Optimism is High

Expectations are nearing extremes.

"Buy when everyone else is selling and hold until everyone else is buying. That's not just a catchy slogan. It's the very essence of successful investing.”

— J. Paul Getty

The bears are officially in hibernation.

As mentioned in detail during my prior long form post that you can read here, optimism amongst the bulls is running rampant as bears capitulate and bulls declare victory.

Here are a few more pieces of evidence to drive home the point.

From MacroCharts quoting BofA:

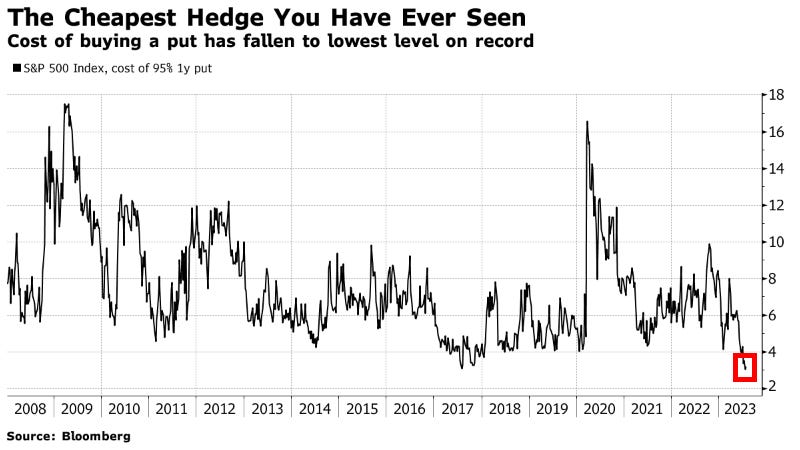

“US stock bulls have grown so confident in the market that the cost of buying protection against a 5% dip in the next YEAR has fallen to what BofA strategist Ben Bowler is calling the ‘cheapest you likely have ever seen.’"

Figure 1 shows the cost to purchase “insurance” against a 5% correction in the S&P 500 has fallen to the lowest level on record. In other words, there is no demand for protection against a decline in stocks. No one believes the market can drop.

Figure 2 shows the most recent update to the CNN Fear & Greed Index. Right now the index is in extreme greed territory. Typically, the lowest risk time to add capital to risk assets is when the index is showing extreme fear.

In Figure 3 we see that active money managers are once again as exposed to equities as they were at the November 2021 peak, one of the most euphoric periods for equities in market history. From NAAIM:

Last, in Figure 4, we have the BofA Global Research Equity Risk-Love Index. Again, another indicator pointing to high optimism for equities and a contrarian reason to be cautious. From BofA:

"Global Equity Risk-Love, our contrarian sentiment indicator for equities, has risen from near-panic in March to the 78th percentile now, with optimism brewing in almost all factors...except positioning."

I’ll end thus quick post with a famous quote from Warren Buffett.

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

— Warren Buffett

I’ll wait until the crowd stops drooling at the sight of equities before rushing in to buy some more.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.