“Today’s stock market is a battleground for an epic, unending war between two opposing forces – the bulls and the bears.”

— Adam O’Dell, Business Insider

In my post from last week, I did my best to steelman the bullish case for US equities. Since that time stocks have jumped back up to the bear market resistance line discussed in the post [Figure 1]. Price went into this morning at a decision point — would resistance break and a new uptrend commence, or would bears overwhelm the bulls, sending price lower once more?

Stocks closed down near 2% today.

For now, the bears are winning the battle and price is once again experiencing rejection at the trendline (the 7th time since December 2021). We do not yet have enough evidence to speculate on who will win the intermediate-term war. However, bulls must quickly overcome the selling pressure if they want a technical resolution of this bear market — otherwise, on the back of a deteriorating economic backdrop [Figure 2], bears will go on the offensive.

Freshly released Empire Manufacturing data shows the 5th worst contraction in the index, ever. It is now matching the 2008 lows. Empire data tends to do a great job leading the ISM Manufacturing PMI, see Figure 2. This is suggesting the ISM PMI is likely to continue its decline into contractionary territory (below 50 = manufacturing sector contraction).

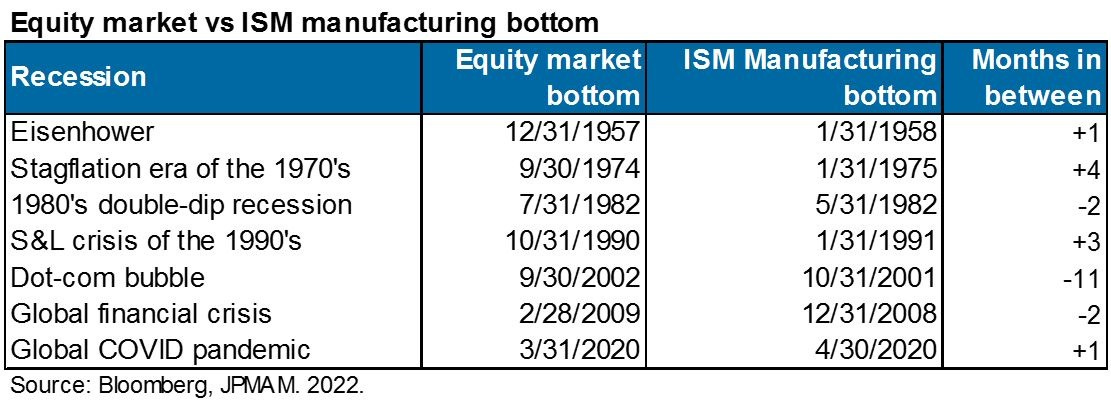

Check out the final figure below, Figure 3. The ISM Manufacturing PMI has historically been one of the best coincident indicators at identifying when conditions are primed for a major stock market bottom. On average, the ISM Manufacturing PMI will bottom approximately 1 month before the stock market. Yes, we only have 7 data points — but the point is that equities don’t typically mount sustainable rallies until the ISM PMI is in the bullish camp.

For now, leading data points continue to forecast weak ISM Manufacturing PMI numbers. Seeing this index bottom would provide a significant check mark in the bullish column that just does not exist at this point. If bears win this technical battle at trendline resistance — it won’t be too difficult to turn a number of bulls to the dark side and for markets to slide towards another visit of the bear market lows.

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.