the institutional cash buyer in the US housing market is likely no where to be found. This creates a significant gap in market demand that must be filled if downward pressure on prices is to be overcome.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.