COTD: Is the Fed's QT over?

Net liquidity is once again on the rise.

TL;DR

The Federal Reserve's balance sheet has stopped shrinking, which is a positive for liquidity and typically results in higher prices for risk assets.

The Fed's net liquidity has risen rapidly due to banks borrowing from the Fed, resulting in an increase in the Fed's balance sheet.

Banks borrowed a record-breaking $164.8 billion from two Federal Reserve backstop facilities, indicating escalated funding strains in the banking system after recent failures.

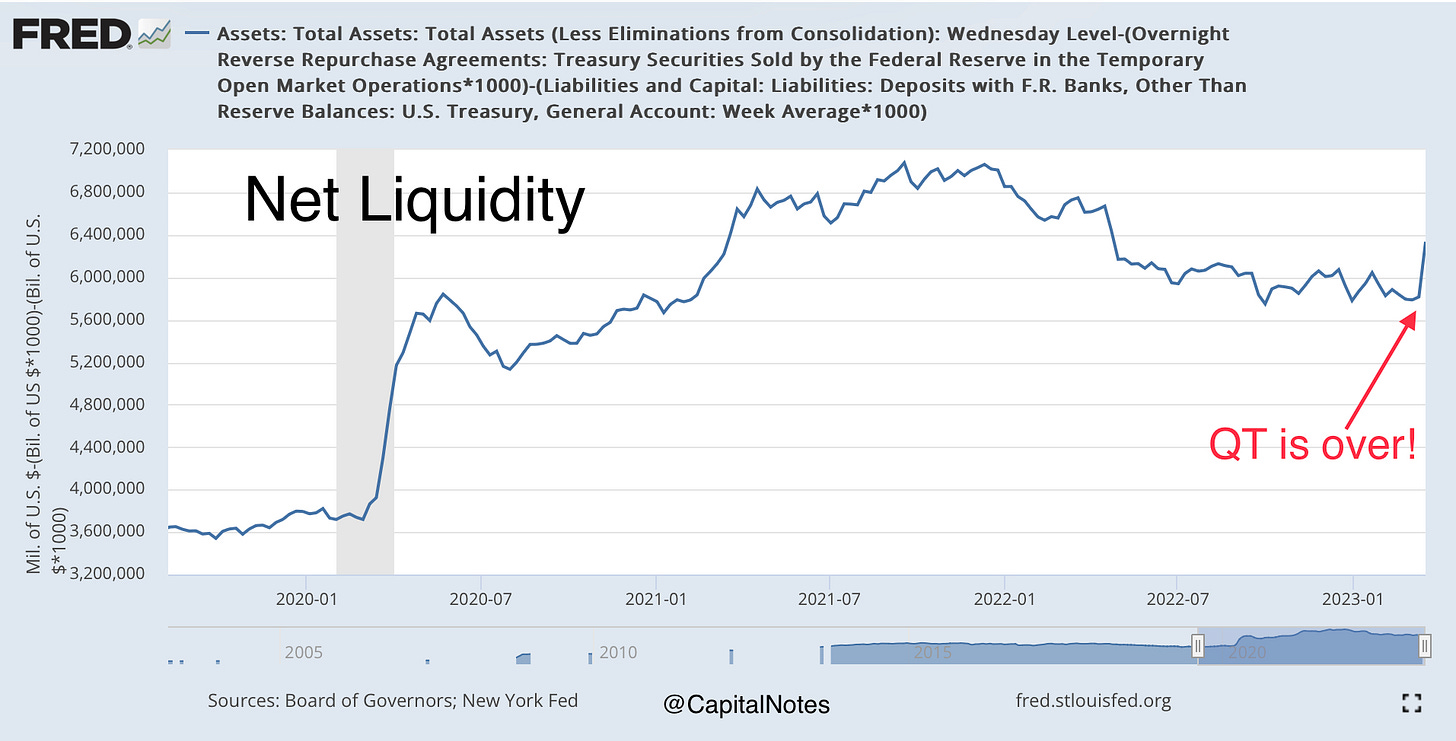

Tonight I’m writing a quick Chart of the Day to point out an interesting development. See Figure 1 below from Octavio Costa, a portfolio manager at Crescat Capital.

The chart shows the total assets of the Federal Reserve. This is a number that should be shrinking as the Fed attempts to reign in inflation through the use of Quantitative Tightening (QT). QT is an explicit reduction in the size of the Fed’s balance sheet, which has the effect of reducing liquidity through a reduction in banking system reserves. QT is one of the reasons why banks have been having liquidity issues recently, as it forces them to exchange cash for securities — securities that have been losing value as rates rise.

The primary takeaway — the Fed is no longer reducing its balance sheet. This is a massive net positive for liquidity. Typically, more liquidity = higher price for risk assets. I discussed the possibility of higher risk asset prices in yesterday’s COTD. Here’s a link to that post: COTD: Is it time to buy stocks?

The Fed’s total assets chart only shows one of 3 pieces of the “Net Liquidity” pie. The other two are the Fed’s reverse repo facility and the US Treasury general account (Uncle Sam’s checking account). Figure 2 displays the net liquidity calculation. Again, when net liquidity rises, it usually result in higher prices for risk assets. When Net liquidity is flat or falling, risk assets tend to be extremely volatile with a downside bias.

Capital Notes is currently free to read. Tell them that you value their writing by subscribing and pledging a future subscription.

As we can see from Figure 2, this week’s reversal to the upside in net liquidity was massive. It’s no wonder stock prices, especially those of the liquidity sensitive technology sector, has been roaring higher over last few days.

So, why is net liquidity rising so rapidly if the Fed has not announced a formal end to QT and a resumption of QE?

Banks are borrowing from the Fed in mass from the discount window and the Fed’s new tool, the Bank Term Funding Program. As banks borrow from the Fed, it creates an asset on the Fed’s balance sheet (total assets up) and the offsetting entry is an increase in liabilities, or an increase in the reserve account at the Fed of the bank receiving the loan (total liabilities up). This results in a net increase in the Fed’s balance sheet.

Here is a summary of the article from Bloomberg highlighted in Figure 4:

Banks borrowed a record-breaking $164.8 billion from two Federal Reserve backstop facilities in the most recent week, showing escalated funding strains in the aftermath of Silicon Valley Bank's failure.

$152.85 billion was borrowed from the traditional liquidity backstop for banks, known as the discount window, marking a record high.

$11.9 billion was borrowed from the Fed’s new emergency backstop known as the Bank Term Funding Program, launched on Sunday.

The borrowing shows a fragile banking system still dealing with deposit migration after the failure of Silicon Valley Bank of California and Signature Bank of New York. The US government is attempting to stabilize the battered California lender by depositing $30 billion with First Republic Bank.

Interesting times. It’ll be important to pay attention to the Fed’s comments in coming days as they address the inevitable questions around this balance sheet expansion and when, or if, they will reverse this increase and continue with inflation fighting QT.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.