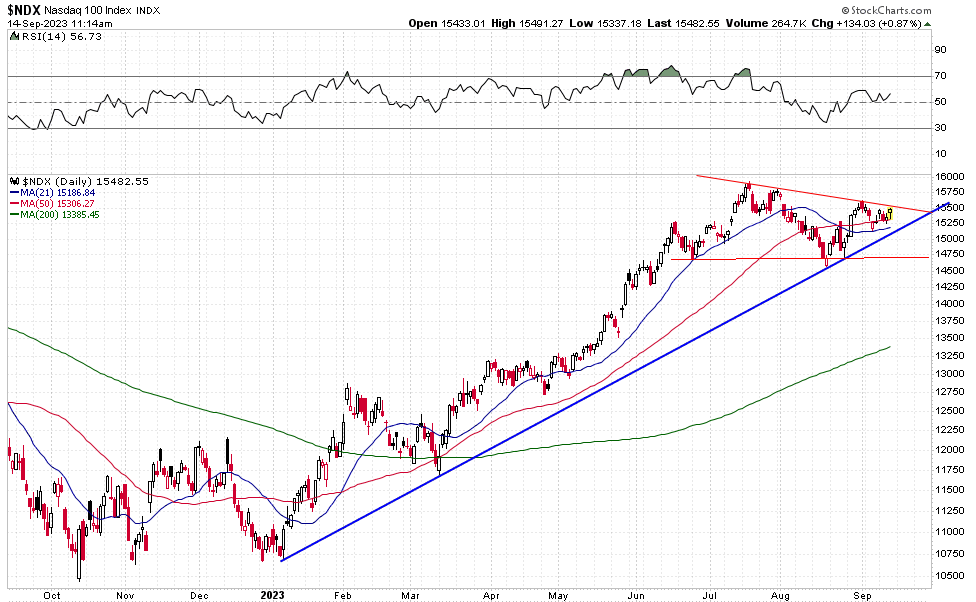

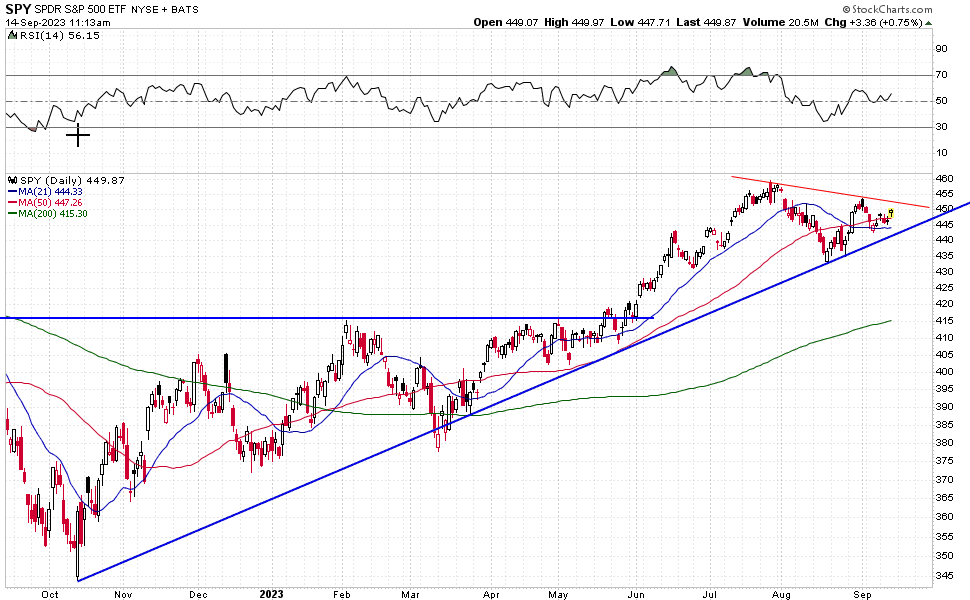

Equity Market Trend

The trend remains higher. Until the uptrend breaks, there is no technical reason to be overly bearish on risk assets.

There are macro and fundamental / valuation reasons to be cautious — outlined here:

Feelings of Deja Vu

The meme at the top of this post is illustrative of the way markets work. Price is largely driven by short and long-term shifts and swings in investor psychology, greed and fear. When it was a good time to buy this YouTube channel was pumping fear with fire 🔥 and doom thumbnails and now that the market has rallied the channel has flipped to selling gre…

However, the music is still playing and the market is still dancing.

For now, the trend remains clear.

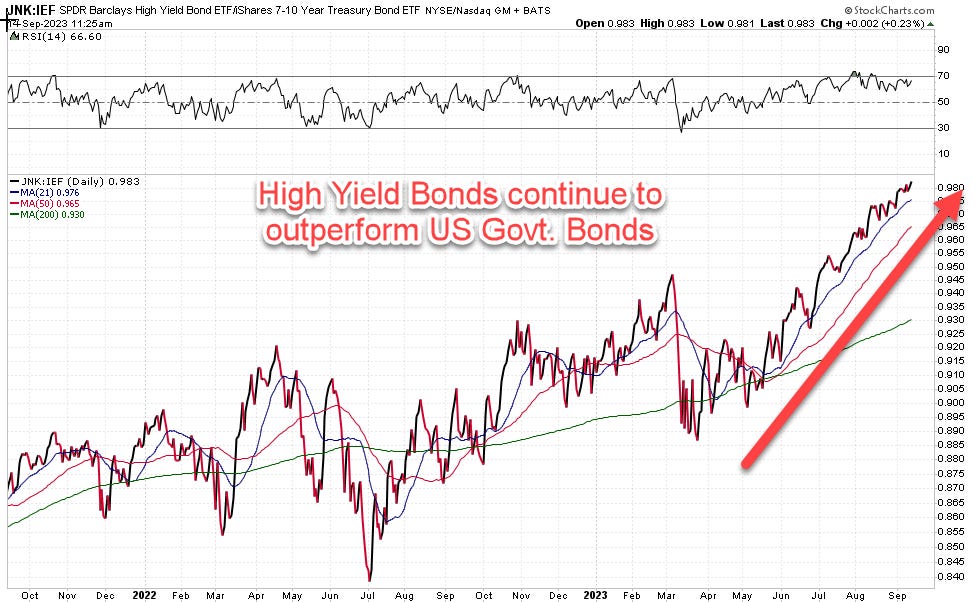

There are intermarket trends between sectors that typically provide a warning before major market tops. These continue to support the uptrend in equity indices shown above.

The fixed income market is also suggesting a major change in trend is not imminent. Junk bonds continue to outperform US government bonds. In other words, fixed income investors are currently willing to accept a high degree of credit risk at increasingly low spreads above safe and liquid t-bonds. This is a typical sign of bullish market conditions.

This sentiment also carries over into the relationship between Emerging Markets Bonds vs US Government Bonds. Again, another indication of risk appetite.

Trend In Danger?

All of this said, there are some shifts occurring under the surface of the market that may endanger the bullish sentiment. Commodities have now clearly resumed their uptrend vs bonds. This is indicative of a resurgence of inflationary pressures. CPI missed yesterday (3.7 vs 3.6 expected) and if this trend continues that upward pressure on prices is likely to worsen.

Here is another chart showing inflationary pressures resuming. Inflation Expectations (RINF) is now at YTD highs and moving higher.

One more — 🛢️oil prices have broken their post-Ukraine Invasion downtrend and are now making higher highs and higher lows. This is the definition of a uptrend. The #1 influence on consumer inflation expectations is the price they pay at the pump. ⛽️

A widespread realization that inflation is not yet dead will likely lead to a re-pricing of future Fed Funds rate hike probabilities. I recently discussed the likelihood of the economy remaining in the “Stagflation” phase of the business cycle here:

The Great Debate: Economic Cycle Update

This post is not about markets. In it I am not, no matter the conclusion, attempting to determine the direction of the stock market. This is a post about the economy. For my latest thoughts on markets see these posts: Feelings of Deja Vu: Shades of 2007 as lag effect amnesia grabs hold.

Conclusion

For the moment, the trend in equities markets remains up. As such, my personal portfolios are between 75%-80% invested in risk assets (which I will be sharing soon as a regular part of this newsletter). However, as described above, it is important to be aware of the mounting risk that could imperil the uptrend and possibly lead to lower risk asset values.

— Brant

Disclaimer: The content provided on the Capital Notes newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.