The meme at the top of this post is illustrative of the way markets work. Price is largely driven by short and long-term shifts and swings in investor psychology, greed and fear. When it was a good time to buy this YouTube channel was pumping fear with fire 🔥 and doom thumbnails and now that the market has rallied the channel has flipped to selling greed. It’s a story as old as markets themselves.

I'm a contrarian by nature. Back in the late fall of 2022, and especially into December/February, I began leaning more and more toward the bull camp as everyone seemed to be calling for a nearby recession and quick resumption of the bear market. If the crowd zigs too much, I zag.

Here’s a list of my bullish commentary from that time:

January 12, 2023: Quick Note: The Bull Case

January 21, 2023: Has Bitcoin Bottomed?

February 1, 2023: Chart of the Day

February 2, 2023: Chart of the Day

February 3, 2023: Chart of the Day

February 4, 2023: Chart of the Day

February 6, 2023: Chart of the Day

February 13, 2023: Chart of the Day

I also identified, on May 24th, the potential for a significant extension of the rally due to what was still extremely bearish sentiment and negative speculative positioning in markets.

May 24, 2023: Chart of the Day

I'm now noticing a similar but opposite shift to the one identified in the fall / winter.

As economic activity has remained resilient, the narrative has now shifted to a no / soft landing. J. Powell has done the impossible and rescued us from the scourge of inflation without the medicine even leaving behind a minor aftertaste.

Or so the narrative goes.

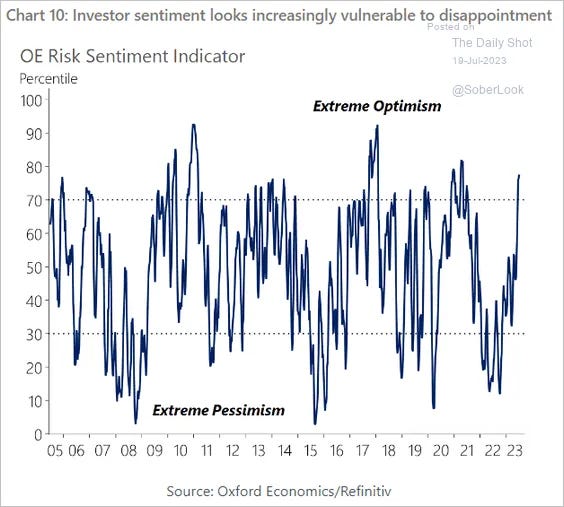

Figure 1 shows the Oxford Economics Risk Sentiment Indicator has moved back into “Extreme Optimism” territory. Investors want to buy stocks during times of extreme pessimism. Why? It’s pretty simple. Stock prices move based on what future expectations are being priced in. When the market is pessimistic it is easy for the future to turn out better than people expect and stock prices will have an easy path higher.

As an example of how optimism makes it more difficult for businesses to meet expectations, see Figure 2 below. Analysts are now predicting profit margins to rise quickly back to record highs, levels that may prove extremely difficult to sustain.

Stocks are now pricing in a highly optimistic scenario that companies may have a difficult time living up to. This creates a higher probability for downside risk events.

A great deal about today's economic and market environment reminds me of my first few years as an investor. Is deja vu real?

The present reminds me quite a lot of early-to-mid 2007. The famous Chuck Prince quote comes to mind:

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing.”

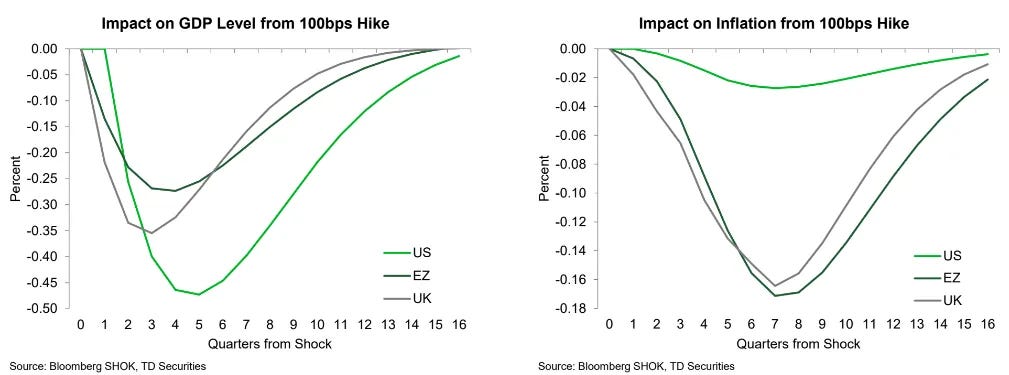

It's only been a little over a year since the first 75 bps rate hike. In a normal cycle the economy does not typically respond negatively to tight monetary policy for 12-18 months (long and variable lags). Don’t take it from me. According to TD Securities, it takes GDP approximately 4 quarters [Figure 3] to fully respond to a rate hike. That means we should only just now begin to feel the negative effects of the tightening cycle.

"Typical central bank models point to the peak impact from a rate hike occurring after around 4 quarters for the level of GDP and about 6 quarters later for inflation...What we're seeing now is the impact of (still-low) policy rates from around the middle of 2022."

However, this cycle is not normal. Consumers and businesses came into this hiking cycle flush with COVID stimulus money. The lags have the potential to be fat tails in the historical distribution (take longer than expected). I'm not surprised to see economic activity trucking along and markets responding accordingly as retail investors realize their risk aversion this last year has costs them.

However, I liken this period to the "calm before the storm". It's a sweet spot where economic activity has yet to be majorly impacted by a wave of policy tightening at the same time as risk appetite is retuning to market participants who have not been rewarded for being cautious.

How long can this Goldilocks period last? Maybe not much longer. The COVID stimulus money that cushioned consumer spending from higher rates is nearly gone. Again, from TD Securities:

"Party is over for US consumers. Surplus in household savings are depleting which is why TD Securities see a recession early next year."

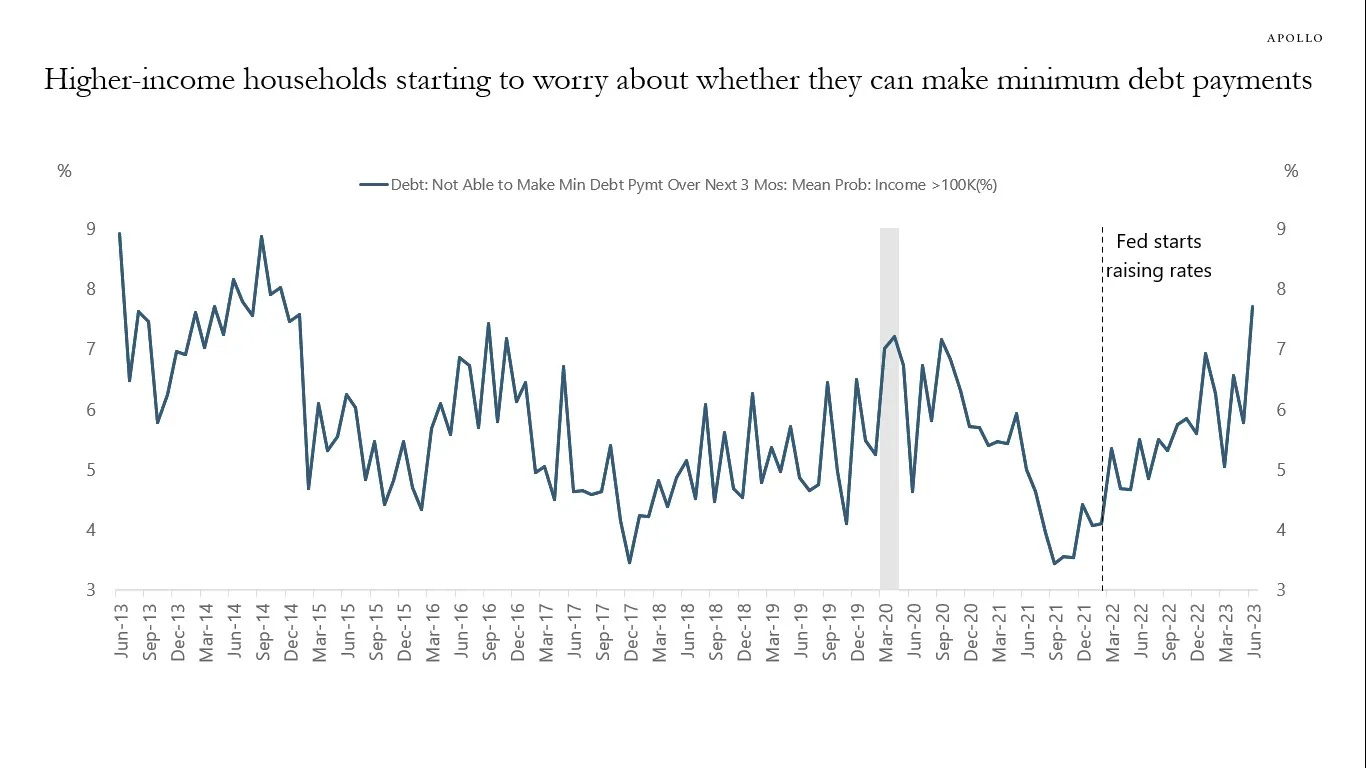

Here is another way to view the worsening consumer situation. This one from Apollo Chief Economist Torsten Sløk:

"The chart below shows the average probability of not being able to make minimum debt payments over the next three months for people earning more than $100,000. The bottom line is that higher-income households are starting to worry about their finances."

Predictably, retail equity positioning has returned to bullish extremes just in time to witness the negative effect on economic activity of the swiftest global tightening cycle in history. Due to the long lagging effects of policy and humanity's ability to push aside logic, relying on extrapolations of the recent past, this unfortunate trait of asset price peaks has historically been and will continue to be the norm.

Before I sign off, let’s quickly review the economic situation. Why, again, should we be expecting a slowdown in economic activity?

As shown in Figure 6, this has been an unprecedented period of monetary policy action by global central banks. Nearly 25% of central banks are currently hiking policy rates, while almost 0% are cutting. No period has been more restrictive.

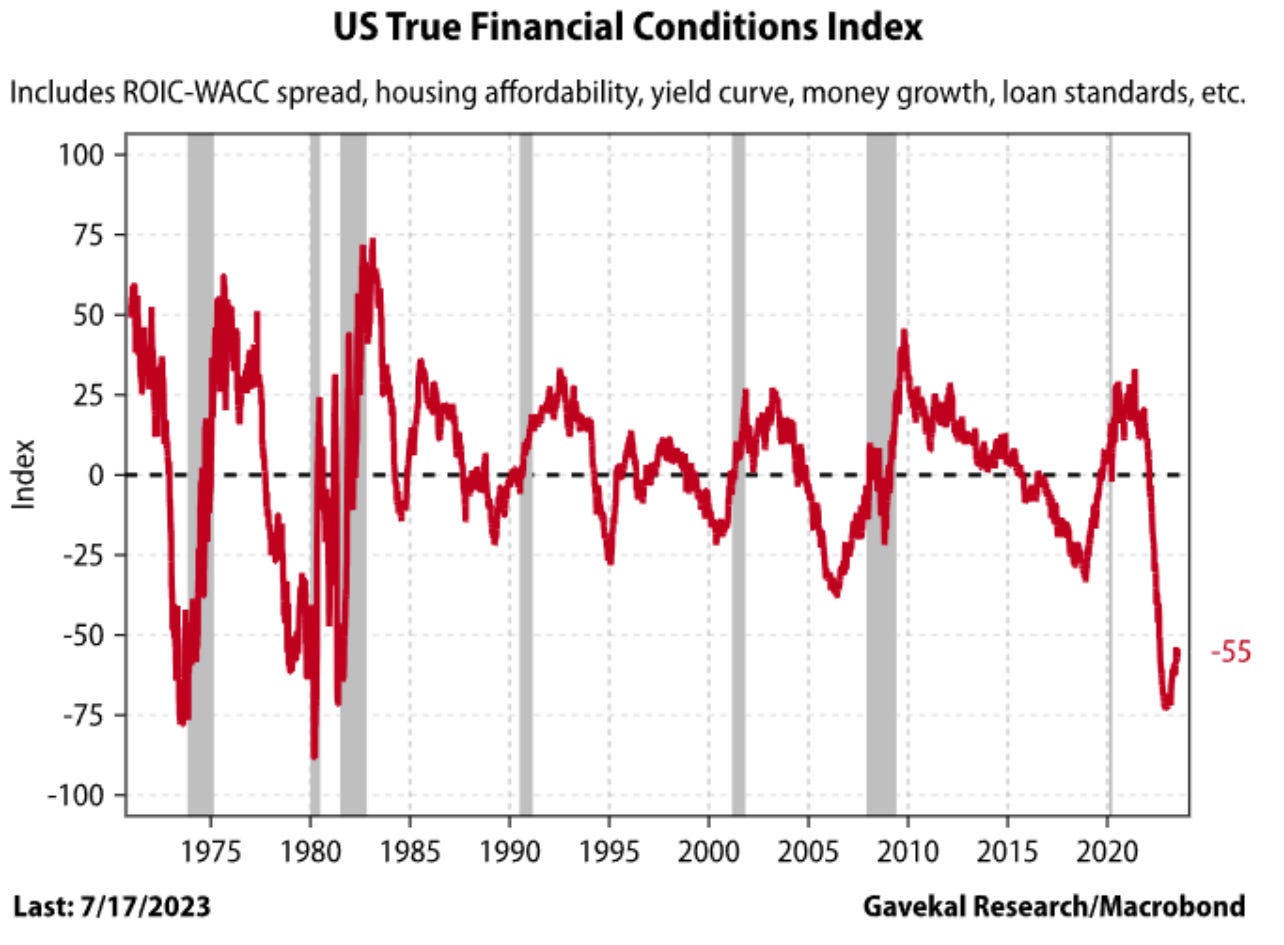

What has been the result? Figure 7 is the Gavekal Research US True Financial Conditions Index. It’s now reached some of the most restrictive levels on record. Notice this index tends to fall rapidly, bottom at low levels, and then it begins to sharply rise BEFORE a recession occurs.

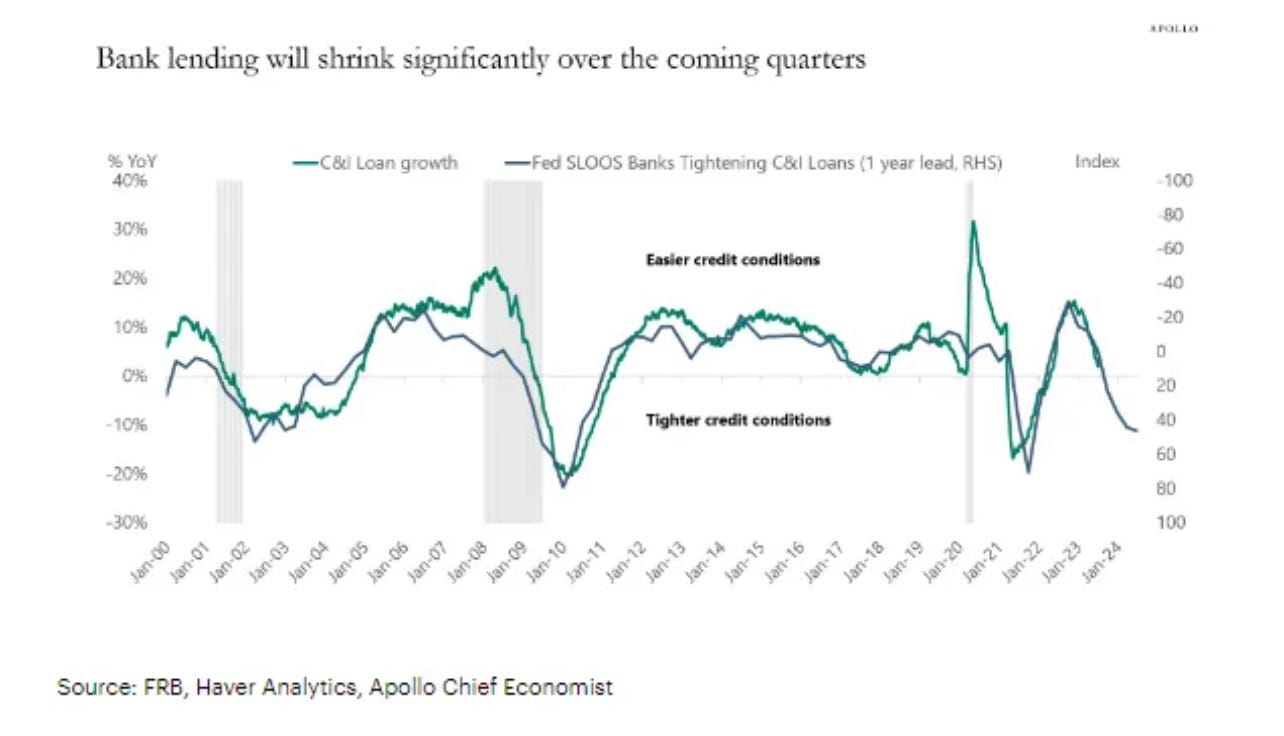

When credit conditions are tight it’s difficult for banks to make a decent spread, one large enough to compensate for their risk, so they begin tightening lending standards. This actually has the effect of exacerbating the problem, making credit conditions even more restrictive and further reducing the risk vs reward gap.

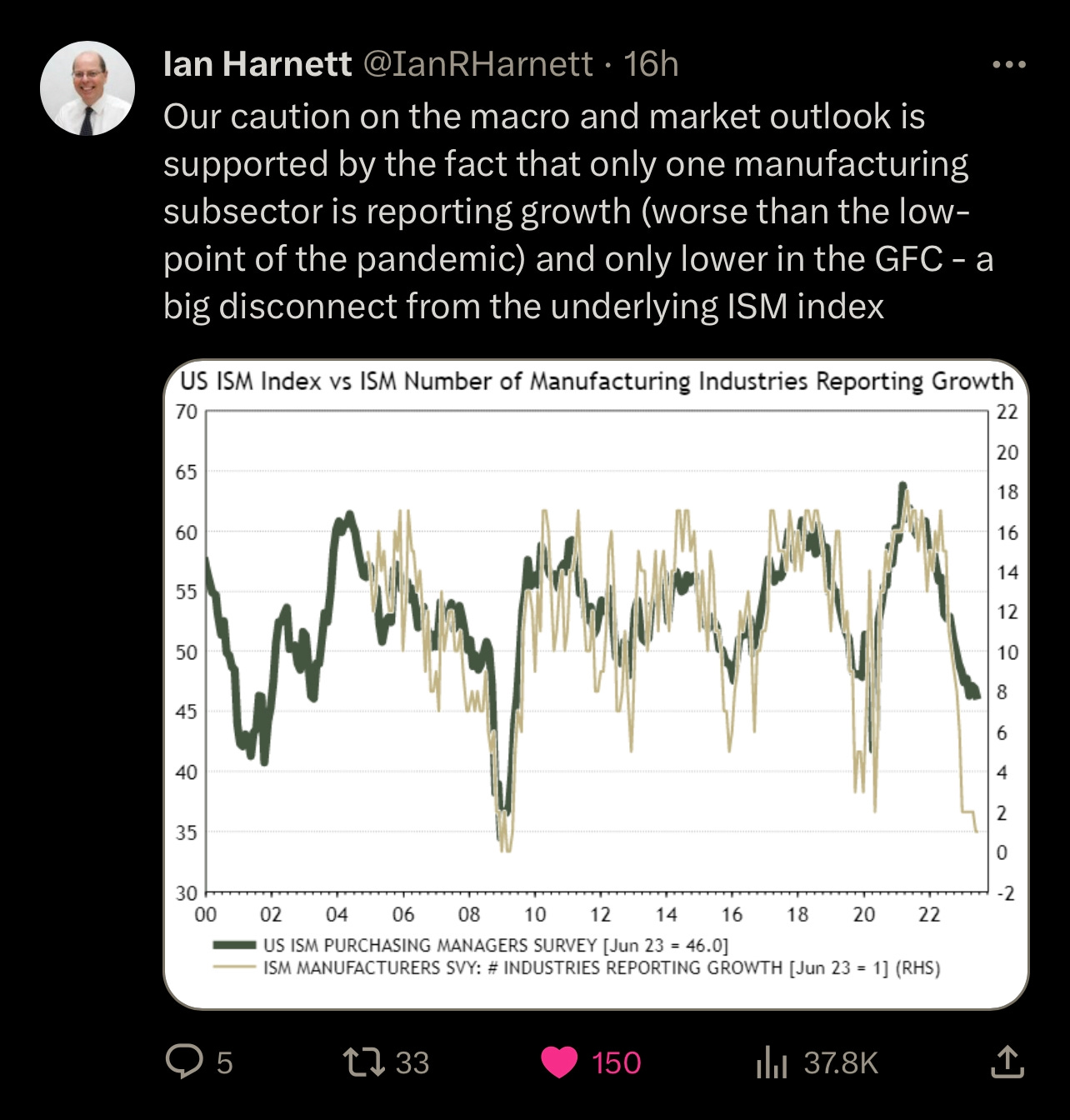

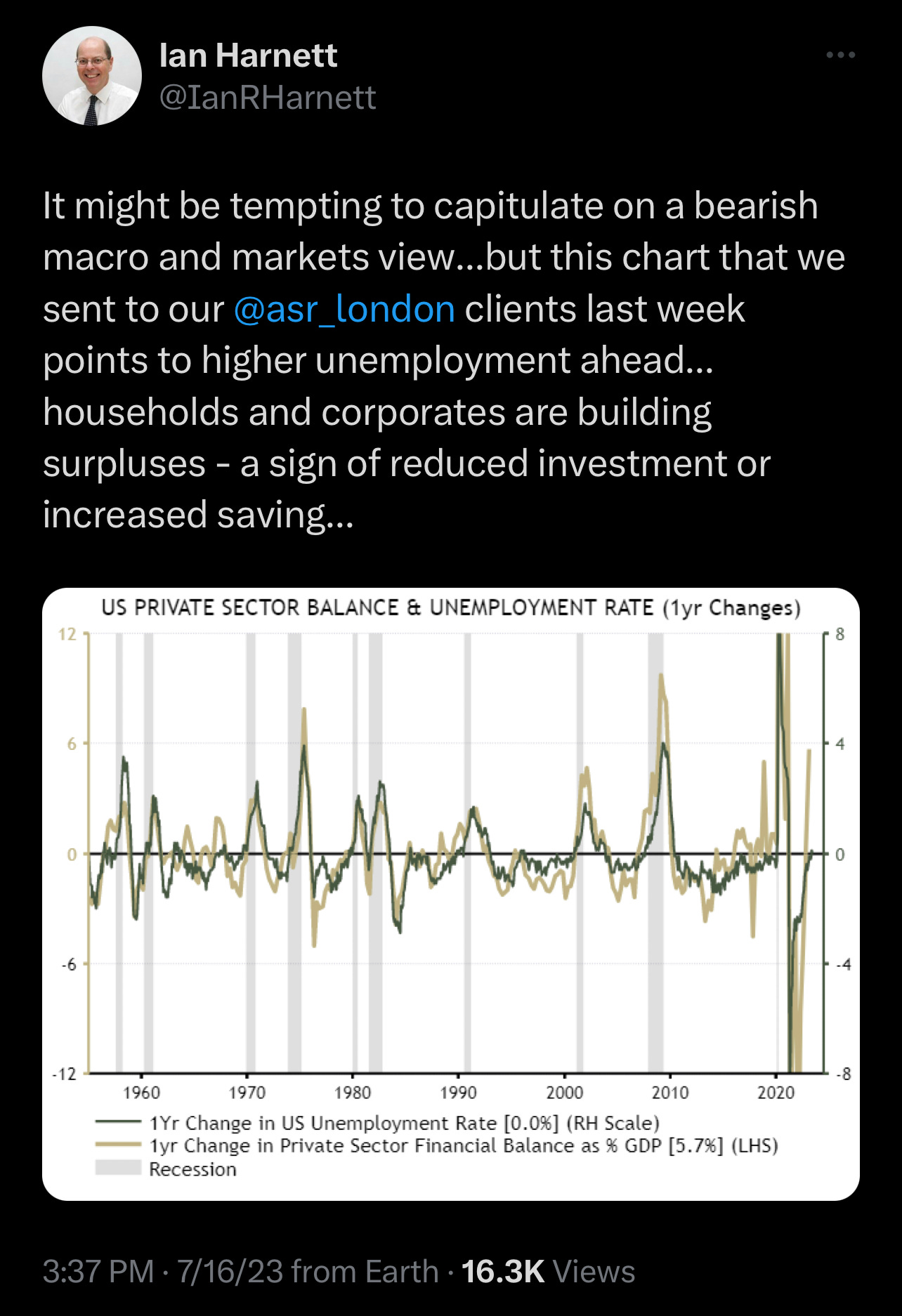

Reduced lending means reduced spending. One entities spending is another entities revenue and ultimately income. As revenues and incomes drop companies go into cost cutting mode. This is when the layoffs begin and unemployment starts to rise and further accelerate he downward spiral. Can we find any signs of reduced spending caused by tightening bank lending standards? Maybe so, see Figure 9.

So where are the layoffs and higher unemployment? I think they’re coming but not quite here yet. See Figure 10.

Remember, right now we remain in what I believe is the tail end of the Goldilocks period, the “calm before the storm”. So all of this is to say that even though the prevailing narrative has caught a case or Lag Effect Amnesia, the recession probably hasn’t been canceled. See Figure 11. It is extremely important that exuberant investors exercise prudence and patience as they deploy fresh capital into frothy risk assets.

While I am not calling for a market crash and I'm not shorting stocks, it's essential to understand what potential risks may surface over the intermediate term.

It's times like this that investors must remember that the future investment returns generated from an asset are DIRECTLY related to the price one pays for said asset. When there are clouds on the horizon it becomes more important to be selective when deploying additional capital, paying special attention not to overpay for your right to an asset's future earnings.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.